Dark pool aggregation offers traders access to large blocks of shares traded privately, minimizing market impact and reducing price slippage compared to lit markets where orders are publicly visible on exchanges. Lit markets provide transparency through real-time order books, enabling price discovery and immediate execution but potentially exposing traders to front-running and higher volatility. Explore the advantages and challenges of dark pool aggregation versus lit market trading to enhance your trading strategy.

Why it is important

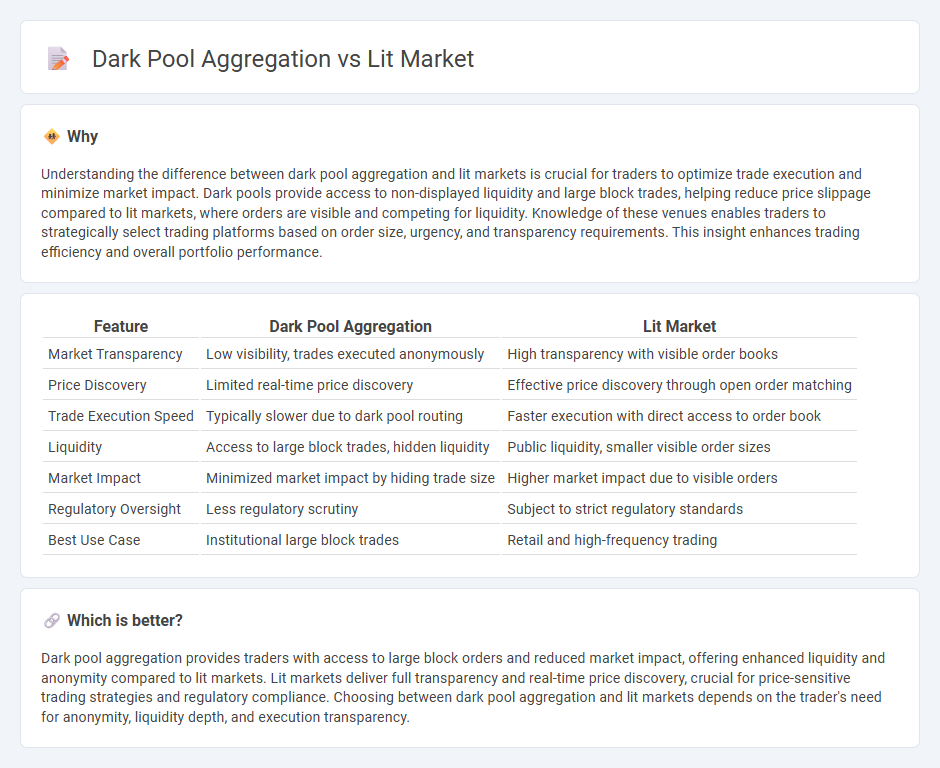

Understanding the difference between dark pool aggregation and lit markets is crucial for traders to optimize trade execution and minimize market impact. Dark pools provide access to non-displayed liquidity and large block trades, helping reduce price slippage compared to lit markets, where orders are visible and competing for liquidity. Knowledge of these venues enables traders to strategically select trading platforms based on order size, urgency, and transparency requirements. This insight enhances trading efficiency and overall portfolio performance.

Comparison Table

| Feature | Dark Pool Aggregation | Lit Market |

|---|---|---|

| Market Transparency | Low visibility, trades executed anonymously | High transparency with visible order books |

| Price Discovery | Limited real-time price discovery | Effective price discovery through open order matching |

| Trade Execution Speed | Typically slower due to dark pool routing | Faster execution with direct access to order book |

| Liquidity | Access to large block trades, hidden liquidity | Public liquidity, smaller visible order sizes |

| Market Impact | Minimized market impact by hiding trade size | Higher market impact due to visible orders |

| Regulatory Oversight | Less regulatory scrutiny | Subject to strict regulatory standards |

| Best Use Case | Institutional large block trades | Retail and high-frequency trading |

Which is better?

Dark pool aggregation provides traders with access to large block orders and reduced market impact, offering enhanced liquidity and anonymity compared to lit markets. Lit markets deliver full transparency and real-time price discovery, crucial for price-sensitive trading strategies and regulatory compliance. Choosing between dark pool aggregation and lit markets depends on the trader's need for anonymity, liquidity depth, and execution transparency.

Connection

Dark pool aggregation consolidates large, non-public trading orders from multiple private venues, enabling institutional traders to execute sizable trades with minimal market impact. Lit markets represent public exchanges where order books and trade information are transparent and accessible, facilitating price discovery and real-time liquidity. Integrating dark pool data with lit market pricing enhances trade execution strategies by providing comprehensive market depth and reducing information asymmetry.

Key Terms

Order Book

Lit markets display visible order books where buy and sell orders are openly available, enabling traders to gauge market depth and price levels transparently. Dark pool aggregation consolidates non-displayed orders, minimizing market impact and preserving anonymity but lacks real-time order book data, which can challenge price discovery. Explore how combining lit and dark liquidity sources enhances trading strategies through deeper market insight.

Liquidity

Lit markets offer transparent liquidity with visible order books, enabling traders to assess real-time supply and demand. Dark pool aggregation consolidates hidden liquidity across multiple private venues, reducing market impact and enhancing execution quality for large orders. Explore the differences in liquidity strategies and execution benefits to optimize trading decisions.

Trade Transparency

Lit market trading offers high trade transparency by displaying order books and real-time price data, allowing market participants to make informed decisions. Dark pool aggregation conceals order details to reduce market impact and provide anonymity, but this can limit transparency and complicate price discovery. Explore the differences in trade transparency between lit markets and dark pool aggregation to understand their effects on market efficiency.

Source and External Links

Dark Pool vs. Lit Exchange: Transparency Trade-Offs - A lit market (or lit exchange) is a public stock trading venue that openly displays all orders and trades in real time, providing transparency through visible order books and price discovery, such as the NYSE and NASDAQ.

Lit pool - Wikipedia - Lit pools, or lit markets, contrast with dark pools by showing available buy and sell prices at all times, accounting for about 70% of trades, and are considered more transparent and ideal for trading.

Lit pool: Explained - TIOmarkets - Lit pools offer advantages like transparency and price discovery by publicly displaying bids and asks, but drawbacks include potential price slippage and information leakage which can lead to predatory trading.

dowidth.com

dowidth.com