Social copy trading allows investors to replicate the trades of experienced traders in real time, offering an accessible way to participate in financial markets without deep technical knowledge. Quantitative trading leverages complex algorithms and statistical models to execute high-frequency trades with precision and minimal emotional bias. Explore the advantages and challenges of both strategies to determine which suits your trading goals best.

Why it is important

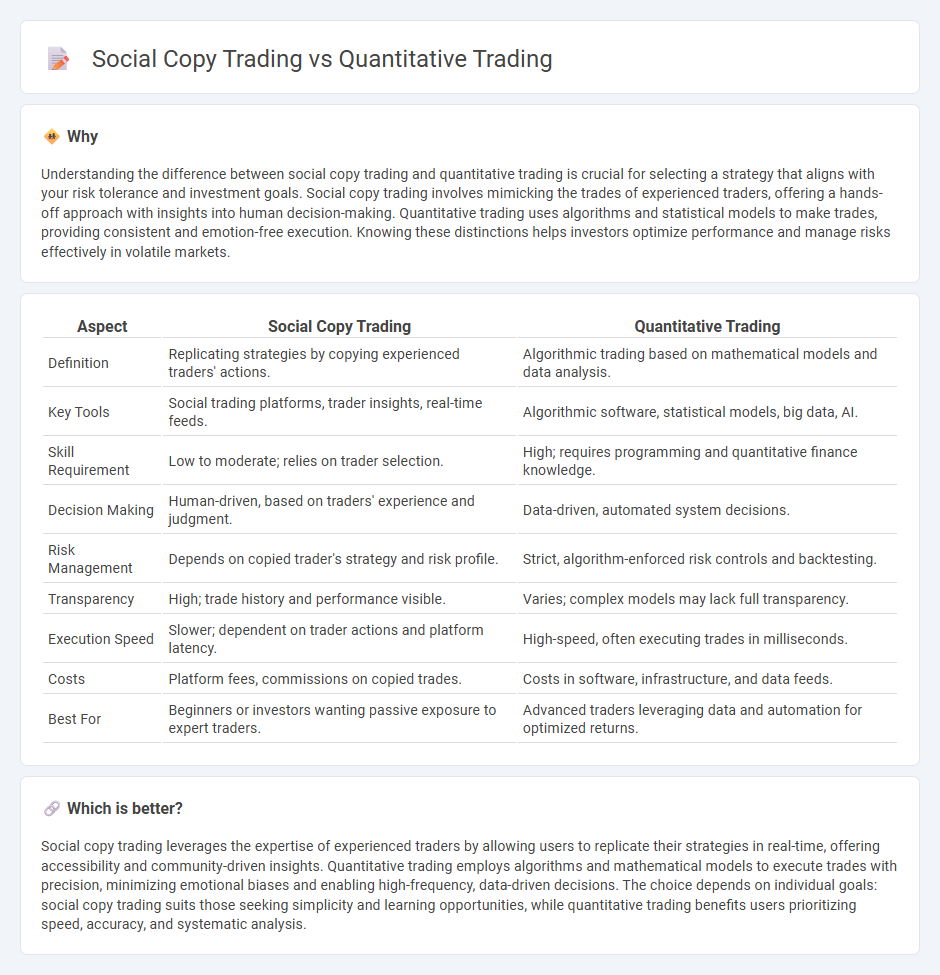

Understanding the difference between social copy trading and quantitative trading is crucial for selecting a strategy that aligns with your risk tolerance and investment goals. Social copy trading involves mimicking the trades of experienced traders, offering a hands-off approach with insights into human decision-making. Quantitative trading uses algorithms and statistical models to make trades, providing consistent and emotion-free execution. Knowing these distinctions helps investors optimize performance and manage risks effectively in volatile markets.

Comparison Table

| Aspect | Social Copy Trading | Quantitative Trading |

|---|---|---|

| Definition | Replicating strategies by copying experienced traders' actions. | Algorithmic trading based on mathematical models and data analysis. |

| Key Tools | Social trading platforms, trader insights, real-time feeds. | Algorithmic software, statistical models, big data, AI. |

| Skill Requirement | Low to moderate; relies on trader selection. | High; requires programming and quantitative finance knowledge. |

| Decision Making | Human-driven, based on traders' experience and judgment. | Data-driven, automated system decisions. |

| Risk Management | Depends on copied trader's strategy and risk profile. | Strict, algorithm-enforced risk controls and backtesting. |

| Transparency | High; trade history and performance visible. | Varies; complex models may lack full transparency. |

| Execution Speed | Slower; dependent on trader actions and platform latency. | High-speed, often executing trades in milliseconds. |

| Costs | Platform fees, commissions on copied trades. | Costs in software, infrastructure, and data feeds. |

| Best For | Beginners or investors wanting passive exposure to expert traders. | Advanced traders leveraging data and automation for optimized returns. |

Which is better?

Social copy trading leverages the expertise of experienced traders by allowing users to replicate their strategies in real-time, offering accessibility and community-driven insights. Quantitative trading employs algorithms and mathematical models to execute trades with precision, minimizing emotional biases and enabling high-frequency, data-driven decisions. The choice depends on individual goals: social copy trading suits those seeking simplicity and learning opportunities, while quantitative trading benefits users prioritizing speed, accuracy, and systematic analysis.

Connection

Social copy trading leverages the collective insights and strategies of experienced traders by allowing users to replicate their trades, while quantitative trading employs algorithmic models and data analysis to execute trades based on mathematical indicators. Both methods utilize data-driven decision-making, with social copy trading depending on human expertise aggregated through social platforms and quantitative trading relying on automated systems to identify market patterns. The integration of social sentiment data into quantitative models enhances predictive accuracy, bridging human insight with algorithmic precision in trading strategies.

Key Terms

Quantitative Trading:

Quantitative trading utilizes mathematical models and algorithms to analyze large datasets and execute trades with precision and speed, minimizing human emotion and maximizing efficiency. This data-driven approach leverages statistical arbitrage, machine learning, and high-frequency trading to exploit market inefficiencies. Explore the advantages and strategies of quantitative trading to enhance your investment portfolio.

Algorithm

Quantitative trading relies on advanced algorithms and mathematical models to analyze market data and execute trades with precision, minimizing human emotion and error. Social copy trading involves replicating trades from seasoned investors in real time, leveraging collective insights rather than algorithmic strategies. Explore the key differences and advantages of each to determine which approach fits your investment goals.

Backtesting

Quantitative trading employs rigorous backtesting by utilizing historical market data and algorithmic models to optimize strategies before live deployment, ensuring risk-adjusted returns. Social copy trading relies less on backtesting, focusing instead on mirroring successful traders' real-time moves, which introduces more uncertainty but benefits from collective expertise. Explore advanced backtesting techniques and their impact on trading strategies to maximize your investment performance.

Source and External Links

Quantitative Trading Firms Explained | Hunter Bond - Quantitative trading firms use mathematical models, statistics, and algorithms to analyze vast financial data to uncover trading opportunities and execute automated trades, often at high speed with minimal human intervention.

How To Become a Quantitative Trader in 4 Steps (With Skills) - Indeed - Quantitative traders, or quants, employ mathematical computations and data analysis to develop and implement trading strategies, often leveraging algorithmic and high-frequency trading technologies.

Quantitative analysis (finance) - Wikipedia - Quantitative analysis in finance applies mathematical and statistical techniques to investment management, involving pattern recognition in large datasets and methods like statistical arbitrage, algorithmic, and electronic trading.

dowidth.com

dowidth.com