Altcoin sniping focuses on rapid purchasing of newly listed cryptocurrencies to capitalize on early price surges, offering high-risk, high-reward opportunities. Grid trading employs automated buy and sell orders at predetermined intervals to profit from market volatility while minimizing manual intervention. Explore the nuances of altcoin sniping and grid trading strategies to optimize your trading approach.

Why it is important

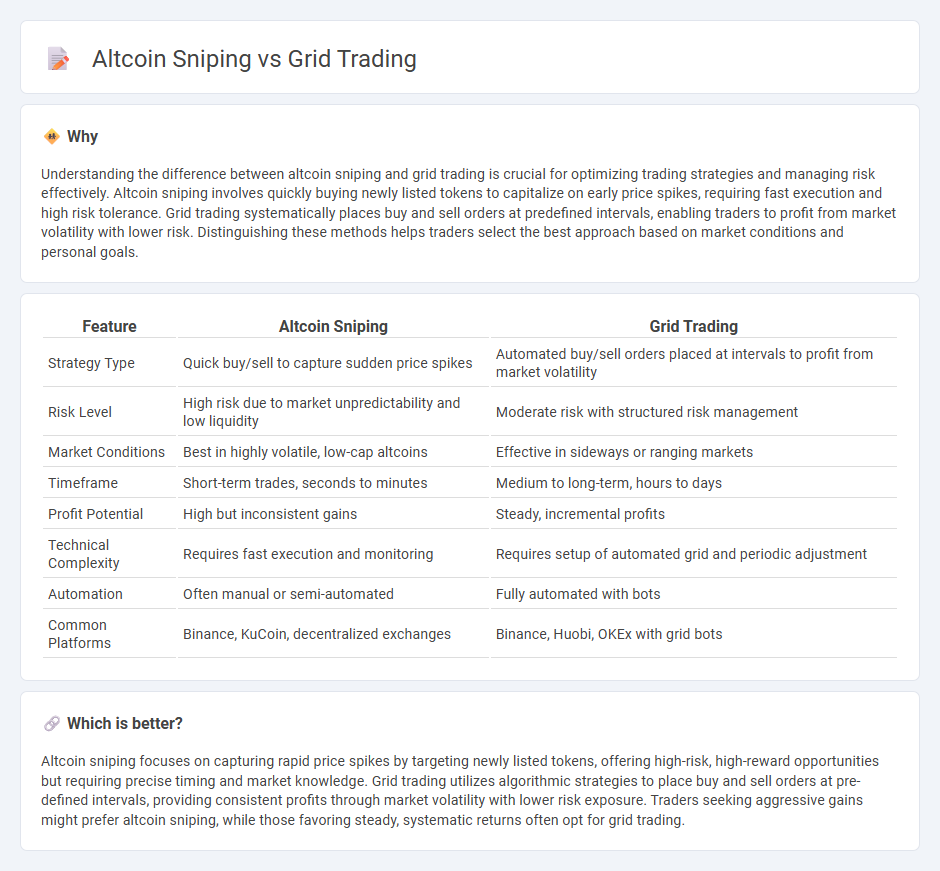

Understanding the difference between altcoin sniping and grid trading is crucial for optimizing trading strategies and managing risk effectively. Altcoin sniping involves quickly buying newly listed tokens to capitalize on early price spikes, requiring fast execution and high risk tolerance. Grid trading systematically places buy and sell orders at predefined intervals, enabling traders to profit from market volatility with lower risk. Distinguishing these methods helps traders select the best approach based on market conditions and personal goals.

Comparison Table

| Feature | Altcoin Sniping | Grid Trading |

|---|---|---|

| Strategy Type | Quick buy/sell to capture sudden price spikes | Automated buy/sell orders placed at intervals to profit from market volatility |

| Risk Level | High risk due to market unpredictability and low liquidity | Moderate risk with structured risk management |

| Market Conditions | Best in highly volatile, low-cap altcoins | Effective in sideways or ranging markets |

| Timeframe | Short-term trades, seconds to minutes | Medium to long-term, hours to days |

| Profit Potential | High but inconsistent gains | Steady, incremental profits |

| Technical Complexity | Requires fast execution and monitoring | Requires setup of automated grid and periodic adjustment |

| Automation | Often manual or semi-automated | Fully automated with bots |

| Common Platforms | Binance, KuCoin, decentralized exchanges | Binance, Huobi, OKEx with grid bots |

Which is better?

Altcoin sniping focuses on capturing rapid price spikes by targeting newly listed tokens, offering high-risk, high-reward opportunities but requiring precise timing and market knowledge. Grid trading utilizes algorithmic strategies to place buy and sell orders at pre-defined intervals, providing consistent profits through market volatility with lower risk exposure. Traders seeking aggressive gains might prefer altcoin sniping, while those favoring steady, systematic returns often opt for grid trading.

Connection

Altcoin sniping and grid trading are connected through their focus on capitalizing on short-term market fluctuations and price volatility in cryptocurrency markets. Altcoin sniping involves quickly purchasing newly listed or undervalued altcoins to exploit initial price spikes, while grid trading automates buy and sell orders at predetermined intervals to profit from price oscillations. Both strategies rely on precise timing and market analysis to enhance trading efficiency and maximize returns in volatile altcoin markets.

Key Terms

Grid Trading:

Grid trading leverages automated buy and sell orders at preset intervals within a specific price range to capitalize on market volatility, ensuring consistent profits regardless of market direction. This strategy reduces the risks associated with timing the market by systematically capturing gains from small price movements, making it ideal for volatile assets like altcoins. Explore our detailed guide to maximize returns through effective grid trading strategies.

Price Range

Grid trading strategically places buy and sell orders at predefined price intervals to profit from market fluctuations within a set price range, making it effective in sideways markets. Altcoin sniping targets rapid entry and exit points immediately after new coin listings or price surges, focusing on quick gains rather than a fixed price range. Explore detailed strategies and risk management techniques to optimize your trading approach.

Limit Orders

Grid trading uses a series of predefined limit orders placed at incremental price levels to capitalize on market volatility, allowing traders to systematically buy low and sell high. Altcoin sniping relies on quickly placing limit orders to purchase newly listed tokens at launch prices before they spike, aiming for rapid profits. Explore the nuances of limit order strategies in both methods to enhance your trading approach.

Source and External Links

A Primer on Grid Trading Strategy - Grid trading is an automated strategy involving setting a "price grid" of multiple buy and sell orders at specified price intervals to capitalize on price oscillations, often used in currency markets and relying on parameters like highest/lowest price and grid spacing based on historical volatility.

Grid trading - This technique places buy and sell orders at fixed price intervals that create a "grid" of orders, aiming to profit from market volatility without forecasting trends by buying low and selling high repeatedly as prices move within the grid.

What is Grid Trading? A Smart Strategy for Market Volatility - Grid trading automates buy and sell orders at predefined intervals within a set price range to exploit price fluctuations across various assets, working best in volatile markets but carries risks if strong trends develop against the grid positions.

dowidth.com

dowidth.com