Delta-neutral strategies minimize exposure to price movements by balancing long and short positions, aiming to reduce risk and volatility in trading portfolios. Quantitative strategies leverage mathematical models and algorithms to identify profitable trading opportunities based on historical data and statistical analysis. Explore how combining these approaches can enhance trading performance and risk management.

Why it is important

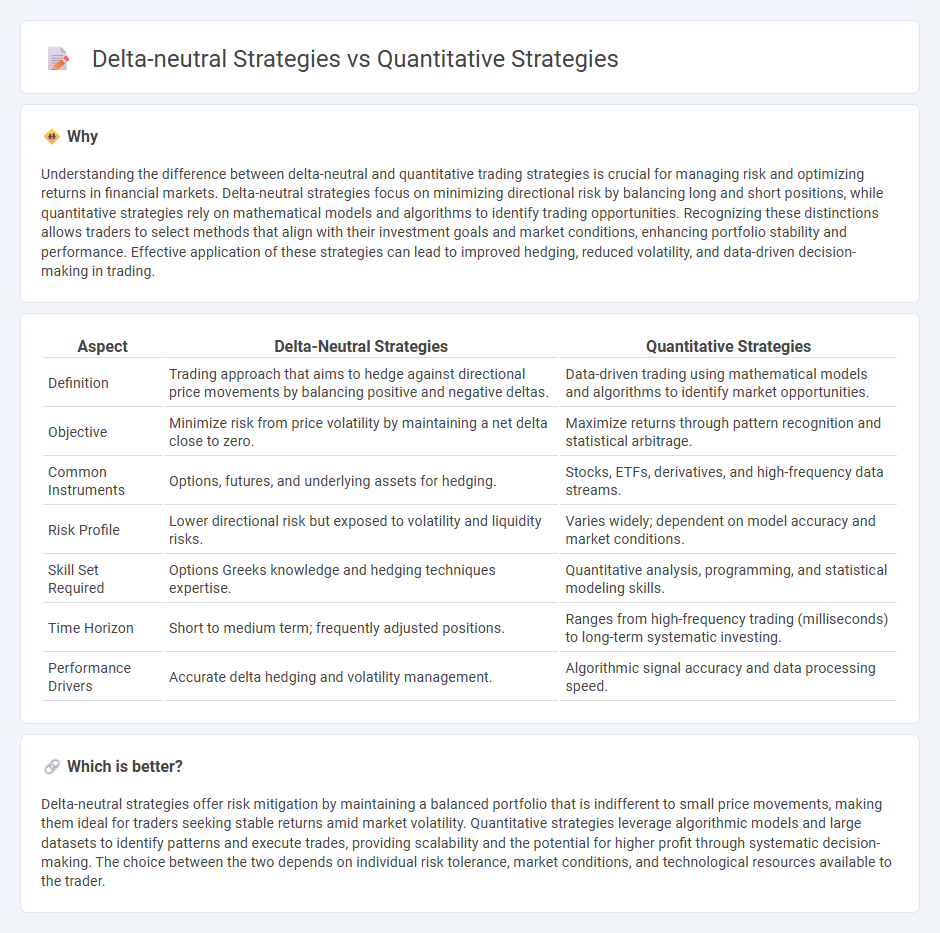

Understanding the difference between delta-neutral and quantitative trading strategies is crucial for managing risk and optimizing returns in financial markets. Delta-neutral strategies focus on minimizing directional risk by balancing long and short positions, while quantitative strategies rely on mathematical models and algorithms to identify trading opportunities. Recognizing these distinctions allows traders to select methods that align with their investment goals and market conditions, enhancing portfolio stability and performance. Effective application of these strategies can lead to improved hedging, reduced volatility, and data-driven decision-making in trading.

Comparison Table

| Aspect | Delta-Neutral Strategies | Quantitative Strategies |

|---|---|---|

| Definition | Trading approach that aims to hedge against directional price movements by balancing positive and negative deltas. | Data-driven trading using mathematical models and algorithms to identify market opportunities. |

| Objective | Minimize risk from price volatility by maintaining a net delta close to zero. | Maximize returns through pattern recognition and statistical arbitrage. |

| Common Instruments | Options, futures, and underlying assets for hedging. | Stocks, ETFs, derivatives, and high-frequency data streams. |

| Risk Profile | Lower directional risk but exposed to volatility and liquidity risks. | Varies widely; dependent on model accuracy and market conditions. |

| Skill Set Required | Options Greeks knowledge and hedging techniques expertise. | Quantitative analysis, programming, and statistical modeling skills. |

| Time Horizon | Short to medium term; frequently adjusted positions. | Ranges from high-frequency trading (milliseconds) to long-term systematic investing. |

| Performance Drivers | Accurate delta hedging and volatility management. | Algorithmic signal accuracy and data processing speed. |

Which is better?

Delta-neutral strategies offer risk mitigation by maintaining a balanced portfolio that is indifferent to small price movements, making them ideal for traders seeking stable returns amid market volatility. Quantitative strategies leverage algorithmic models and large datasets to identify patterns and execute trades, providing scalability and the potential for higher profit through systematic decision-making. The choice between the two depends on individual risk tolerance, market conditions, and technological resources available to the trader.

Connection

Delta-neutral strategies and quantitative strategies are interconnected through their reliance on mathematical models and data analysis to minimize market risk and optimize trading performance. Delta-neutral approaches use quantitative algorithms to continuously hedge options positions, maintaining a portfolio with zero net delta and reducing exposure to price fluctuations. Quantitative strategies apply statistical methods and historical data to identify profitable trading signals, enabling delta-neutral tactics to execute precise adjustments in response to dynamic market conditions.

Key Terms

Quantitative strategies:

Quantitative strategies leverage mathematical models, statistical analysis, and algorithmic trading to identify market inefficiencies and optimize portfolio returns. These strategies utilize vast datasets and automated systems to execute trades based on predefined criteria, aiming to reduce human bias and improve consistency. Explore more about how quantitative strategies redefine investment decision-making in dynamic markets.

Algorithmic Trading

Quantitative strategies in algorithmic trading leverage mathematical models and statistical techniques to identify trading opportunities based on historical data patterns and market signals. Delta-neutral strategies aim to minimize directional risk by constructing portfolios that offset positive and negative delta exposures, often using options and underlying assets to maintain market neutrality. Discover more about how these approaches optimize trading performance and risk management in algorithmic environments.

Statistical Arbitrage

Quantitative strategies leverage mathematical models and large datasets to identify market inefficiencies, while delta-neutral strategies aim to hedge directional risk by balancing positive and negative deltas, often seen in options trading. Statistical Arbitrage, a subtype of quantitative strategies, exploits mean-reverting price relationships between correlated assets to generate profits with limited directional exposure. Explore deeper insights into Statistical Arbitrage techniques and risk management to enhance your trading approach.

Source and External Links

6 Common Quantitative Strategies - Quantitative strategies include quantitative value investing, which finds undervalued stocks, and smart beta strategies that focus on securities' market sensitivity (beta) to build portfolios aligned with risk preferences.

Quantitative Strategies for Investing: Types, Pros & Cons - Key quantitative strategies include factor investing (using metrics like value and momentum to rank stocks), smart beta (alternative weighting based on factors), and statistical arbitrage, which exploits short-term price inefficiencies using mean reversion analysis.

Best Quantitative Investment Strategies of 2024 - Popular strategies for 2024 highlight machine learning models, factor investing focused on value and volatility, alternative data-driven techniques, and risk parity approaches to balance risk across asset classes.

dowidth.com

dowidth.com