Quantitative backtesting relies on historical market data and statistical models to evaluate trading strategies' performance under various conditions, emphasizing accuracy and large-scale data analysis. Event-driven testing, on the other hand, simulates market events and order book dynamics in real time to assess strategy responsiveness to market changes such as news releases or price spikes. Explore the key differences and practical applications of both approaches to optimize your trading strategy development.

Why it is important

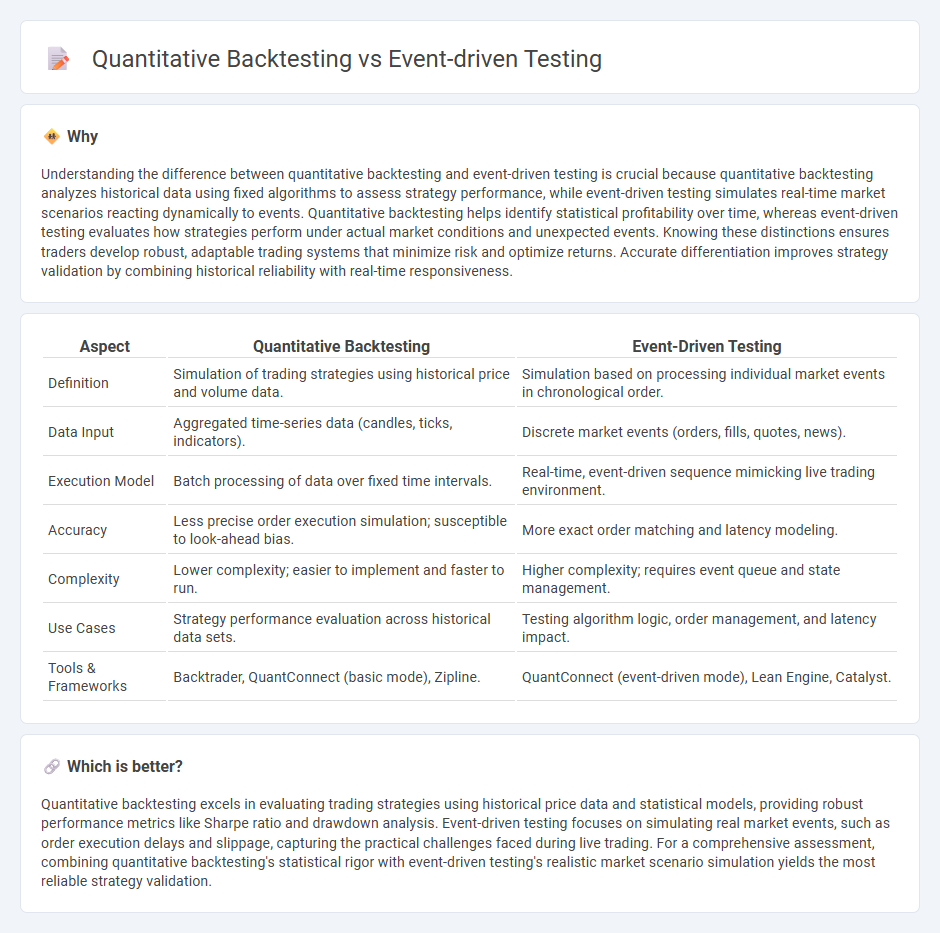

Understanding the difference between quantitative backtesting and event-driven testing is crucial because quantitative backtesting analyzes historical data using fixed algorithms to assess strategy performance, while event-driven testing simulates real-time market scenarios reacting dynamically to events. Quantitative backtesting helps identify statistical profitability over time, whereas event-driven testing evaluates how strategies perform under actual market conditions and unexpected events. Knowing these distinctions ensures traders develop robust, adaptable trading systems that minimize risk and optimize returns. Accurate differentiation improves strategy validation by combining historical reliability with real-time responsiveness.

Comparison Table

| Aspect | Quantitative Backtesting | Event-Driven Testing |

|---|---|---|

| Definition | Simulation of trading strategies using historical price and volume data. | Simulation based on processing individual market events in chronological order. |

| Data Input | Aggregated time-series data (candles, ticks, indicators). | Discrete market events (orders, fills, quotes, news). |

| Execution Model | Batch processing of data over fixed time intervals. | Real-time, event-driven sequence mimicking live trading environment. |

| Accuracy | Less precise order execution simulation; susceptible to look-ahead bias. | More exact order matching and latency modeling. |

| Complexity | Lower complexity; easier to implement and faster to run. | Higher complexity; requires event queue and state management. |

| Use Cases | Strategy performance evaluation across historical data sets. | Testing algorithm logic, order management, and latency impact. |

| Tools & Frameworks | Backtrader, QuantConnect (basic mode), Zipline. | QuantConnect (event-driven mode), Lean Engine, Catalyst. |

Which is better?

Quantitative backtesting excels in evaluating trading strategies using historical price data and statistical models, providing robust performance metrics like Sharpe ratio and drawdown analysis. Event-driven testing focuses on simulating real market events, such as order execution delays and slippage, capturing the practical challenges faced during live trading. For a comprehensive assessment, combining quantitative backtesting's statistical rigor with event-driven testing's realistic market scenario simulation yields the most reliable strategy validation.

Connection

Quantitative backtesting utilizes historical market data to statistically evaluate trading strategies for performance and risk metrics. Event-driven testing simulates real-time market conditions by reacting dynamically to new data and market events, ensuring strategies adapt effectively under live trading scenarios. Combining both methods enhances strategy robustness by validating statistical reliability and operational responsiveness.

Key Terms

Market Events

Event-driven testing emphasizes analyzing market reactions to specific economic events such as earnings reports, interest rate announcements, or geopolitical developments, capturing the impact on asset prices and volatility. Quantitative backtesting relies on historical price data and predefined algorithms across extended periods to evaluate strategy performance under various market conditions without isolating individual events. Explore deeper to understand how integrating event-driven insights can enhance quantitative backtesting frameworks.

Historical Data

Event-driven testing leverages historical event data to simulate market reactions and assess trading strategy performance under specific conditions, emphasizing scenario-based analysis. Quantitative backtesting utilizes historical price and volume data to statistically evaluate a strategy's profitability and risk metrics over extensive timeframes. Explore detailed methodologies and comparative insights to optimize your testing approach.

Trading Strategy Logic

Event-driven testing evaluates trading strategy logic by simulating market events such as order executions, price changes, and news impacts to analyze algorithm responses in real-time scenarios. Quantitative backtesting relies on historical price and volume data, assessing strategy performance through statistical metrics like Sharpe ratio, drawdown, and profit factor over past market conditions. Explore in-depth comparisons and practical applications of both methods to optimize your trading strategies.

Source and External Links

Testing Event-Driven Architecture - DEV Community - Event-driven testing involves validating event ordering, handling asynchronous event arrival, event payload/schema changes, and testing event-triggered services by simulating event delays, duplication, and failure scenarios to ensure system resilience and correctness.

Testing Event-Driven Application Architectures: An Asynchronous ... - Testing event-driven systems requires adapting unit, integration, and performance tests to handle asynchronous message passing with automation for provisioning messaging infrastructure, along with aggregated logging and distributed tracing to monitor and validate system behavior at scale.

Testing Event-driven Systems with OpenTelemetry | Tracetest Blog - Event-driven systems can be tested by using trace-based methods and tools like OpenTelemetry and Kafka to emit and track event consumption, enabling validation of asynchronous workflow correctness in distributed services such as payment processing and risk analysis.

dowidth.com

dowidth.com