Perpetual swaps are derivative contracts that provide continuous exposure to an underlying asset without an expiration date, enabling traders to hold positions indefinitely with leverage. Leveraged tokens represent a fixed amount of leverage in a single token, offering simplified exposure to amplified price movements without the need for margin management. Explore the key differences and strategic uses of perpetual swaps and leveraged tokens to enhance your trading approach.

Why it is important

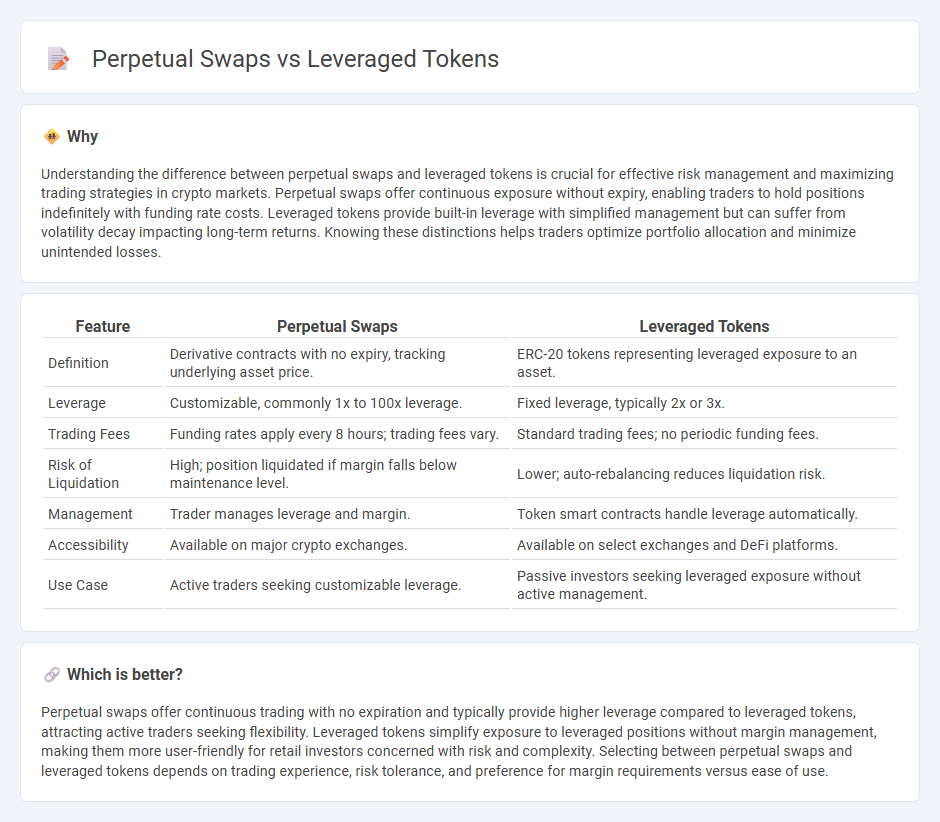

Understanding the difference between perpetual swaps and leveraged tokens is crucial for effective risk management and maximizing trading strategies in crypto markets. Perpetual swaps offer continuous exposure without expiry, enabling traders to hold positions indefinitely with funding rate costs. Leveraged tokens provide built-in leverage with simplified management but can suffer from volatility decay impacting long-term returns. Knowing these distinctions helps traders optimize portfolio allocation and minimize unintended losses.

Comparison Table

| Feature | Perpetual Swaps | Leveraged Tokens |

|---|---|---|

| Definition | Derivative contracts with no expiry, tracking underlying asset price. | ERC-20 tokens representing leveraged exposure to an asset. |

| Leverage | Customizable, commonly 1x to 100x leverage. | Fixed leverage, typically 2x or 3x. |

| Trading Fees | Funding rates apply every 8 hours; trading fees vary. | Standard trading fees; no periodic funding fees. |

| Risk of Liquidation | High; position liquidated if margin falls below maintenance level. | Lower; auto-rebalancing reduces liquidation risk. |

| Management | Trader manages leverage and margin. | Token smart contracts handle leverage automatically. |

| Accessibility | Available on major crypto exchanges. | Available on select exchanges and DeFi platforms. |

| Use Case | Active traders seeking customizable leverage. | Passive investors seeking leveraged exposure without active management. |

Which is better?

Perpetual swaps offer continuous trading with no expiration and typically provide higher leverage compared to leveraged tokens, attracting active traders seeking flexibility. Leveraged tokens simplify exposure to leveraged positions without margin management, making them more user-friendly for retail investors concerned with risk and complexity. Selecting between perpetual swaps and leveraged tokens depends on trading experience, risk tolerance, and preference for margin requirements versus ease of use.

Connection

Perpetual swaps and leveraged tokens both enable traders to amplify exposure to underlying assets without owning them directly, utilizing leverage to maximize potential returns. Perpetual swaps are derivative contracts with no expiration, allowing continuous trading based on asset price movements, while leveraged tokens represent a fixed leverage position that automatically adjusts to maintain target leverage ratios. Both instruments rely on underlying asset price dynamics and funding rates to sustain leverage effects, facilitating strategic trading in cryptocurrency markets.

Key Terms

Leverage

Leveraged tokens offer fixed leverage exposure without the risk of liquidation, making them suitable for traders seeking controlled risk in volatile markets, while perpetual swaps provide dynamic leverage with liquidation risk, enabling more aggressive trading strategies. Leveraged tokens typically maintain a constant leverage ratio, such as 3x, through daily rebalancing, contrasting with the flexible but risky leverage adjustments in perpetual swaps. Explore the detailed mechanics and risk profiles of leveraged tokens versus perpetual swaps to optimize your trading approach.

Liquidation

Leveraged tokens allow traders to gain exposure to cryptocurrency price movements without managing margin or liquidation risk directly, as liquidation is handled internally within the token structure. Perpetual swaps require active margin management, with positions subjected to liquidation if margin requirements fall below maintenance thresholds, resulting in forced closure at unfavorable prices. Explore more to understand the risk management mechanisms and suitability of each instrument for your trading strategy.

Funding Rate

Leveraged tokens offer built-in leverage without the risk of liquidation, while perpetual swaps require active margin management to avoid liquidation based on funding rate fluctuations. The funding rate in perpetual swaps is a periodic payment exchanged between long and short positions to keep the contract price aligned with the underlying asset, impacting the cost of holding a position. Explore the nuances of funding rates and their effects on your trading strategies to optimize returns.

Source and External Links

What is a Leveraged Token? - Coincall - Leveraged tokens are crypto tokens with built-in leverage that provide amplified exposure to an asset, allowing higher returns with less capital, without risk of liquidation because they never expire or reach zero, and can be traded freely like normal tokens.

Leveraged Tokens Explained: A Comprehensive Guide for Crypto - KuCoin - These tokens offer leveraged exposure to cryptocurrencies by following a basket of perpetual contract positions, thus providing leverage benefits without the risks and management complexity of traditional margin trading or futures contracts.

Leverage Tokens Overview - Toros Finance - Toros leveraged tokens automatically manage and rebalance leverage dynamically to maximize returns and reduce liquidation risk, adjusting leverage upward when the asset moves favorably and reducing it when the price moves against to protect the position.

dowidth.com

dowidth.com