Synthetic positions replicate the payoff of owning an asset by combining options, such as buying a call and selling a put with the same strike price and expiration. Married puts involve purchasing a stock and simultaneously buying a put option to limit downside risk through a protective strategy. Explore the distinct risk profiles and strategic uses of synthetic positions versus married puts to enhance your trading approach.

Why it is important

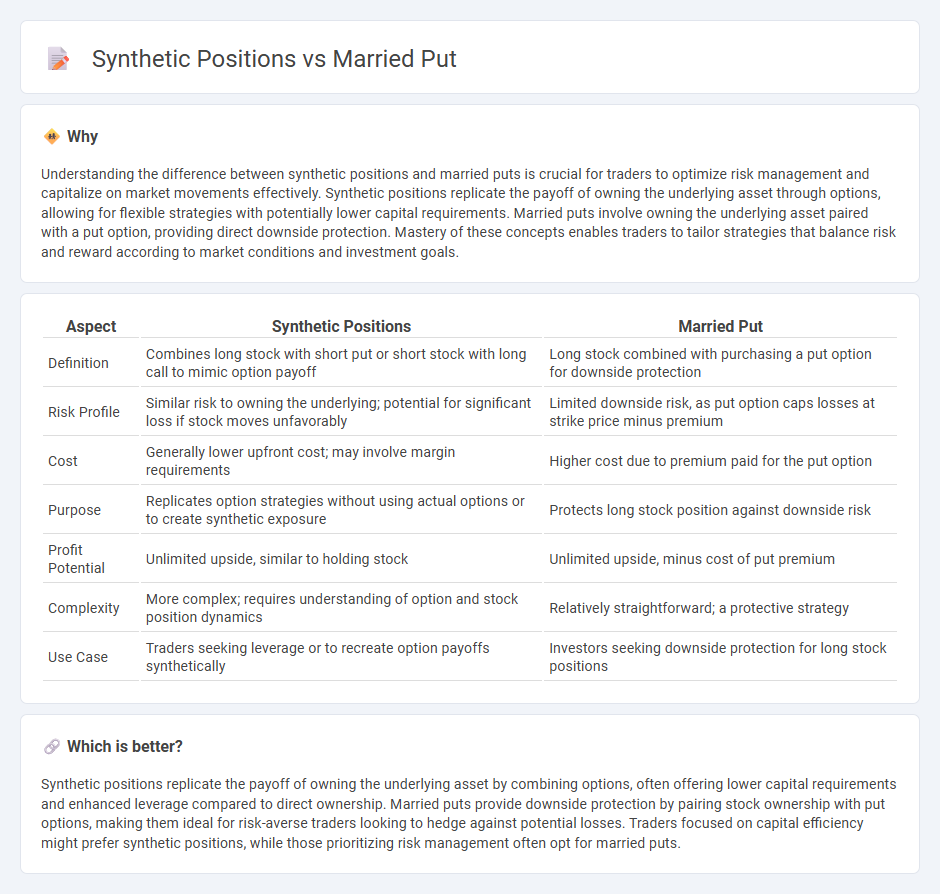

Understanding the difference between synthetic positions and married puts is crucial for traders to optimize risk management and capitalize on market movements effectively. Synthetic positions replicate the payoff of owning the underlying asset through options, allowing for flexible strategies with potentially lower capital requirements. Married puts involve owning the underlying asset paired with a put option, providing direct downside protection. Mastery of these concepts enables traders to tailor strategies that balance risk and reward according to market conditions and investment goals.

Comparison Table

| Aspect | Synthetic Positions | Married Put |

|---|---|---|

| Definition | Combines long stock with short put or short stock with long call to mimic option payoff | Long stock combined with purchasing a put option for downside protection |

| Risk Profile | Similar risk to owning the underlying; potential for significant loss if stock moves unfavorably | Limited downside risk, as put option caps losses at strike price minus premium |

| Cost | Generally lower upfront cost; may involve margin requirements | Higher cost due to premium paid for the put option |

| Purpose | Replicates option strategies without using actual options or to create synthetic exposure | Protects long stock position against downside risk |

| Profit Potential | Unlimited upside, similar to holding stock | Unlimited upside, minus cost of put premium |

| Complexity | More complex; requires understanding of option and stock position dynamics | Relatively straightforward; a protective strategy |

| Use Case | Traders seeking leverage or to recreate option payoffs synthetically | Investors seeking downside protection for long stock positions |

Which is better?

Synthetic positions replicate the payoff of owning the underlying asset by combining options, often offering lower capital requirements and enhanced leverage compared to direct ownership. Married puts provide downside protection by pairing stock ownership with put options, making them ideal for risk-averse traders looking to hedge against potential losses. Traders focused on capital efficiency might prefer synthetic positions, while those prioritizing risk management often opt for married puts.

Connection

Synthetic positions replicate the payoff of an asset using options, while a married put involves holding the underlying asset combined with a put option for downside protection. Both strategies utilize options to manage risk and mimic or hedge underlying asset exposures in trading. Traders employ synthetic positions and married puts to optimize portfolio risk and return by leveraging option contracts effectively.

Key Terms

Hedging

Married puts involve purchasing a put option while holding the underlying asset, providing direct downside protection by locking in a minimum sale price, which is ideal for conservative hedging strategies. Synthetic positions replicate stock ownership through options, such as using a long call and short put, offering leveraged exposure but involving more complex risk management and less straightforward hedging efficacy. Explore deeper insights into how married puts and synthetic positions optimize risk management and portfolio protection.

Options

Married put options involve purchasing a stock and a put option simultaneously to hedge against downside risk, providing a synthetic insurance policy for long equity positions. Synthetic positions replicate the payoff of holding the underlying asset by combining options, such as a long call and short put, creating equivalent exposure without owning the stock outright. Explore further to understand how these strategies optimize risk management and portfolio flexibility in options trading.

Payoff Structure

Married puts combine owning the underlying asset with a protective put option, limiting downside risk while allowing upside potential, resulting in a payoff structure similar to a long call with defined risk. Synthetic positions, typically created by combining options such as a long call and a short put, replicate the payoff of owning the underlying asset but with different margin and risk characteristics. Explore detailed comparisons to understand how these strategies can optimize risk-return profiles in various market conditions.

Source and External Links

Married Put Options Strategy: Defined & Explained - SoFi - A married put is an options trading strategy where an investor buys shares and simultaneously purchases an at-the-money put option to protect against a price drop, offering downside protection while retaining upside potential, with the trade-off being the premium paid for the put option.

Protective Put (Married Put) - The Options Industry Council - This strategy involves adding a long put option to a long stock position to insure the stock's value, limiting loss if the stock price falls below the put's strike price, while allowing unlimited upside gain if the stock price rises.

Protective option - Wikipedia - A married put, also called a protective put, consists of holding shares and buying put options as insurance to limit losses on owned stock, with the premium paid acting as the cost of this protection compared to using stop-loss orders.

dowidth.com

dowidth.com