Bid-ask spread capture involves traders profiting from the difference between the buying (bid) and selling (ask) prices, capitalizing on market liquidity. Order flow internalization occurs when brokers execute client orders within their own inventory, potentially reducing market impact and trading costs. Explore the nuances and implications of these strategies to enhance your trading insights.

Why it is important

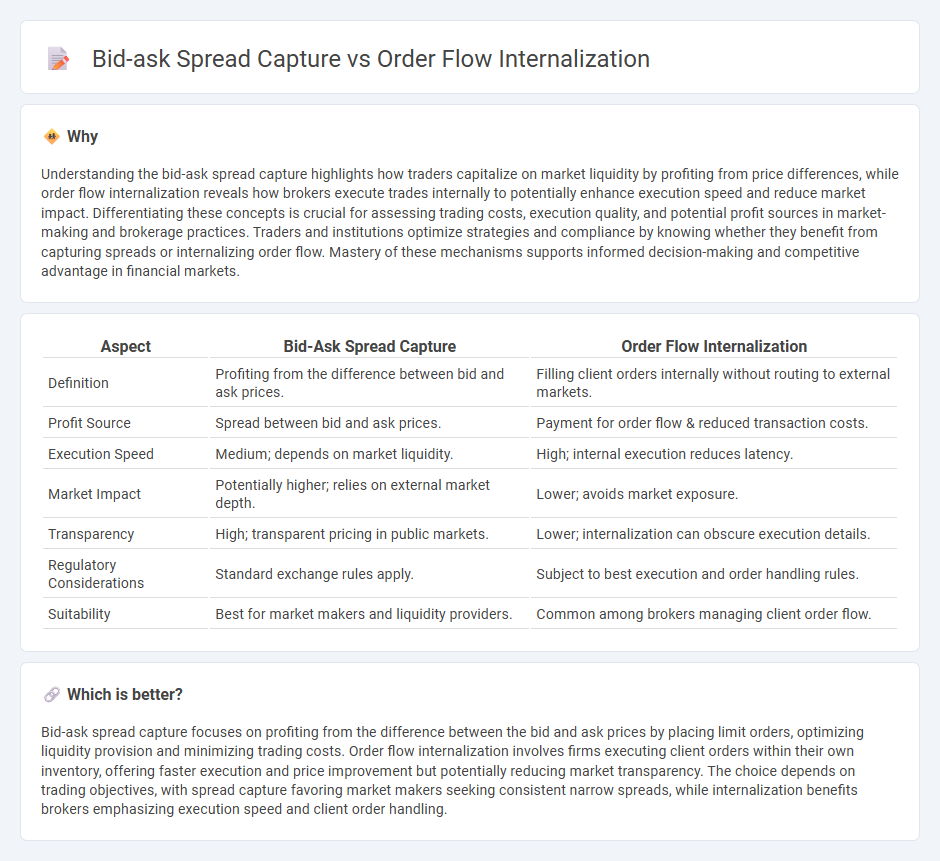

Understanding the bid-ask spread capture highlights how traders capitalize on market liquidity by profiting from price differences, while order flow internalization reveals how brokers execute trades internally to potentially enhance execution speed and reduce market impact. Differentiating these concepts is crucial for assessing trading costs, execution quality, and potential profit sources in market-making and brokerage practices. Traders and institutions optimize strategies and compliance by knowing whether they benefit from capturing spreads or internalizing order flow. Mastery of these mechanisms supports informed decision-making and competitive advantage in financial markets.

Comparison Table

| Aspect | Bid-Ask Spread Capture | Order Flow Internalization |

|---|---|---|

| Definition | Profiting from the difference between bid and ask prices. | Filling client orders internally without routing to external markets. |

| Profit Source | Spread between bid and ask prices. | Payment for order flow & reduced transaction costs. |

| Execution Speed | Medium; depends on market liquidity. | High; internal execution reduces latency. |

| Market Impact | Potentially higher; relies on external market depth. | Lower; avoids market exposure. |

| Transparency | High; transparent pricing in public markets. | Lower; internalization can obscure execution details. |

| Regulatory Considerations | Standard exchange rules apply. | Subject to best execution and order handling rules. |

| Suitability | Best for market makers and liquidity providers. | Common among brokers managing client order flow. |

Which is better?

Bid-ask spread capture focuses on profiting from the difference between the bid and ask prices by placing limit orders, optimizing liquidity provision and minimizing trading costs. Order flow internalization involves firms executing client orders within their own inventory, offering faster execution and price improvement but potentially reducing market transparency. The choice depends on trading objectives, with spread capture favoring market makers seeking consistent narrow spreads, while internalization benefits brokers emphasizing execution speed and client order handling.

Connection

Bid-ask spread capture and order flow internalization are interconnected through the mechanism of liquidity provision and cost efficiency in trading. Market makers capture the bid-ask spread by executing trades within the spread, while internalizers route orders internally to match buyers and sellers without crossing the public order book, reducing transaction costs and market impact. This synergy enhances market quality by improving price discovery and minimizing slippage for traders.

Key Terms

Market Maker

Market makers primarily generate profits through order flow internalization by matching buy and sell orders internally, reducing reliance on external liquidity and minimizing bid-ask spread costs. Capturing the bid-ask spread occurs when market makers facilitate trades at quoted prices, earning the spread as compensation for liquidity provision and risk. Explore the dynamics between these strategies to understand how market makers optimize profitability and market efficiency.

Liquidity Provider

Liquidity providers maximize profits through order flow internalization and bid-ask spread capture by efficiently matching incoming orders within their own inventory, reducing market impact and transaction costs. Order flow internalization allows these providers to execute trades internally, minimizing exposure to market volatility, while bid-ask spread capture capitalizes on the difference between buying and selling prices, enhancing revenue per trade. Explore how liquidity providers leverage these strategies to optimize market-making and improve trading performance.

Order Routing

Order flow internalization involves brokers executing client orders internally, profiting from the difference between the execution price and the mid-market price, while bid-ask spread capture refers to liquidity providers earning the spread by facilitating trades on exchanges. Effective order routing strategies determine whether orders are sent to internalizers or external venues, impacting execution quality, price improvement opportunities, and fill rates. Explore order routing techniques to optimize order flow strategies and enhance trading outcomes.

Source and External Links

Does Retail Order Flow Internalization Increase Information Acquisition? - SSRN - Order flow internalization by wholesalers decreases liquidity in lit exchanges but may enhance liquidity provision to sophisticated investors, increasing their incentives to acquire information and potentially improving price informativeness and market efficiency.

An Analysis of Brokers' Trading with Applications to Order Flow Internalization - Federal Reserve - In a free entry equilibrium, order flow internalization by broker-dealers tends to harm retail customers and market quality, being more common in thin markets with fewer informed traders.

Payment for Order Flow and Internalization in the Options Markets - SEC - Internalization occurs when a dealer acts as the exclusive counterparty to customer orders without exposing them to competing market participants, a common practice in Nasdaq markets subject to best execution obligations but not requiring order exposure to competitors.

dowidth.com

dowidth.com