Perpetual swaps and futures contracts are popular derivatives in trading, allowing investors to speculate on asset prices without owning the underlying. Perpetual swaps differ by having no expiry date and typically employ funding rates to keep prices aligned with spot markets, while futures contracts have set expiration dates and settle periodically. Explore the key differences and trading strategies to enhance your market understanding.

Why it is important

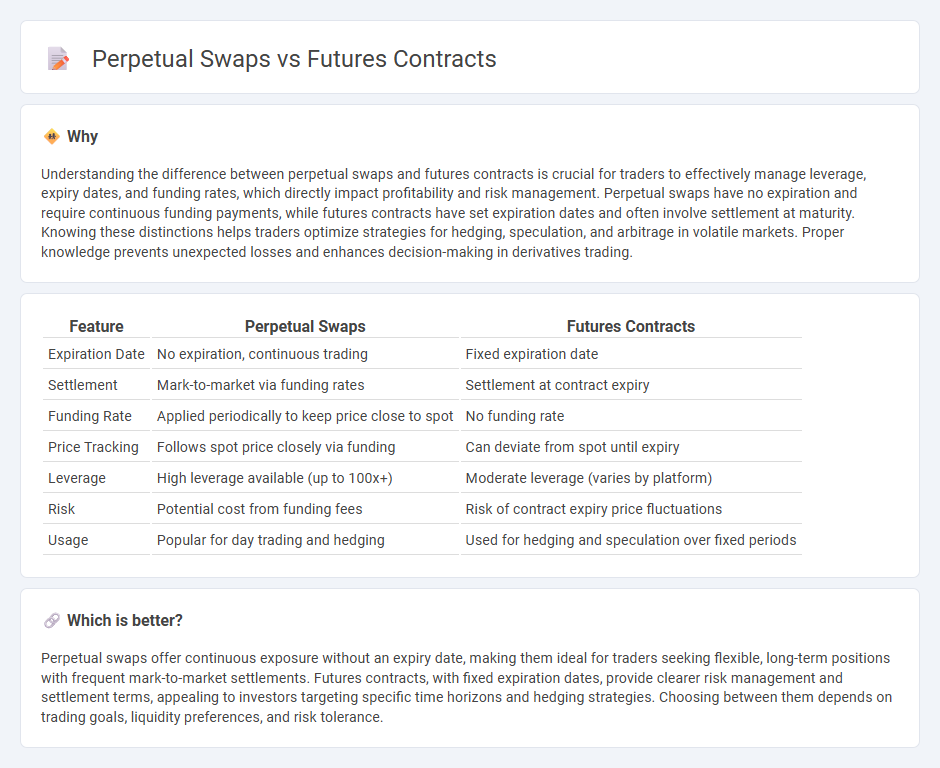

Understanding the difference between perpetual swaps and futures contracts is crucial for traders to effectively manage leverage, expiry dates, and funding rates, which directly impact profitability and risk management. Perpetual swaps have no expiration and require continuous funding payments, while futures contracts have set expiration dates and often involve settlement at maturity. Knowing these distinctions helps traders optimize strategies for hedging, speculation, and arbitrage in volatile markets. Proper knowledge prevents unexpected losses and enhances decision-making in derivatives trading.

Comparison Table

| Feature | Perpetual Swaps | Futures Contracts |

|---|---|---|

| Expiration Date | No expiration, continuous trading | Fixed expiration date |

| Settlement | Mark-to-market via funding rates | Settlement at contract expiry |

| Funding Rate | Applied periodically to keep price close to spot | No funding rate |

| Price Tracking | Follows spot price closely via funding | Can deviate from spot until expiry |

| Leverage | High leverage available (up to 100x+) | Moderate leverage (varies by platform) |

| Risk | Potential cost from funding fees | Risk of contract expiry price fluctuations |

| Usage | Popular for day trading and hedging | Used for hedging and speculation over fixed periods |

Which is better?

Perpetual swaps offer continuous exposure without an expiry date, making them ideal for traders seeking flexible, long-term positions with frequent mark-to-market settlements. Futures contracts, with fixed expiration dates, provide clearer risk management and settlement terms, appealing to investors targeting specific time horizons and hedging strategies. Choosing between them depends on trading goals, liquidity preferences, and risk tolerance.

Connection

Perpetual swaps and futures contracts are both derivative instruments used in trading to speculate on asset price movements or hedge risk, sharing similarities such as standardized contract terms and margin requirements. Unlike futures contracts, perpetual swaps do not have an expiration date, allowing traders to hold positions indefinitely while using a funding rate mechanism to anchor the contract price to the underlying asset. This connection enables traders to choose between time-bound futures and continuous perpetual swaps based on their trading strategy and market outlook.

Key Terms

Expiry Date

Futures contracts have a fixed expiry date, requiring settlement or rollover by investors before contract maturity, which influences trading strategies and risk management. Perpetual swaps lack an expiry date, allowing traders to hold positions indefinitely while using funding rates to tether contract prices to spot markets. Explore further to understand how expiry dates affect leverage, liquidity, and market dynamics in both instruments.

Funding Rate

Futures contracts involve fixed expiry dates and determined settlement prices, while perpetual swaps lack expiration and use funding rates to anchor their price close to the underlying asset's spot price. The funding rate is a periodic payment exchanged between long and short positions, incentivizing traders to maintain price convergence in perpetual swap markets. Explore the intricacies of funding rates to understand their impact on trading strategies and market dynamics.

Settlement

Futures contracts have a predetermined settlement date where positions are closed and profits or losses are realized, offering certainty in trade duration. Perpetual swaps, unlike futures, do not have an expiry date and use a funding mechanism to anchor contract prices to the spot market continuously. Explore the distinct benefits and risks of settlement types to optimize your trading strategy.

Source and External Links

Futures Contract | Definition + Examples - Wall Street Prep - Futures contracts are standardized financial derivatives obligating counterparties to buy or sell an underlying asset at a predetermined price on a specified future date, typically traded on exchanges with centralized clearing to reduce counterparty risk.

Futures Contracts Compared to Forwards - CME Group - Futures contracts allow buyers and sellers to lock in prices for assets for delivery at a future date, traded on exchanges with central clearing and used for hedging or speculative purposes, differing from forward contracts which are customized and traded OTC with higher default risk.

Futures contract - Wikipedia - Futures contracts require margins and are marked to market daily to mitigate default risk, ensuring daily settlement of gains and losses until the contract's expiration or delivery.

dowidth.com

dowidth.com