Perpetual swaps offer continuous exposure to cryptocurrencies without an expiration date, allowing traders to maintain positions indefinitely with leverage. ETFs (Exchange-Traded Funds) provide diversified investment in asset baskets, such as stocks or commodities, with regulated trading on traditional exchanges and less risk of liquidation. Discover the key differences and benefits of perpetual swaps versus ETFs to optimize your trading strategy.

Why it is important

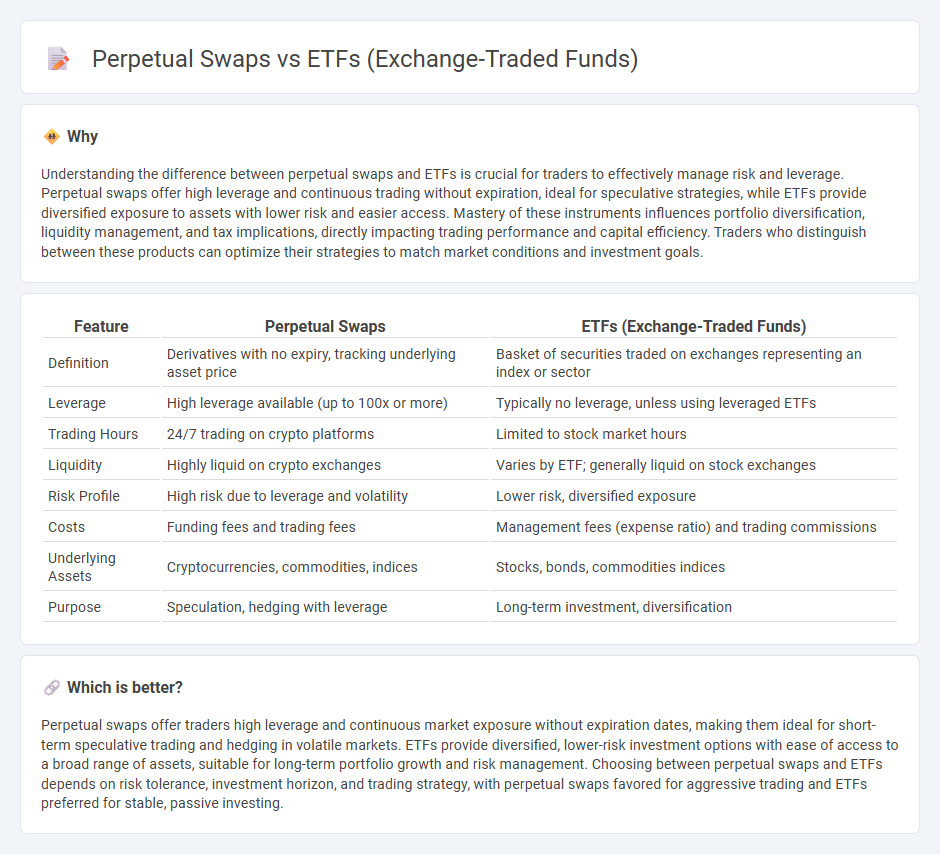

Understanding the difference between perpetual swaps and ETFs is crucial for traders to effectively manage risk and leverage. Perpetual swaps offer high leverage and continuous trading without expiration, ideal for speculative strategies, while ETFs provide diversified exposure to assets with lower risk and easier access. Mastery of these instruments influences portfolio diversification, liquidity management, and tax implications, directly impacting trading performance and capital efficiency. Traders who distinguish between these products can optimize their strategies to match market conditions and investment goals.

Comparison Table

| Feature | Perpetual Swaps | ETFs (Exchange-Traded Funds) |

|---|---|---|

| Definition | Derivatives with no expiry, tracking underlying asset price | Basket of securities traded on exchanges representing an index or sector |

| Leverage | High leverage available (up to 100x or more) | Typically no leverage, unless using leveraged ETFs |

| Trading Hours | 24/7 trading on crypto platforms | Limited to stock market hours |

| Liquidity | Highly liquid on crypto exchanges | Varies by ETF; generally liquid on stock exchanges |

| Risk Profile | High risk due to leverage and volatility | Lower risk, diversified exposure |

| Costs | Funding fees and trading fees | Management fees (expense ratio) and trading commissions |

| Underlying Assets | Cryptocurrencies, commodities, indices | Stocks, bonds, commodities indices |

| Purpose | Speculation, hedging with leverage | Long-term investment, diversification |

Which is better?

Perpetual swaps offer traders high leverage and continuous market exposure without expiration dates, making them ideal for short-term speculative trading and hedging in volatile markets. ETFs provide diversified, lower-risk investment options with ease of access to a broad range of assets, suitable for long-term portfolio growth and risk management. Choosing between perpetual swaps and ETFs depends on risk tolerance, investment horizon, and trading strategy, with perpetual swaps favored for aggressive trading and ETFs preferred for stable, passive investing.

Connection

Perpetual swaps and ETFs (Exchange-Traded Funds) are connected through their roles in providing traders with exposure to asset price movements without owning the underlying assets directly. Perpetual swaps offer leveraged trading and continuous settlement, often used to speculate on cryptocurrency prices, while ETFs allow for diversified investment in a basket of securities traded on traditional exchanges. Both instruments enhance market liquidity and enable portfolio management strategies by offering different risk and return profiles.

Key Terms

Underlying Asset

ETFs (Exchange-Traded Funds) represent a basket of underlying assets such as stocks, bonds, or commodities, offering diversified exposure and tradability on stock exchanges. Perpetual swaps are derivative contracts with no expiration date, typically linked to the price of a single underlying asset like cryptocurrencies or commodities, enabling leveraged trading without ownership of the asset itself. Explore the detailed differences in risk profile, liquidity, and regulatory environment between ETFs and perpetual swaps to make informed investment decisions.

Leverage

ETFs offer leveraged exposure through borrowing and derivatives while maintaining regulated risk limits, typically maxing out at 2x to 3x leverage. Perpetual swaps provide significantly higher leverage, often exceeding 100x, allowing traders to amplify positions but with increased liquidation risk due to margin calls. Explore deeper insights into leverage mechanisms in ETFs and perpetual swaps to make informed trading decisions.

Expiration

ETFs (Exchange-Traded Funds) have fixed expiration dates, which means investors must manage their positions before the fund's maturity to avoid liquidation or rollover. Perpetual swaps, on the other hand, have no expiration, allowing traders to hold positions indefinitely while paying or receiving funding fees based on the market. Explore the key differences in expiration and other contract features to understand which financial instrument suits your trading strategy best.

Source and External Links

Exchange-Traded Fund (ETF) - An ETF is an SEC-registered investment product that pools investors' money to buy a portfolio of stocks, bonds, or other assets, which trades on an exchange at market prices and can offer tax efficiency compared to mutual funds.

What is an ETF? - ETFs are tradeable funds containing diversified investments like stocks and bonds, organized around strategies or market indexes, that provide liquidity by trading like stocks throughout the day.

What is an ETF (Exchange-Traded Fund)? - ETFs combine the diversification benefits of mutual funds with the flexibility of stocks, allowing investors to buy and sell a basket of assets on exchanges often at a lower cost and with tax advantages.

dowidth.com

dowidth.com