High-frequency scalp bots execute numerous rapid trades within milliseconds, capitalizing on small price fluctuations for quick profits in volatile markets. Copy trading bots replicate the strategies of experienced traders in real-time, allowing users to automatically mirror trades without deep market analysis. Explore the differences in strategy, risk, and technology to determine which bot suits your trading goals.

Why it is important

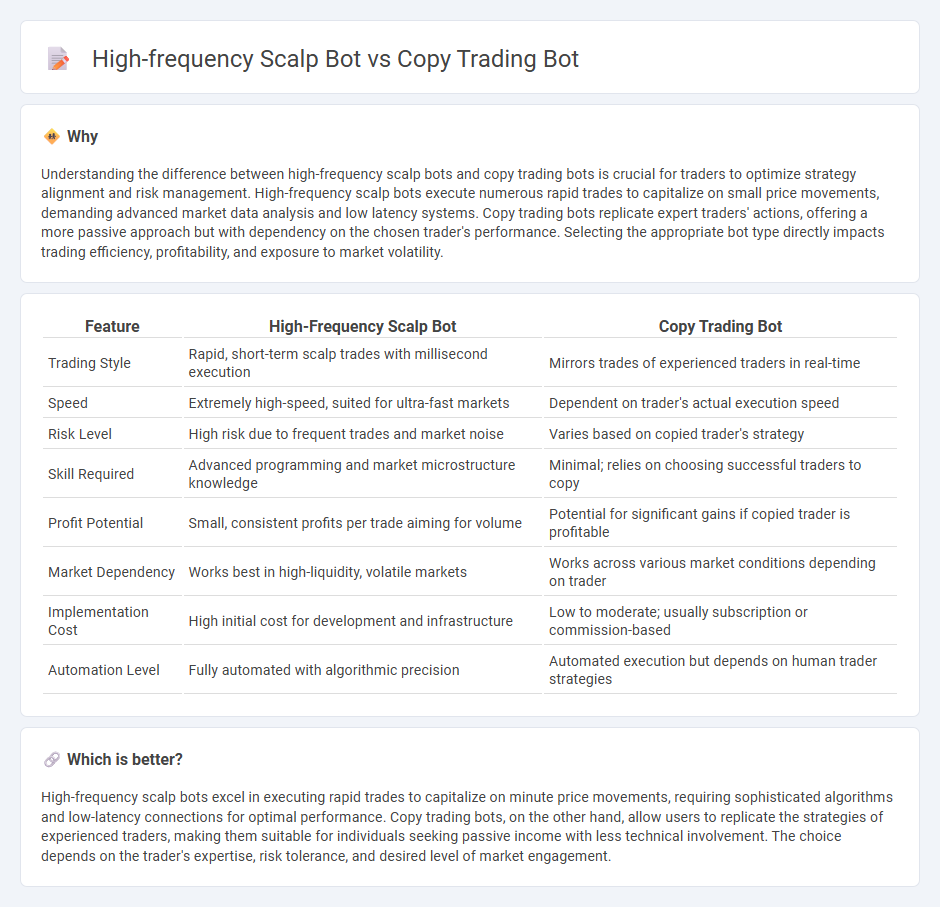

Understanding the difference between high-frequency scalp bots and copy trading bots is crucial for traders to optimize strategy alignment and risk management. High-frequency scalp bots execute numerous rapid trades to capitalize on small price movements, demanding advanced market data analysis and low latency systems. Copy trading bots replicate expert traders' actions, offering a more passive approach but with dependency on the chosen trader's performance. Selecting the appropriate bot type directly impacts trading efficiency, profitability, and exposure to market volatility.

Comparison Table

| Feature | High-Frequency Scalp Bot | Copy Trading Bot |

|---|---|---|

| Trading Style | Rapid, short-term scalp trades with millisecond execution | Mirrors trades of experienced traders in real-time |

| Speed | Extremely high-speed, suited for ultra-fast markets | Dependent on trader's actual execution speed |

| Risk Level | High risk due to frequent trades and market noise | Varies based on copied trader's strategy |

| Skill Required | Advanced programming and market microstructure knowledge | Minimal; relies on choosing successful traders to copy |

| Profit Potential | Small, consistent profits per trade aiming for volume | Potential for significant gains if copied trader is profitable |

| Market Dependency | Works best in high-liquidity, volatile markets | Works across various market conditions depending on trader |

| Implementation Cost | High initial cost for development and infrastructure | Low to moderate; usually subscription or commission-based |

| Automation Level | Fully automated with algorithmic precision | Automated execution but depends on human trader strategies |

Which is better?

High-frequency scalp bots excel in executing rapid trades to capitalize on minute price movements, requiring sophisticated algorithms and low-latency connections for optimal performance. Copy trading bots, on the other hand, allow users to replicate the strategies of experienced traders, making them suitable for individuals seeking passive income with less technical involvement. The choice depends on the trader's expertise, risk tolerance, and desired level of market engagement.

Connection

High-frequency scalp bots execute rapid trades to capitalize on small price movements, generating numerous microprofits within seconds. Copy trading bots replicate these high-frequency strategies across multiple accounts, enabling traders to harness scalp bot efficiency without manual intervention. The integration of both bots enhances market responsiveness and scalability in algorithmic trading environments.

Key Terms

Trade Execution Speed

Trade execution speed is crucial in high-frequency scalp bots, which rely on ultra-fast order placements and cancellations to capitalize on minute price fluctuations within milliseconds. Copy trading bots prioritize mirroring the trades of experienced traders, where execution speed is moderately important but secondary to replicating strategy accuracy. Explore detailed comparisons to understand which bot aligns better with your trading goals and technology preferences.

Signal Replication

Copy trading bots excel in signal replication by mirroring trades from experienced traders, ensuring precise execution aligned with proven strategies. High-frequency scalp bots operate with rapid market entries and exits, prioritizing speed and small profit margins rather than direct signal replication. Discover how each bot's approach impacts market performance and trader outcomes.

Latency Optimization

Latency optimization is crucial for high-frequency scalp bots, as they rely on executing numerous trades within milliseconds to capitalize on small price movements, demanding ultra-low-latency infrastructure and high-speed data feeds. Copy trading bots prioritize accurate replication of trades from signal providers but can tolerate higher latency since trades are not initiated by the bot itself but mirrored, making speed less critical. Explore detailed strategies and technologies used to optimize latency in both trading bot types to enhance performance and profitability.

Source and External Links

Copy trading bot on Solana - GitHub - A copy trading bot on Solana automatically mimics trades of a chosen trader's wallet in real-time across multiple decentralized exchanges on Solana, enabling seamless access to deep liquidity and optimized trade execution.

Copy-Trading Platform for Binance, Bybit, OKX and More - WunderTrading is a platform that replicates trades from experienced traders and bots across major exchanges via API, allowing users to copy trades with customizable trade sizes and full control over position management.

Copy Bot - Features - Cryptohopper Crypto Trading - Cryptohopper's Copy Bots automate technical analysis or algo trading by copying successful traders, offering features to track profits, max drawdown, and trade details to help users make informed decisions while managing subscriptions and portfolios easily.

dowidth.com

dowidth.com