Risk reversal and diagonal spread are two advanced trading strategies used to manage risk and enhance profit potential in options trading. Risk reversal involves simultaneously buying a call option and selling a put option, often used for bullish positions, while diagonal spreads combine options with different strike prices and expiration dates to exploit time decay and volatility. Explore the nuances of these strategies to optimize your trading approach and manage market exposure effectively.

Why it is important

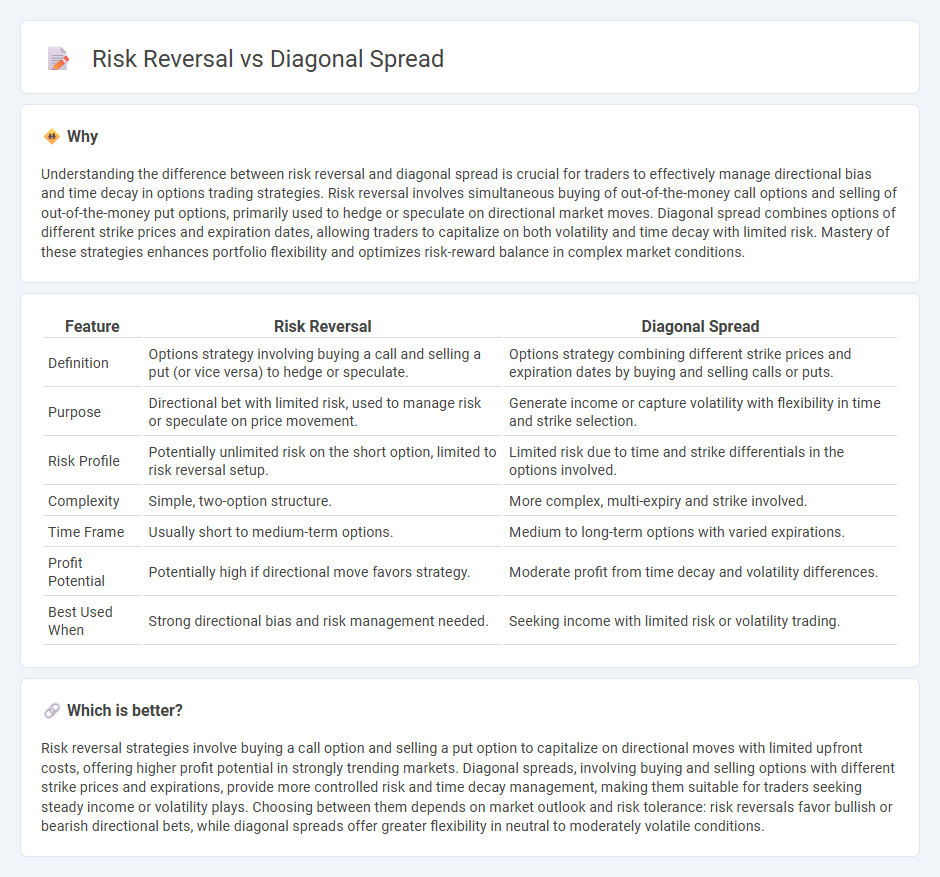

Understanding the difference between risk reversal and diagonal spread is crucial for traders to effectively manage directional bias and time decay in options trading strategies. Risk reversal involves simultaneous buying of out-of-the-money call options and selling of out-of-the-money put options, primarily used to hedge or speculate on directional market moves. Diagonal spread combines options of different strike prices and expiration dates, allowing traders to capitalize on both volatility and time decay with limited risk. Mastery of these strategies enhances portfolio flexibility and optimizes risk-reward balance in complex market conditions.

Comparison Table

| Feature | Risk Reversal | Diagonal Spread |

|---|---|---|

| Definition | Options strategy involving buying a call and selling a put (or vice versa) to hedge or speculate. | Options strategy combining different strike prices and expiration dates by buying and selling calls or puts. |

| Purpose | Directional bet with limited risk, used to manage risk or speculate on price movement. | Generate income or capture volatility with flexibility in time and strike selection. |

| Risk Profile | Potentially unlimited risk on the short option, limited to risk reversal setup. | Limited risk due to time and strike differentials in the options involved. |

| Complexity | Simple, two-option structure. | More complex, multi-expiry and strike involved. |

| Time Frame | Usually short to medium-term options. | Medium to long-term options with varied expirations. |

| Profit Potential | Potentially high if directional move favors strategy. | Moderate profit from time decay and volatility differences. |

| Best Used When | Strong directional bias and risk management needed. | Seeking income with limited risk or volatility trading. |

Which is better?

Risk reversal strategies involve buying a call option and selling a put option to capitalize on directional moves with limited upfront costs, offering higher profit potential in strongly trending markets. Diagonal spreads, involving buying and selling options with different strike prices and expirations, provide more controlled risk and time decay management, making them suitable for traders seeking steady income or volatility plays. Choosing between them depends on market outlook and risk tolerance: risk reversals favor bullish or bearish directional bets, while diagonal spreads offer greater flexibility in neutral to moderately volatile conditions.

Connection

Risk reversal and diagonal spread are connected through their use in options trading strategies to manage risk and enhance potential returns. Risk reversal involves simultaneously buying a call option and selling a put option to create directional exposure, while a diagonal spread combines options of different strike prices and expiration dates, offering a balance between risk and reward. Both strategies allow traders to adjust their market outlook while controlling risk through carefully selected option strikes and expirations.

Key Terms

Strike Prices

Diagonal spreads involve options with different strike prices and expiration dates, allowing for flexible strike selection to target specific price points and manage risk. Risk reversals combine a long call and short put with different strikes, typically used to hedge or speculate on directional moves, emphasizing strike price placement relative to the underlying asset's current price. Explore detailed strategies and strike selection techniques to optimize your options trading approach.

Volatility Exposure

Diagonal spreads involve buying and selling options with different strike prices and expiration dates, offering a strategic way to capitalize on volatility changes across time frames. Risk reversals combine buying calls and selling puts (or vice versa) to create a directional volatility position that benefits from skewed market expectations. Explore detailed volatility exposure differences to enhance your options trading strategies.

Directional Bias

A diagonal spread combines options of different strike prices and expirations to create a strategy with limited risk and moderate directional bias, typically favoring moderate price movements. Risk reversals involve buying a call and selling a put (or vice versa) at different strikes, expressing a strong directional bias by capitalizing on expected price swings. Explore detailed comparisons of directional biases in options strategies to optimize trading decisions.

Source and External Links

What is a Long Call Diagonal Spread & How to Trade it? - A long call diagonal spread consists of buying a call option with a longer expiration and a closer-to-the-money (or in-the-money) strike, while selling a call with a nearer expiration and a further-out-of-the-money strike, aiming to benefit from both direction and time decay.

Call Diagonal Spread Guide [Setup, Entry, Adjustments, Exit] - This strategy involves selling a near-term call at a lower strike and buying a longer-term call at a higher strike, defining risk and profit, and is ideally deployed when expecting the stock to be neutral or bearish in the short term.

What Is Double Diagonal Spread? - A double diagonal spread is formed by buying a longer-term straddle and selling a shorter-term strangle, creating a defined-risk, advanced options play with limited profit and loss, designed to profit from a stock landing near the short strangle's strikes at the nearer expiration.

dowidth.com

dowidth.com