Market making involves providing liquidity by continuously buying and selling securities at quoted bid and ask prices, profiting from the spread. Momentum trading focuses on capitalizing on the continuation of existing price trends through strategic entry and exit points. Explore deeper insights into the dynamics and strategies of market making versus momentum trading.

Why it is important

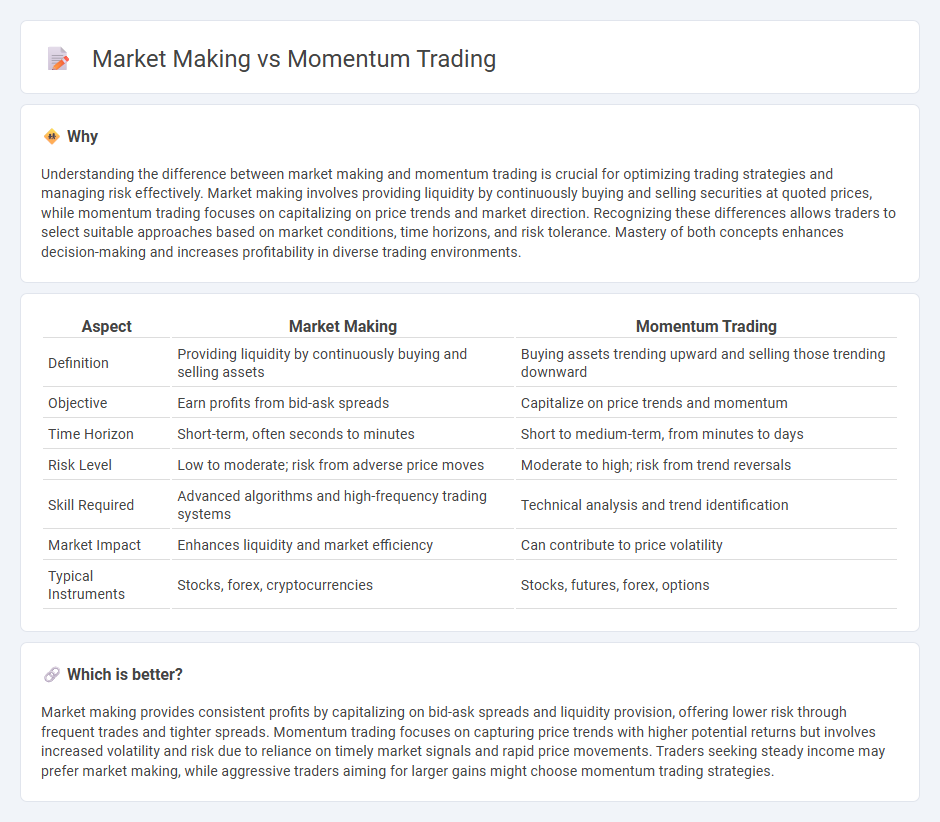

Understanding the difference between market making and momentum trading is crucial for optimizing trading strategies and managing risk effectively. Market making involves providing liquidity by continuously buying and selling securities at quoted prices, while momentum trading focuses on capitalizing on price trends and market direction. Recognizing these differences allows traders to select suitable approaches based on market conditions, time horizons, and risk tolerance. Mastery of both concepts enhances decision-making and increases profitability in diverse trading environments.

Comparison Table

| Aspect | Market Making | Momentum Trading |

|---|---|---|

| Definition | Providing liquidity by continuously buying and selling assets | Buying assets trending upward and selling those trending downward |

| Objective | Earn profits from bid-ask spreads | Capitalize on price trends and momentum |

| Time Horizon | Short-term, often seconds to minutes | Short to medium-term, from minutes to days |

| Risk Level | Low to moderate; risk from adverse price moves | Moderate to high; risk from trend reversals |

| Skill Required | Advanced algorithms and high-frequency trading systems | Technical analysis and trend identification |

| Market Impact | Enhances liquidity and market efficiency | Can contribute to price volatility |

| Typical Instruments | Stocks, forex, cryptocurrencies | Stocks, futures, forex, options |

Which is better?

Market making provides consistent profits by capitalizing on bid-ask spreads and liquidity provision, offering lower risk through frequent trades and tighter spreads. Momentum trading focuses on capturing price trends with higher potential returns but involves increased volatility and risk due to reliance on timely market signals and rapid price movements. Traders seeking steady income may prefer market making, while aggressive traders aiming for larger gains might choose momentum trading strategies.

Connection

Market making provides liquidity by continuously quoting bid and ask prices, which allows momentum traders to exploit price trends more efficiently. Momentum trading relies on rapid price movements that are facilitated by the tight spreads and high volume generated by market makers. The interaction between market making and momentum trading enhances market efficiency and short-term price discovery.

Key Terms

Momentum Trading:

Momentum trading involves capitalizing on existing market trends by buying assets that show upward price momentum and selling those with downward momentum, aiming to profit from short- to medium-term price movements. Key indicators used in momentum trading include relative strength index (RSI), moving average convergence divergence (MACD), and volume analysis to identify potential entry and exit points. Explore in-depth strategies and risk management techniques to master momentum trading effectively.

Trend

Momentum trading capitalizes on identifying and riding established market trends by buying assets showing upward price momentum and selling those with downward momentum to maximize short-term gains. Market making involves continuously providing buy and sell quotes to capture bid-ask spreads and maintain liquidity, with less emphasis on trend direction. Explore our detailed analysis to understand how each strategy thrives in different market conditions.

Volume

Momentum trading capitalizes on high trading volumes to identify and ride strong price trends, leveraging rapid buying or selling to maximize short-term gains. Market making relies on continuous order flow and volume to provide liquidity, profiting from bid-ask spreads while managing inventory risks in varying volume conditions. Explore detailed strategies and volume implications in both approaches to enhance your trading expertise.

Source and External Links

Momentum Trading: Types, Strategies and More - Part I - Momentum trading involves buying or selling assets based on recent price trends, using either time-series (individual asset vs. its own past) or cross-sectional (asset vs. peers) approaches to identify strong momentum.

Momentum Trading: Types, Strategies, and More - Traders execute momentum strategies by focusing on assets with strong recent performance, either ranking them against their own history or against other assets, aiming to capitalize on continued trends.

Momentum Trading for Beginners (What They Don't ... - The video teaches beginners how to identify and ride strong price moves using tools like RSI and MACD, emphasizing the importance of trading with the trend, risk management, and practical chart examples.

dowidth.com

dowidth.com