Market making involves continuously providing liquidity by placing buy and sell orders to capture the bid-ask spread, thus profiting from market inefficiencies and volatility. Trend following focuses on identifying and trading in the direction of prevailing market trends using technical indicators and momentum strategies. Explore more to understand which trading approach aligns best with your investment goals and risk tolerance.

Why it is important

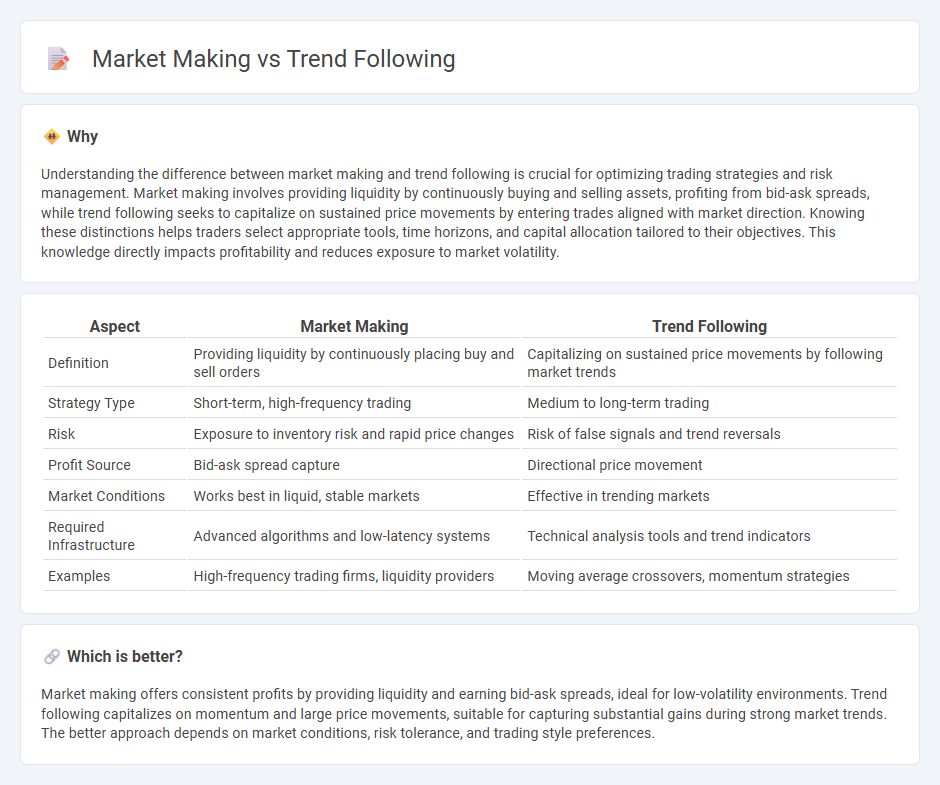

Understanding the difference between market making and trend following is crucial for optimizing trading strategies and risk management. Market making involves providing liquidity by continuously buying and selling assets, profiting from bid-ask spreads, while trend following seeks to capitalize on sustained price movements by entering trades aligned with market direction. Knowing these distinctions helps traders select appropriate tools, time horizons, and capital allocation tailored to their objectives. This knowledge directly impacts profitability and reduces exposure to market volatility.

Comparison Table

| Aspect | Market Making | Trend Following |

|---|---|---|

| Definition | Providing liquidity by continuously placing buy and sell orders | Capitalizing on sustained price movements by following market trends |

| Strategy Type | Short-term, high-frequency trading | Medium to long-term trading |

| Risk | Exposure to inventory risk and rapid price changes | Risk of false signals and trend reversals |

| Profit Source | Bid-ask spread capture | Directional price movement |

| Market Conditions | Works best in liquid, stable markets | Effective in trending markets |

| Required Infrastructure | Advanced algorithms and low-latency systems | Technical analysis tools and trend indicators |

| Examples | High-frequency trading firms, liquidity providers | Moving average crossovers, momentum strategies |

Which is better?

Market making offers consistent profits by providing liquidity and earning bid-ask spreads, ideal for low-volatility environments. Trend following capitalizes on momentum and large price movements, suitable for capturing substantial gains during strong market trends. The better approach depends on market conditions, risk tolerance, and trading style preferences.

Connection

Market making and trend following interact through liquidity and price momentum dynamics, where market makers provide essential liquidity that enables trend followers to enter and exit positions smoothly. Market makers profit from bid-ask spreads by continuously buying and selling assets, which stabilizes prices and reduces volatility that trend followers capitalize on. Trend following strategies rely on the sustained price movements facilitated by market makers' liquidity provision to identify and exploit upward or downward market trends effectively.

Key Terms

**Trend Following:**

Trend following relies on identifying and capitalizing on sustained market movements by analyzing price patterns and momentum indicators to make buy or sell decisions. This strategy is prevalent among commodity traders and hedge funds, leveraging algorithms and technical analysis tools to optimize entry and exit points. Discover more about how trend following strategies can enhance your trading performance and risk management.

Breakout

Trend following strategies capitalize on breakout signals by entering trades when price breaks above resistance or below support levels, seeking to ride prolonged market momentum. Market making involves providing liquidity by placing buy and sell orders around the current price, profiting from the bid-ask spread rather than directional moves, which makes breakouts less favorable due to increased volatility. Explore detailed comparisons to understand how breakout dynamics influence the effectiveness of trend following versus market making approaches.

Moving Average

Trend following strategies using Moving Averages capitalize on identifying sustained price directions by tracking the crossover of short-term and long-term averages to signal entry and exit points. Market making involves providing liquidity by continuously quoting buy and sell prices around the Moving Average to profit from the bid-ask spread while managing inventory risk. Explore deeper insights into how these methodologies can complement various trading styles and risk profiles.

Source and External Links

Trend following - Wikipedia - Trend following is a trading strategy where traders buy assets when prices are trending up and sell when trending down, using methods like moving averages and channel breakouts, without attempting to forecast exact price levels.

Trend Following Trading Strategies and Systems (Backtest Results) - Trend following strategies rely on technical analysis tools to identify and enter trades along existing market trends and exit upon signs of reversal, emphasizing systematic rules, risk management, and adaptability across various asset classes.

Trend-Following Primer - Graham Capital Management - As a major alternative investment strategy managing over $300 billion, trend following uses algorithmic models to systematically capture price trends by taking long or short positions across diverse liquid futures and currency markets, providing portfolio diversification and risk control.

dowidth.com

dowidth.com