Tokenized assets represent ownership of real-world assets through blockchain-based digital tokens, offering increased liquidity and fractional ownership compared to traditional financial instruments. Exchange-Traded Funds (ETFs) provide diversified exposure to various assets by pooling investor funds into a single tradable security on stock exchanges. Discover more about how tokenized assets and ETFs revolutionize investment strategies and market accessibility.

Why it is important

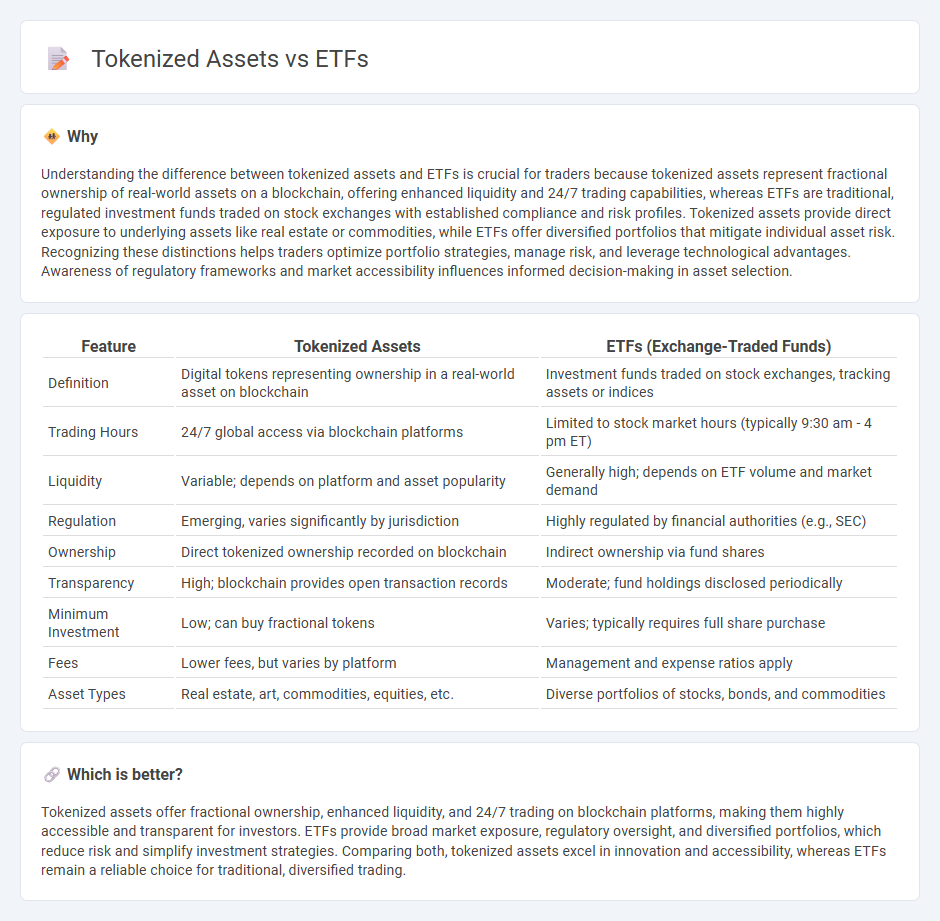

Understanding the difference between tokenized assets and ETFs is crucial for traders because tokenized assets represent fractional ownership of real-world assets on a blockchain, offering enhanced liquidity and 24/7 trading capabilities, whereas ETFs are traditional, regulated investment funds traded on stock exchanges with established compliance and risk profiles. Tokenized assets provide direct exposure to underlying assets like real estate or commodities, while ETFs offer diversified portfolios that mitigate individual asset risk. Recognizing these distinctions helps traders optimize portfolio strategies, manage risk, and leverage technological advantages. Awareness of regulatory frameworks and market accessibility influences informed decision-making in asset selection.

Comparison Table

| Feature | Tokenized Assets | ETFs (Exchange-Traded Funds) |

|---|---|---|

| Definition | Digital tokens representing ownership in a real-world asset on blockchain | Investment funds traded on stock exchanges, tracking assets or indices |

| Trading Hours | 24/7 global access via blockchain platforms | Limited to stock market hours (typically 9:30 am - 4 pm ET) |

| Liquidity | Variable; depends on platform and asset popularity | Generally high; depends on ETF volume and market demand |

| Regulation | Emerging, varies significantly by jurisdiction | Highly regulated by financial authorities (e.g., SEC) |

| Ownership | Direct tokenized ownership recorded on blockchain | Indirect ownership via fund shares |

| Transparency | High; blockchain provides open transaction records | Moderate; fund holdings disclosed periodically |

| Minimum Investment | Low; can buy fractional tokens | Varies; typically requires full share purchase |

| Fees | Lower fees, but varies by platform | Management and expense ratios apply |

| Asset Types | Real estate, art, commodities, equities, etc. | Diverse portfolios of stocks, bonds, and commodities |

Which is better?

Tokenized assets offer fractional ownership, enhanced liquidity, and 24/7 trading on blockchain platforms, making them highly accessible and transparent for investors. ETFs provide broad market exposure, regulatory oversight, and diversified portfolios, which reduce risk and simplify investment strategies. Comparing both, tokenized assets excel in innovation and accessibility, whereas ETFs remain a reliable choice for traditional, diversified trading.

Connection

Tokenized assets represent ownership of physical or financial assets on a blockchain, enabling fractional trading and enhanced liquidity. Exchange-Traded Funds (ETFs) can incorporate tokenized assets, allowing investors to gain exposure to diversified portfolios with blockchain-enabled transparency and efficiency. The integration of tokenized assets within ETFs bridges traditional finance and decentralized markets, optimizing trading accessibility and operational costs.

Key Terms

Liquidity

ETFs (Exchange-Traded Funds) exhibit high liquidity due to their presence on established stock exchanges, enabling investors to buy and sell shares throughout the trading day with minimal bid-ask spreads. Tokenized assets leverage blockchain technology to offer enhanced liquidity by enabling fractional ownership and 24/7 trading across decentralized platforms. Explore the evolving landscape of ETFs and tokenized assets to understand how liquidity impacts modern investment strategies.

Regulation

ETFs operate under well-established regulatory frameworks like the SEC in the U.S., ensuring investor protection and market transparency. Tokenized assets, often governed by blockchain protocols, face evolving regulations with varying compliance requirements across jurisdictions. Explore the regulatory landscape to understand the risks and benefits of each investment method.

Ownership structure

ETFs represent pooled ownership through shares managed by fund managers, offering investors indirect claim on underlying assets while tokenized assets provide fractional ownership recorded on a blockchain, ensuring transparency and direct control. Tokenized assets enable real-time asset transfer and settlement without intermediaries, contrasting ETFs' reliance on regulatory frameworks and custodians. Explore the nuances of ownership structures to understand which investment aligns better with your portfolio goals.

Source and External Links

What is an ETF (Exchange-Traded Fund)? - ETFs are funds traded on stock exchanges that hold collections of stocks, bonds, or other securities, offering diversification, lower costs compared to mutual funds, and trading flexibility throughout market hours.

Exchange-Traded Funds (ETFs) - ETFs are SEC-registered investment products pooling money from investors to buy portfolios of stocks, bonds, or other securities, providing diversification, professional management, liquidity, low minimum investment, and potential tax advantages.

Exchange-traded fund - Most ETFs track performance indexes like the S&P 500 or NASDAQ-100 by holding the same securities as these indexes, allowing investors exposure to broad markets or specific sectors with low costs and passive management.

dowidth.com

dowidth.com