Algorithmic arbitrage exploits price discrepancies across multiple markets using automated trading systems to execute rapid, risk-free trades. Sentiment analysis, on the other hand, uses natural language processing to gauge market mood from news, social media, and other textual data to predict asset price movements. Explore the detailed differences and benefits of these strategies to enhance your trading approach.

Why it is important

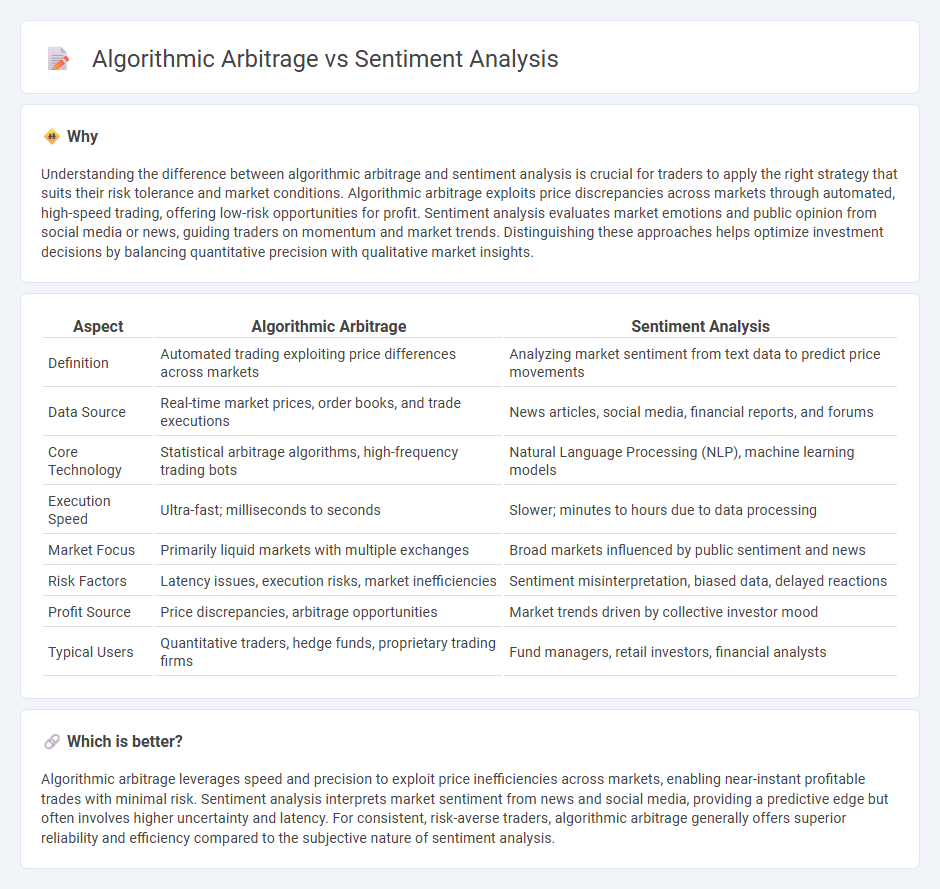

Understanding the difference between algorithmic arbitrage and sentiment analysis is crucial for traders to apply the right strategy that suits their risk tolerance and market conditions. Algorithmic arbitrage exploits price discrepancies across markets through automated, high-speed trading, offering low-risk opportunities for profit. Sentiment analysis evaluates market emotions and public opinion from social media or news, guiding traders on momentum and market trends. Distinguishing these approaches helps optimize investment decisions by balancing quantitative precision with qualitative market insights.

Comparison Table

| Aspect | Algorithmic Arbitrage | Sentiment Analysis |

|---|---|---|

| Definition | Automated trading exploiting price differences across markets | Analyzing market sentiment from text data to predict price movements |

| Data Source | Real-time market prices, order books, and trade executions | News articles, social media, financial reports, and forums |

| Core Technology | Statistical arbitrage algorithms, high-frequency trading bots | Natural Language Processing (NLP), machine learning models |

| Execution Speed | Ultra-fast; milliseconds to seconds | Slower; minutes to hours due to data processing |

| Market Focus | Primarily liquid markets with multiple exchanges | Broad markets influenced by public sentiment and news |

| Risk Factors | Latency issues, execution risks, market inefficiencies | Sentiment misinterpretation, biased data, delayed reactions |

| Profit Source | Price discrepancies, arbitrage opportunities | Market trends driven by collective investor mood |

| Typical Users | Quantitative traders, hedge funds, proprietary trading firms | Fund managers, retail investors, financial analysts |

Which is better?

Algorithmic arbitrage leverages speed and precision to exploit price inefficiencies across markets, enabling near-instant profitable trades with minimal risk. Sentiment analysis interprets market sentiment from news and social media, providing a predictive edge but often involves higher uncertainty and latency. For consistent, risk-averse traders, algorithmic arbitrage generally offers superior reliability and efficiency compared to the subjective nature of sentiment analysis.

Connection

Algorithmic arbitrage leverages real-time data and advanced algorithms to exploit price discrepancies across markets, while sentiment analysis processes vast amounts of textual information to gauge market mood and investor behavior. Integrating sentiment analysis into algorithmic arbitrage strategies enhances prediction accuracy by incorporating market sentiment indicators from news, social media, and financial reports. This fusion enables more informed decision-making and improved arbitrage opportunities in high-frequency trading environments.

Key Terms

**Sentiment Analysis:**

Sentiment analysis leverages natural language processing (NLP) and machine learning algorithms to interpret and quantify public opinion from social media, news, and reviews, providing crucial insights for market sentiment evaluation. This technique enhances investment strategies by identifying trends and predicting market movements based on collective emotional responses, distinguishing it from purely quantitative approaches like algorithmic arbitrage. Discover how sentiment analysis transforms decision-making in finance and other industries for smarter, data-driven outcomes.

Natural Language Processing (NLP)

Sentiment analysis in Natural Language Processing (NLP) evaluates textual data to gauge public opinion and market sentiment, enabling traders to anticipate price movements based on social media, news, and financial reports. Algorithmic arbitrage leverages real-time data, often integrating NLP-driven sentiment scores, to automate cross-market trading strategies and exploit price discrepancies. Explore the cutting-edge intersection of sentiment analysis and algorithmic arbitrage to gain competitive trading insights.

Market Psychology

Sentiment analysis leverages natural language processing to gauge market psychology through public opinion, news, and social media sentiment, providing insights into investor emotions and potential market movements. Algorithmic arbitrage employs quantitative models and high-frequency trading to exploit price inefficiencies across markets without direct emotional input. Explore the nuances between these approaches to better understand their impact on trading strategies and market behavior.

Source and External Links

Sentiment Analysis and How to Leverage It - Sentiment analysis identifies and interprets qualitative data to understand feelings about a topic and includes types like fine-grained, aspect-based, and intent-based sentiment analysis for nuanced insights on emotional tone and intent in text.

What is Sentiment Analysis? | Definition from TechTarget - Sentiment analysis (or opinion mining) uses NLP and AI to identify emotional tone in text, helping organizations measure positive, negative, or neutral opinions across various online sources in real time.

What is Sentiment Analysis? - Sentiment analysis processes digital text to classify emotional tone as positive, negative, or neutral, with different types including fine-grained scoring, aspect-based, intent-based, and emotional detection for detailed understanding of customer sentiment.

dowidth.com

dowidth.com