Proprietary firms often prioritize quick trade execution, strict risk limits, and individual performance metrics, contrasting with hedge funds' focus on long-term portfolio diversification and collaborative decision-making. Prop traders face rigorous daily P&L targets and tighter capital constraints, while hedge fund candidates undergo comprehensive evaluations of macroeconomic strategy and asset class expertise. Explore deeper insights into these recruitment dynamics to enhance your trading career strategy.

Why it is important

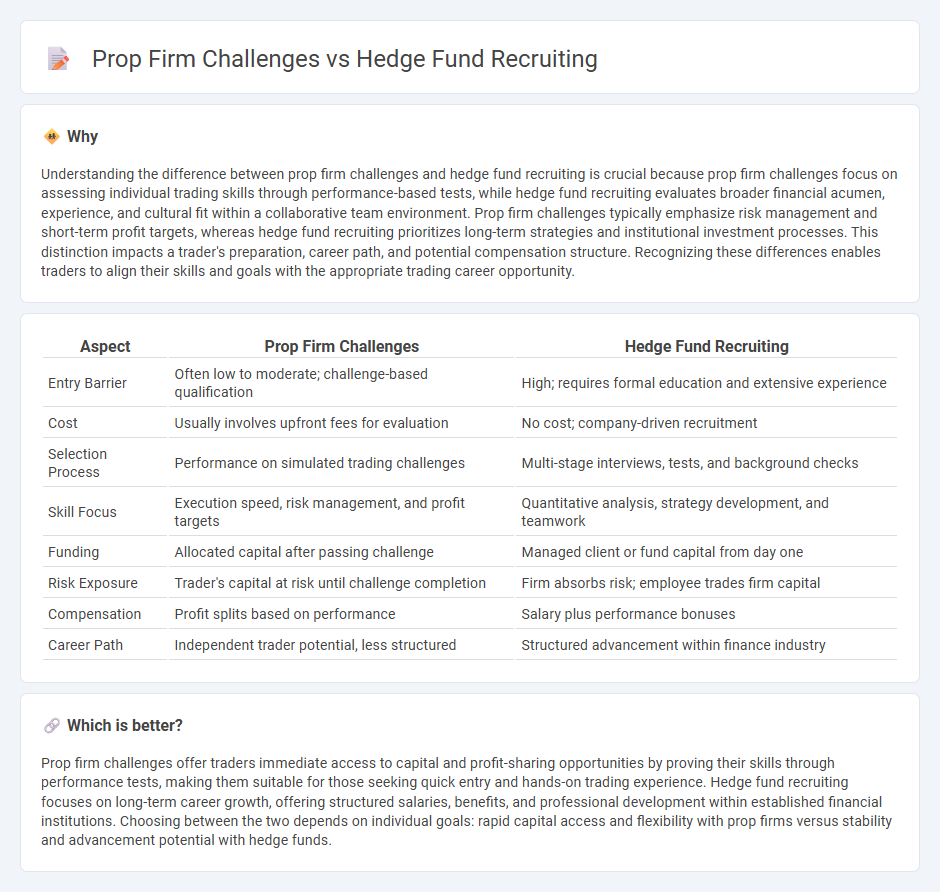

Understanding the difference between prop firm challenges and hedge fund recruiting is crucial because prop firm challenges focus on assessing individual trading skills through performance-based tests, while hedge fund recruiting evaluates broader financial acumen, experience, and cultural fit within a collaborative team environment. Prop firm challenges typically emphasize risk management and short-term profit targets, whereas hedge fund recruiting prioritizes long-term strategies and institutional investment processes. This distinction impacts a trader's preparation, career path, and potential compensation structure. Recognizing these differences enables traders to align their skills and goals with the appropriate trading career opportunity.

Comparison Table

| Aspect | Prop Firm Challenges | Hedge Fund Recruiting |

|---|---|---|

| Entry Barrier | Often low to moderate; challenge-based qualification | High; requires formal education and extensive experience |

| Cost | Usually involves upfront fees for evaluation | No cost; company-driven recruitment |

| Selection Process | Performance on simulated trading challenges | Multi-stage interviews, tests, and background checks |

| Skill Focus | Execution speed, risk management, and profit targets | Quantitative analysis, strategy development, and teamwork |

| Funding | Allocated capital after passing challenge | Managed client or fund capital from day one |

| Risk Exposure | Trader's capital at risk until challenge completion | Firm absorbs risk; employee trades firm capital |

| Compensation | Profit splits based on performance | Salary plus performance bonuses |

| Career Path | Independent trader potential, less structured | Structured advancement within finance industry |

Which is better?

Prop firm challenges offer traders immediate access to capital and profit-sharing opportunities by proving their skills through performance tests, making them suitable for those seeking quick entry and hands-on trading experience. Hedge fund recruiting focuses on long-term career growth, offering structured salaries, benefits, and professional development within established financial institutions. Choosing between the two depends on individual goals: rapid capital access and flexibility with prop firms versus stability and advancement potential with hedge funds.

Connection

Prop firm challenges serve as rigorous assessments of traders' skills, offering performance metrics that hedge funds use to identify top talent. Successful completion of these challenges demonstrates risk management and strategic execution, qualities highly valued in hedge fund recruiting. This connection creates a direct pipeline where proven traders transition from proprietary trading firms to hedge fund roles.

Key Terms

Performance Track Record

Hedge fund recruiting emphasizes a strong, verifiable performance track record to attract top-tier investors and secure capital commitments. Proprietary trading firms face challenges in demonstrating consistent returns under varying market conditions without external funding reliance. Explore deeper insights into how performance metrics shape recruitment strategies across these trading environments.

Risk Appetite

Hedge fund recruiting prioritizes candidates with a deep understanding of risk management, emphasizing a balance between aggressive growth and capital preservation to meet stringent investor expectations. Proprietary trading firms challenge traders to manage high-risk appetites with rapid decision-making and autonomous strategies, often demanding a tolerance for volatility and quick adaptation. Explore the nuanced differences in risk appetite approaches to enhance your recruitment or trading strategies.

Compensation Structure

Hedge fund recruiting often emphasizes performance-based bonuses and long-term incentive plans, attracting candidates with substantial earnings potential tied to fund profitability. Proprietary trading firms typically offer a more variable compensation structure, including base salary plus a significant share of trading profits, aiming to align trader performance closely with personal earnings. Explore more about how these compensation models shape talent acquisition and retention strategies in both industries.

Source and External Links

Hedge Fund Jobs | Street Of Walls - Hedge fund recruiting typically lacks a formal hiring process; traditional methods include job boards and hedge fund websites, but headhunters play a key role by vetting candidates and providing quality applicants to funds, including larger firms that may have internal HR teams but still rely heavily on external recruiters.

Top 12 Hedge Fund Recruiters - Jake Jorgovan - Leading recruiters such as Alpha Apex Group specialize in placing portfolio managers, traders, and analysts in hedge funds, offering tailored recruitment, executive search, and talent retention advisory to align candidates with fund goals and market demands.

How to Get a Job at a Hedge Fund: Networking, Interviews & Pitching - Networking is crucial in hedge fund recruiting, often more effective than job boards or headhunters; hedge funds may not have dedicated HR teams, so reaching out directly to professionals via LinkedIn or alumni networks is recommended, while reputable headhunters like Glocap and Dynamics Search Partners remain important for many funds.

dowidth.com

dowidth.com