Liquidity sweep involves aggressively targeting visible orders to quickly execute large trades, often revealing the trader's intentions to the market. Hidden liquidity refers to unadvertised orders placed within order books that remain concealed until matched, providing discretion in trading strategies. Explore how these mechanisms impact market efficiency and trading outcomes for deeper insights.

Why it is important

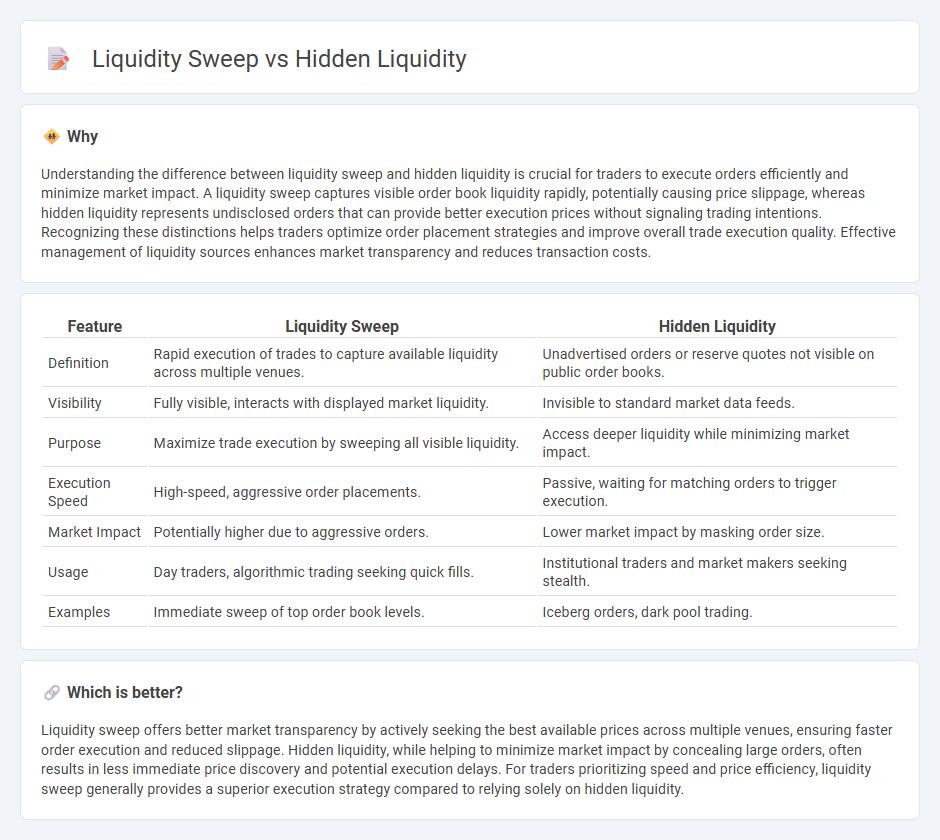

Understanding the difference between liquidity sweep and hidden liquidity is crucial for traders to execute orders efficiently and minimize market impact. A liquidity sweep captures visible order book liquidity rapidly, potentially causing price slippage, whereas hidden liquidity represents undisclosed orders that can provide better execution prices without signaling trading intentions. Recognizing these distinctions helps traders optimize order placement strategies and improve overall trade execution quality. Effective management of liquidity sources enhances market transparency and reduces transaction costs.

Comparison Table

| Feature | Liquidity Sweep | Hidden Liquidity |

|---|---|---|

| Definition | Rapid execution of trades to capture available liquidity across multiple venues. | Unadvertised orders or reserve quotes not visible on public order books. |

| Visibility | Fully visible, interacts with displayed market liquidity. | Invisible to standard market data feeds. |

| Purpose | Maximize trade execution by sweeping all visible liquidity. | Access deeper liquidity while minimizing market impact. |

| Execution Speed | High-speed, aggressive order placements. | Passive, waiting for matching orders to trigger execution. |

| Market Impact | Potentially higher due to aggressive orders. | Lower market impact by masking order size. |

| Usage | Day traders, algorithmic trading seeking quick fills. | Institutional traders and market makers seeking stealth. |

| Examples | Immediate sweep of top order book levels. | Iceberg orders, dark pool trading. |

Which is better?

Liquidity sweep offers better market transparency by actively seeking the best available prices across multiple venues, ensuring faster order execution and reduced slippage. Hidden liquidity, while helping to minimize market impact by concealing large orders, often results in less immediate price discovery and potential execution delays. For traders prioritizing speed and price efficiency, liquidity sweep generally provides a superior execution strategy compared to relying solely on hidden liquidity.

Connection

Liquidity sweep refers to the rapid execution of large orders by accessing multiple liquidity pools to minimize market impact. Hidden liquidity consists of non-displayed orders in the order book that provide additional depth without revealing trading intentions. Both concepts interact as liquidity sweeps can uncover and consume hidden liquidity, thereby increasing market efficiency and reducing transaction costs.

Key Terms

Order Book

Hidden liquidity refers to undisclosed resting orders in the order book, often placed by large institutional traders to avoid market impact and signaling their true trading intent. A liquidity sweep occurs when aggressive orders rapidly consume visible order book levels, triggering hidden liquidity to surface and execute, providing deeper market depth. Explore how these mechanisms influence order book dynamics and trading strategies to gain a competitive edge.

Iceberg Order

Iceberg orders strategically conceal large trade quantities by displaying only a fraction, enhancing market stealth and reducing price impact, whereas liquidity sweeps aggressively capture hidden liquidity across multiple price levels to rapidly execute substantial orders. Iceberg orders optimize execution by revealing limited volume to prevent market signals, contrasting with liquidity sweeps designed for urgent fulfillment of large bids or asks. Explore how iceberg orders balance discretion and execution efficiency in modern trading strategies by learning more about their market implications.

Market Impact

Hidden liquidity minimizes market impact by keeping large orders discreet through iceberg orders or dark pools, preventing price fluctuations caused by visible supply and demand. Liquidity sweeps aggressively remove liquidity by targeting multiple price levels to execute large trades quickly, often resulting in significant short-term market impact due to sudden order book depletion. Explore deeper insights on how each strategy shapes trading dynamics and affects market efficiency.

Source and External Links

Advanced Order Flow Trading: Spotting Hidden Liquidity & Iceberg Orders - Hidden liquidity refers to large orders intentionally concealed by breaking them into smaller portions (iceberg orders) to prevent revealing the full size in the order book, allowing traders to anticipate price moves and detect market manipulation.

Hidden Liquidity: Some new light on dark trading - Bank of Canada - Hidden liquidity allows traders to conceal all or part of their orders in equity markets, resulting in a non-displayed component of market liquidity that obscures true market depth and can affect price transparency.

Navigating the Murky World of Hidden Liquidity - Despite regulatory goals for transparency, hidden liquidity provides about 40% of trading volume in US equity markets and up to 75% for high-priced stocks, with advanced AI models now used to detect and predict such liquidity for better execution quality.

dowidth.com

dowidth.com