Order flow analysis provides real-time insights by examining the actual buy and sell orders in the market, offering granular data on market sentiment and liquidity. Elliott Wave Theory, by contrast, interprets price movements through recurring patterns and waves, attempting to predict future market trends based on historical cycles. Explore how each method can enhance your trading strategy by understanding their distinct approaches in depth.

Why it is important

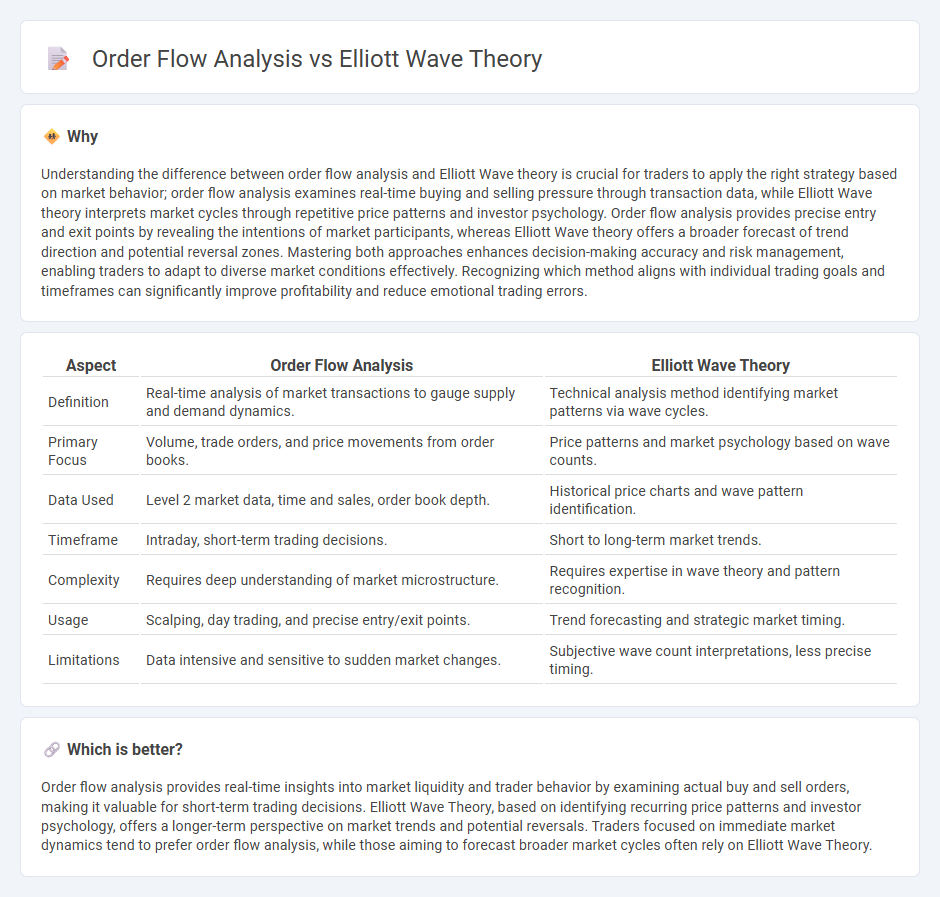

Understanding the difference between order flow analysis and Elliott Wave theory is crucial for traders to apply the right strategy based on market behavior; order flow analysis examines real-time buying and selling pressure through transaction data, while Elliott Wave theory interprets market cycles through repetitive price patterns and investor psychology. Order flow analysis provides precise entry and exit points by revealing the intentions of market participants, whereas Elliott Wave theory offers a broader forecast of trend direction and potential reversal zones. Mastering both approaches enhances decision-making accuracy and risk management, enabling traders to adapt to diverse market conditions effectively. Recognizing which method aligns with individual trading goals and timeframes can significantly improve profitability and reduce emotional trading errors.

Comparison Table

| Aspect | Order Flow Analysis | Elliott Wave Theory |

|---|---|---|

| Definition | Real-time analysis of market transactions to gauge supply and demand dynamics. | Technical analysis method identifying market patterns via wave cycles. |

| Primary Focus | Volume, trade orders, and price movements from order books. | Price patterns and market psychology based on wave counts. |

| Data Used | Level 2 market data, time and sales, order book depth. | Historical price charts and wave pattern identification. |

| Timeframe | Intraday, short-term trading decisions. | Short to long-term market trends. |

| Complexity | Requires deep understanding of market microstructure. | Requires expertise in wave theory and pattern recognition. |

| Usage | Scalping, day trading, and precise entry/exit points. | Trend forecasting and strategic market timing. |

| Limitations | Data intensive and sensitive to sudden market changes. | Subjective wave count interpretations, less precise timing. |

Which is better?

Order flow analysis provides real-time insights into market liquidity and trader behavior by examining actual buy and sell orders, making it valuable for short-term trading decisions. Elliott Wave Theory, based on identifying recurring price patterns and investor psychology, offers a longer-term perspective on market trends and potential reversals. Traders focused on immediate market dynamics tend to prefer order flow analysis, while those aiming to forecast broader market cycles often rely on Elliott Wave Theory.

Connection

Order flow analysis and Elliott wave theory intersect in trading by providing complementary insights into market behavior; order flow analysis offers real-time data on buying and selling pressure, while Elliott wave theory identifies recurring price patterns based on investor psychology. Combining these methods enhances the precision of market trend predictions by aligning wave structures with underlying order flow dynamics. Traders leveraging both tools can better anticipate price movements and optimize entry and exit points in various asset classes.

Key Terms

**Elliott wave theory:**

Elliott Wave Theory analyzes market price movements by identifying recurring fractal wave patterns that reflect trader psychology and market sentiment, aiding in forecasting future price trends. It emphasizes the natural rhythm of crowd behavior structured into impulsive and corrective waves across five and three-wave sequences, respectively. Explore the distinct methodologies and applications to deepen your understanding of Elliott Wave Theory and its comparative value in market analysis.

Impulse waves

Impulse waves in Elliott Wave Theory represent strong, directional price movements defined by five-wave patterns indicating market trends. Order flow analysis examines the real-time interactions between buyers and sellers, providing granular insights into market participants' intentions during these impulse waves. Explore how combining Elliott Wave's structural patterns with order flow dynamics enhances precision in trend prediction.

Corrective waves

Corrective waves in Elliott Wave Theory represent market retracements within a larger trend, characterized by patterns such as zigzags, flats, and triangles, which indicate temporary price reversals. Order flow analysis, on the other hand, emphasizes real-time transaction data and liquidity, revealing the underlying supply and demand dynamics that drive these corrective movements. Explore the nuances between these approaches to enhance your trading strategy with deeper insights into market corrections.

Source and External Links

What is Elliott Wave Theory? Rules and Principles | IG International - Elliott Wave Theory posits that market prices move in repetitive cycles of five waves in the direction of the main trend (impulsive waves) followed by three corrective waves, forming fractal patterns that reflect market psychology.

Elliott Wave Theory: Introduction to the Wave Principle - This theory describes how crowd behavior trends and reverses in recognizable patterns, with market progress characterized by five waves moving in the direction of the trend interspersed with countertrend interruptions.

Elliott Wave Theory - NYU Stern - Elliott Wave Theory analyzes market movements as a repetitive 5-wave pattern in the direction of the trend followed by a 3-wave correction, a structure that repeats fractally across different time frames.

dowidth.com

dowidth.com