Paper trading competitions provide a risk-free environment for traders to practice strategies using virtual funds, emphasizing skill development without financial exposure. Futures trading competitions involve real-market assets where participants trade contracts based on commodity or financial index prices with actual capital at risk, introducing higher stakes and potential profits. Explore the key differences and advantages of each competition type to enhance your trading proficiency.

Why it is important

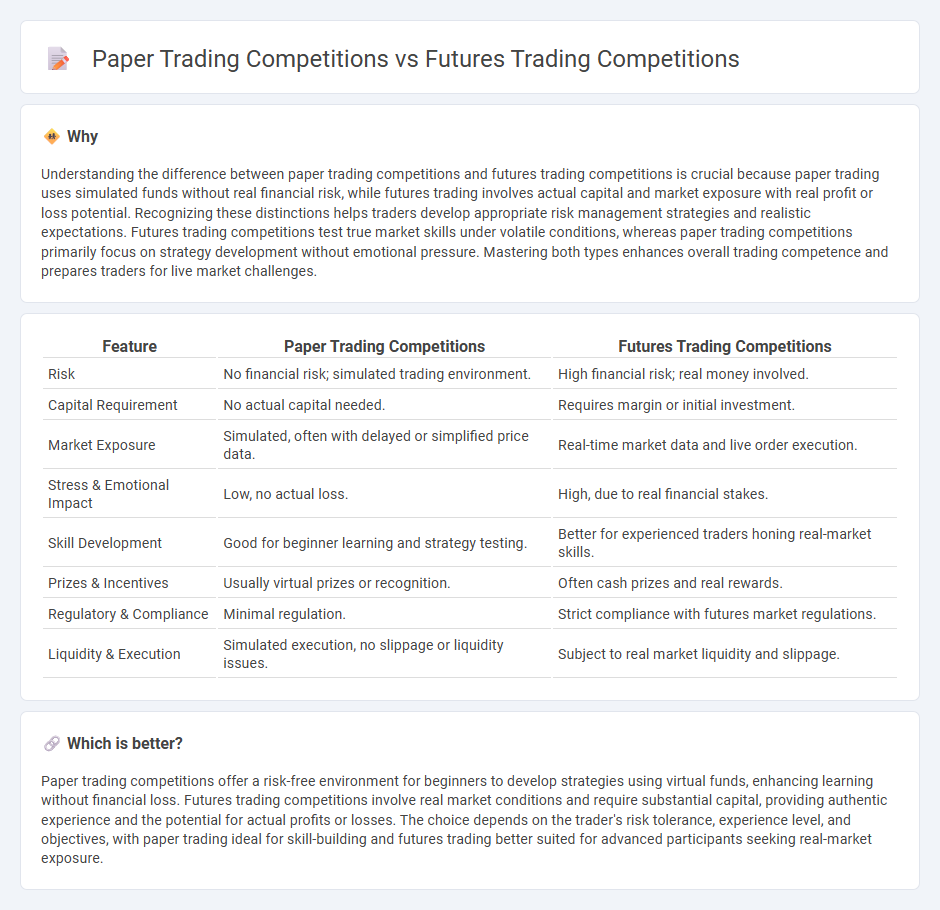

Understanding the difference between paper trading competitions and futures trading competitions is crucial because paper trading uses simulated funds without real financial risk, while futures trading involves actual capital and market exposure with real profit or loss potential. Recognizing these distinctions helps traders develop appropriate risk management strategies and realistic expectations. Futures trading competitions test true market skills under volatile conditions, whereas paper trading competitions primarily focus on strategy development without emotional pressure. Mastering both types enhances overall trading competence and prepares traders for live market challenges.

Comparison Table

| Feature | Paper Trading Competitions | Futures Trading Competitions |

|---|---|---|

| Risk | No financial risk; simulated trading environment. | High financial risk; real money involved. |

| Capital Requirement | No actual capital needed. | Requires margin or initial investment. |

| Market Exposure | Simulated, often with delayed or simplified price data. | Real-time market data and live order execution. |

| Stress & Emotional Impact | Low, no actual loss. | High, due to real financial stakes. |

| Skill Development | Good for beginner learning and strategy testing. | Better for experienced traders honing real-market skills. |

| Prizes & Incentives | Usually virtual prizes or recognition. | Often cash prizes and real rewards. |

| Regulatory & Compliance | Minimal regulation. | Strict compliance with futures market regulations. |

| Liquidity & Execution | Simulated execution, no slippage or liquidity issues. | Subject to real market liquidity and slippage. |

Which is better?

Paper trading competitions offer a risk-free environment for beginners to develop strategies using virtual funds, enhancing learning without financial loss. Futures trading competitions involve real market conditions and require substantial capital, providing authentic experience and the potential for actual profits or losses. The choice depends on the trader's risk tolerance, experience level, and objectives, with paper trading ideal for skill-building and futures trading better suited for advanced participants seeking real-market exposure.

Connection

Paper trading competitions simulate real market conditions allowing participants to practice futures trading strategies without financial risk. Both types of competitions emphasize skill development in analyzing market trends, risk management, and order execution within futures markets. Competitors gain valuable experience transferable to live futures trading, enhancing decision-making and confidence before engaging with actual capital.

Key Terms

**Futures Trading Competitions:**

Futures trading competitions provide participants with real market experience by involving actual capital and live market conditions, enabling traders to develop risk management skills and execute strategies under pressure. These competitions often offer substantial cash prizes and career opportunities, attracting serious traders seeking to validate their skills in competitive environments. Explore more about how futures trading competitions can accelerate your professional trading journey.

Leverage

Futures trading competitions offer real-market leverage, allowing participants to amplify potential gains and risks using actual capital, while paper trading competitions simulate leverage without real financial consequences, providing a risk-free learning environment. The use of genuine leverage in futures competitions can affect strategy and emotional management due to real profit and loss exposure. Explore how leverage impacts trading performance and risk tolerance in both competition types for deeper insights.

Liquidation

Futures trading competitions often involve real capital and market risk, leading to potential liquidations that directly impact participants' accounts, whereas paper trading competitions use simulated funds, eliminating actual liquidation consequences but still allowing for strategy testing. The emphasis on liquidation in futures trading cultivates risk management skills crucial for professional traders, while paper trading provides a risk-free environment to refine tactics without financial loss. Explore the differences in depth to determine which competition aligns best with your trading objectives.

Source and External Links

Trade Against a Pro Trading Challenge | CME Group - Participate in simulated, risk-free futures trading competitions with real-time market data, competing for cash prizes by trading a variety of futures including Cryptocurrency, Equities, and Energy, open to residents in several countries including the US and UK.

Futures Trading Challenges | The Arena | NinjaTrader - Offers risk-free, simulated futures trading contests where traders compete on live CME market data for leaderboard positions and cash prizes, suitable for all skill levels and includes ongoing challenge events.

World Cup Trading Championships - A prestigious futures and forex trading competition since 1983 where traders use their own strategies over weeks or months to achieve the highest net return, requiring a minimum account size of $10,000 for futures participation.

dowidth.com

dowidth.com