Airdrop farming involves collecting free cryptocurrency tokens distributed by new projects to encourage adoption and community growth, while liquidity mining requires users to provide assets to decentralized finance (DeFi) protocols in exchange for rewards. Both strategies incentivize participation in evolving blockchain ecosystems but differ in risk, effort, and potential returns. Explore the nuances of airdrop farming and liquidity mining to optimize your trading strategy.

Why it is important

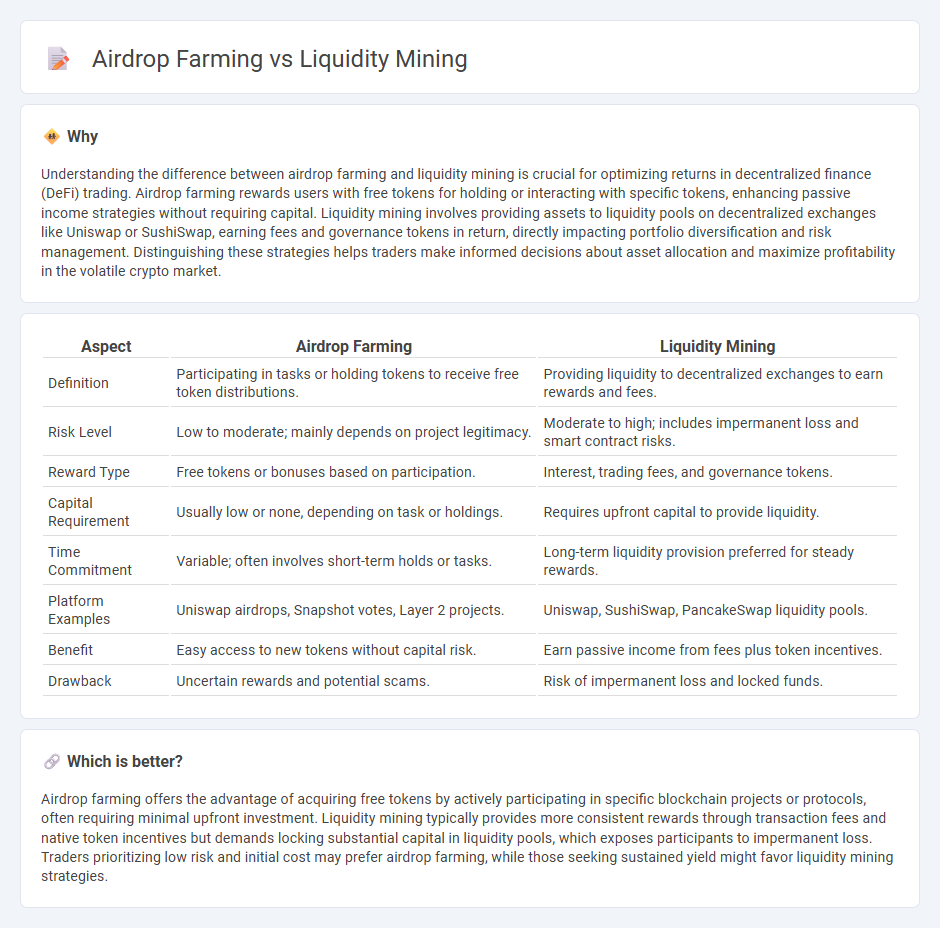

Understanding the difference between airdrop farming and liquidity mining is crucial for optimizing returns in decentralized finance (DeFi) trading. Airdrop farming rewards users with free tokens for holding or interacting with specific tokens, enhancing passive income strategies without requiring capital. Liquidity mining involves providing assets to liquidity pools on decentralized exchanges like Uniswap or SushiSwap, earning fees and governance tokens in return, directly impacting portfolio diversification and risk management. Distinguishing these strategies helps traders make informed decisions about asset allocation and maximize profitability in the volatile crypto market.

Comparison Table

| Aspect | Airdrop Farming | Liquidity Mining |

|---|---|---|

| Definition | Participating in tasks or holding tokens to receive free token distributions. | Providing liquidity to decentralized exchanges to earn rewards and fees. |

| Risk Level | Low to moderate; mainly depends on project legitimacy. | Moderate to high; includes impermanent loss and smart contract risks. |

| Reward Type | Free tokens or bonuses based on participation. | Interest, trading fees, and governance tokens. |

| Capital Requirement | Usually low or none, depending on task or holdings. | Requires upfront capital to provide liquidity. |

| Time Commitment | Variable; often involves short-term holds or tasks. | Long-term liquidity provision preferred for steady rewards. |

| Platform Examples | Uniswap airdrops, Snapshot votes, Layer 2 projects. | Uniswap, SushiSwap, PancakeSwap liquidity pools. |

| Benefit | Easy access to new tokens without capital risk. | Earn passive income from fees plus token incentives. |

| Drawback | Uncertain rewards and potential scams. | Risk of impermanent loss and locked funds. |

Which is better?

Airdrop farming offers the advantage of acquiring free tokens by actively participating in specific blockchain projects or protocols, often requiring minimal upfront investment. Liquidity mining typically provides more consistent rewards through transaction fees and native token incentives but demands locking substantial capital in liquidity pools, which exposes participants to impermanent loss. Traders prioritizing low risk and initial cost may prefer airdrop farming, while those seeking sustained yield might favor liquidity mining strategies.

Connection

Airdrop farming and liquidity mining are interconnected DeFi strategies that maximize crypto asset rewards by participating in decentralized exchanges and protocols. Airdrop farming involves qualifying for token distributions by actively providing liquidity or engaging with a platform, while liquidity mining specifically rewards users for staking assets in liquidity pools to facilitate trading. Both methods enhance user engagement and increase token circulation, driving ecosystem growth and incentivizing long-term participation.

Key Terms

**Liquidity Mining:**

Liquidity mining involves providing cryptocurrency assets to decentralized finance (DeFi) platforms in exchange for rewards, often paid in the platform's native tokens. This process helps enhance market liquidity and enables users to earn passive income based on their asset contributions. Discover detailed strategies and benefits of liquidity mining to maximize your DeFi earning potential.

Liquidity Pool

Liquidity mining involves providing tokens to a liquidity pool, earning rewards proportional to the share of assets supplied, which enhances decentralized exchange efficiency through increased liquidity. Airdrop farming focuses on holding or interacting with specific tokens or platforms to qualify for free token distributions, often requiring less active contribution to liquidity pools. Explore detailed strategies and risk factors in liquidity pool participation and airdrop farming to maximize your decentralized finance gains.

Yield Farming

Liquidity mining and airdrop farming are integral strategies within yield farming, where liquidity mining involves providing assets to decentralized finance (DeFi) pools to earn rewards, whereas airdrop farming capitalizes on receiving free tokens distributed by new projects. Yield farming maximizes returns by strategically deploying capital into DeFi protocols, leveraging both liquidity mining rewards and opportunistic airdrops. Explore our detailed guide to master yield farming and optimize your crypto asset growth.

Source and External Links

Staking vs Yield Farming vs Liquidity Mining - Blockchain Council - Liquidity mining is a DeFi mechanism where users supply liquidity to decentralized exchanges (DEXs) and are rewarded with the platform's own tokens plus fees, enabling passive income and helping bootstrap liquidity for trading without centralized intermediaries.

Liquidity Mining - What It Means and How It Works? - Token Metrics - Liquidity mining rewards investors with cryptocurrency for providing liquidity to decentralized platforms, offering a low-risk way to earn passively while increasing a token's liquidity and tradability.

Introduction to Liquidity Mining on Bybit - Liquidity mining on Bybit allows participants to deposit crypto assets into AMM-based liquidity pools, earning fees and tokens, with features like auto-rebalancing and optional leverage to maximize yield, while facilitating liquidity for derivative markets.

dowidth.com

dowidth.com