Volatility harvesting and market making are distinct trading strategies that leverage market fluctuations differently. Volatility harvesting focuses on profiting from price swings by actively adjusting portfolio positions, while market making involves quoting buy and sell prices to earn the bid-ask spread. Discover how each approach can optimize trading outcomes in dynamic markets.

Why it is important

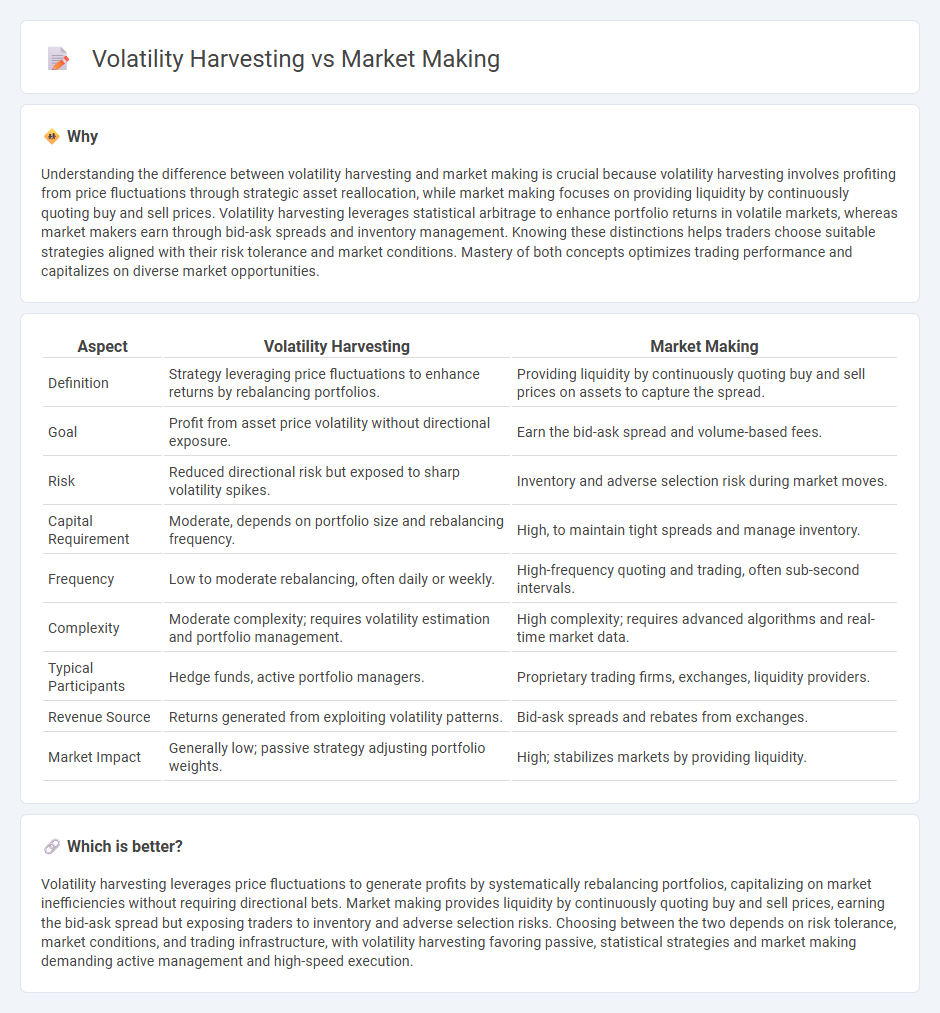

Understanding the difference between volatility harvesting and market making is crucial because volatility harvesting involves profiting from price fluctuations through strategic asset reallocation, while market making focuses on providing liquidity by continuously quoting buy and sell prices. Volatility harvesting leverages statistical arbitrage to enhance portfolio returns in volatile markets, whereas market makers earn through bid-ask spreads and inventory management. Knowing these distinctions helps traders choose suitable strategies aligned with their risk tolerance and market conditions. Mastery of both concepts optimizes trading performance and capitalizes on diverse market opportunities.

Comparison Table

| Aspect | Volatility Harvesting | Market Making |

|---|---|---|

| Definition | Strategy leveraging price fluctuations to enhance returns by rebalancing portfolios. | Providing liquidity by continuously quoting buy and sell prices on assets to capture the spread. |

| Goal | Profit from asset price volatility without directional exposure. | Earn the bid-ask spread and volume-based fees. |

| Risk | Reduced directional risk but exposed to sharp volatility spikes. | Inventory and adverse selection risk during market moves. |

| Capital Requirement | Moderate, depends on portfolio size and rebalancing frequency. | High, to maintain tight spreads and manage inventory. |

| Frequency | Low to moderate rebalancing, often daily or weekly. | High-frequency quoting and trading, often sub-second intervals. |

| Complexity | Moderate complexity; requires volatility estimation and portfolio management. | High complexity; requires advanced algorithms and real-time market data. |

| Typical Participants | Hedge funds, active portfolio managers. | Proprietary trading firms, exchanges, liquidity providers. |

| Revenue Source | Returns generated from exploiting volatility patterns. | Bid-ask spreads and rebates from exchanges. |

| Market Impact | Generally low; passive strategy adjusting portfolio weights. | High; stabilizes markets by providing liquidity. |

Which is better?

Volatility harvesting leverages price fluctuations to generate profits by systematically rebalancing portfolios, capitalizing on market inefficiencies without requiring directional bets. Market making provides liquidity by continuously quoting buy and sell prices, earning the bid-ask spread but exposing traders to inventory and adverse selection risks. Choosing between the two depends on risk tolerance, market conditions, and trading infrastructure, with volatility harvesting favoring passive, statistical strategies and market making demanding active management and high-speed execution.

Connection

Volatility harvesting leverages price fluctuations to generate profits by systematically capturing gains from market movements, while market making provides liquidity by continuously quoting buy and sell prices. The connection lies in the market maker's ability to exploit short-term volatility through dynamic bid-ask spreads, effectively harvesting volatility embedded in asset price variations. This synergy enhances market efficiency and allows traders to benefit from both liquidity provision and price oscillations.

Key Terms

Bid-Ask Spread

Market making profits primarily from the bid-ask spread by continuously providing liquidity and capitalizing on the difference between buying and selling prices. Volatility harvesting involves exploiting price fluctuations to generate returns, often by systematically rebalancing portfolios to capture gains from market volatility rather than relying on spread income. Discover how these strategies differ in managing risk and enhancing returns through detailed bid-ask spread analysis.

Mean Reversion

Market making involves providing liquidity by continuously buying and selling assets, capitalizing on small bid-ask spreads, while volatility harvesting exploits price fluctuations to generate returns through frequent rebalancing. Both strategies benefit from mean reversion, which assumes asset prices tend to revert to their historical average, enhancing profitability by identifying entry and exit points when prices deviate significantly. Explore detailed insights into these strategies to optimize your trading approach based on mean reversion dynamics.

Liquidity Provision

Liquidity provision plays a crucial role in market making by continuously offering buy and sell orders, thus narrowing spreads and enhancing market efficiency. Volatility harvesting leverages fluctuations in asset prices to generate profits through strategic adjustment of positions, often benefiting from increased market activity and liquidity. Explore the dynamics between liquidity provision and volatility harvesting to optimize trading strategies and market participation.

Source and External Links

Mastering the Market Maker Trading Strategy | EPAM SolutionsHub - Market makers earn profits by providing liquidity, primarily through the bid-ask spread, managing inventory, and analyzing order flow to anticipate price movements while adhering to market regulations.

Market maker: What it is, importance, benefits & examples - StoneX - A market maker continuously quotes buy (bid) and sell (ask) prices for securities, profiting from the bid-ask spread while managing inventory risk to ensure market liquidity and smooth trading.

Market Maker - Definition, Role, How They Work | Corporate Finance Institute - Market makers are firms or individuals that provide two-sided markets by posting bid and ask prices, profiting from the spread and maintaining market liquidity by trading for themselves and others.

dowidth.com

dowidth.com