Risk reversals involve simultaneously buying a call option and selling a put option to hedge against potential price movements, typically used when anticipating directional shifts in the underlying asset. Credit spreads, on the other hand, are option strategies that involve selling a higher-premium option and buying a lower-premium option to profit from time decay while limiting risk exposure. Explore the nuances of risk reversal versus credit spread strategies to optimize your trading decisions and manage risk effectively.

Why it is important

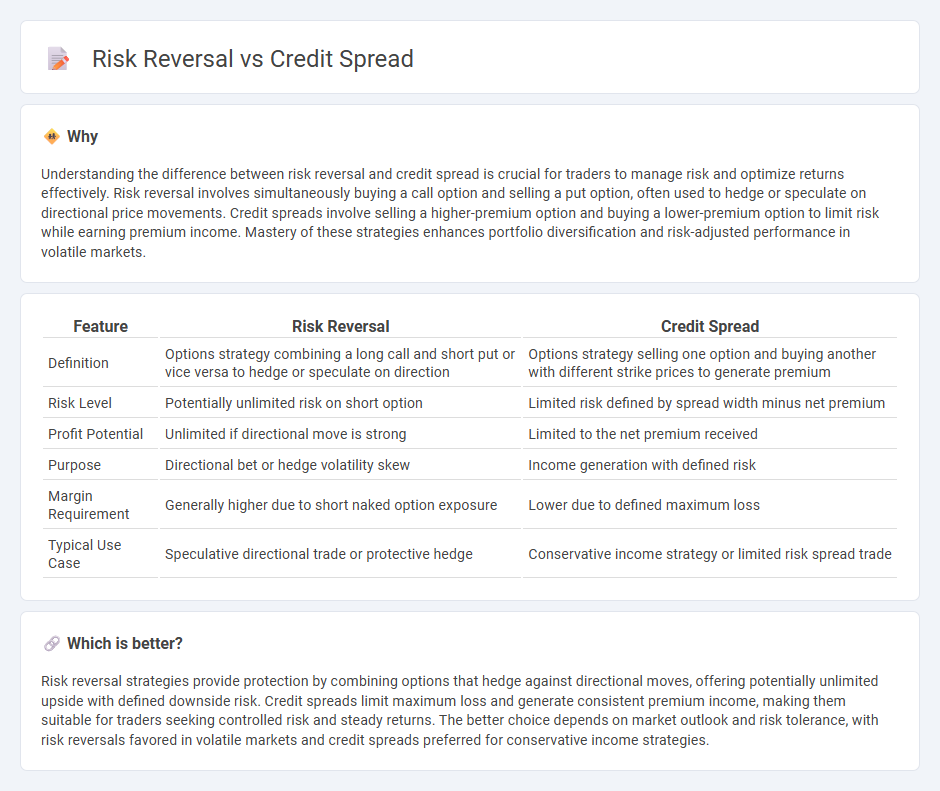

Understanding the difference between risk reversal and credit spread is crucial for traders to manage risk and optimize returns effectively. Risk reversal involves simultaneously buying a call option and selling a put option, often used to hedge or speculate on directional price movements. Credit spreads involve selling a higher-premium option and buying a lower-premium option to limit risk while earning premium income. Mastery of these strategies enhances portfolio diversification and risk-adjusted performance in volatile markets.

Comparison Table

| Feature | Risk Reversal | Credit Spread |

|---|---|---|

| Definition | Options strategy combining a long call and short put or vice versa to hedge or speculate on direction | Options strategy selling one option and buying another with different strike prices to generate premium |

| Risk Level | Potentially unlimited risk on short option | Limited risk defined by spread width minus net premium |

| Profit Potential | Unlimited if directional move is strong | Limited to the net premium received |

| Purpose | Directional bet or hedge volatility skew | Income generation with defined risk |

| Margin Requirement | Generally higher due to short naked option exposure | Lower due to defined maximum loss |

| Typical Use Case | Speculative directional trade or protective hedge | Conservative income strategy or limited risk spread trade |

Which is better?

Risk reversal strategies provide protection by combining options that hedge against directional moves, offering potentially unlimited upside with defined downside risk. Credit spreads limit maximum loss and generate consistent premium income, making them suitable for traders seeking controlled risk and steady returns. The better choice depends on market outlook and risk tolerance, with risk reversals favored in volatile markets and credit spreads preferred for conservative income strategies.

Connection

Risk reversal and credit spread are interconnected options strategies used to manage market risk and enhance portfolio returns. Risk reversal involves simultaneously buying a call option and selling a put option to hedge against price fluctuations, while credit spread entails selling a higher-premium option and buying a lower-premium option to earn a net credit with defined risk. Both strategies leverage the volatility skew and premium differentials in options to optimize risk-reward profiles in trading.

Key Terms

Option Positions

Credit spreads involve simultaneously selling a higher-premium option and buying a lower-premium option of the same type, aiming to profit from limited price movement with a net credit received. Risk reversals combine buying a call option and selling a put option (or vice versa) to hedge or speculate on directional market moves, typically reflecting bullish or bearish sentiment. Explore detailed strategies and risk profiles to optimize your options trading approach.

Net Premium

Credit spreads generate net premium by selling an option with higher implied volatility and buying one with lower implied volatility, resulting in a net inflow when premiums collected exceed premiums paid. Risk reversals combine buying a call and selling a put (or vice versa) to express directional bias without net premium or with minimal net premium impact, as the premium received on one option offsets the premium paid on the other. Explore detailed strategies to optimize net premium and risk exposure in options trading for better portfolio management.

Risk Profile

Credit spreads measure the difference in yield between a corporate bond and a risk-free government bond, reflecting the credit risk or default probability of the issuer, while risk reversals gauge market sentiment on currency options by comparing implied volatilities of out-of-the-money calls and puts, thereby capturing directional risk bias. Credit spreads widen during economic uncertainty as investors demand higher compensation for default risk, whereas risk reversals shift to indicate potential currency movements driven by geopolitical or macroeconomic events. Explore how these instruments distinctively shape risk profiles and investment strategies in volatile markets.

Source and External Links

Mastering Credit Spreads: A Low-Risk Options Trading Strategy - A credit spread is the difference in yield between two debt instruments of the same maturity but different credit risk, typically calculated as the corporate bond yield minus the risk-free Treasury bond yield, reflecting the extra return investors demand for the additional risk.

Credit Spread | Formula + Calculator - Wall Street Prep - The credit spread measures the difference between the yield to maturity of a corporate bond and a benchmark risk-free rate, mainly U.S. Treasuries, indicating the excess premium investors require for credit risk.

Credit Spread - Overview, How to Calculate, Example - The credit spread is the difference in yields between two bonds with the same maturity but different credit qualities, used to assess the additional yield required by investors for credit risk beyond that of a risk-free Treasury bond.

dowidth.com

dowidth.com