Funding rate arbitrage exploits differences in perpetual futures funding rates to generate risk-free profits by taking opposing positions in spot and futures markets. Delta-neutral arbitrage involves balancing long and short positions to hedge price movements while capturing mispriced assets or spreads. Explore these strategies further to understand their mechanisms and benefits in trading.

Why it is important

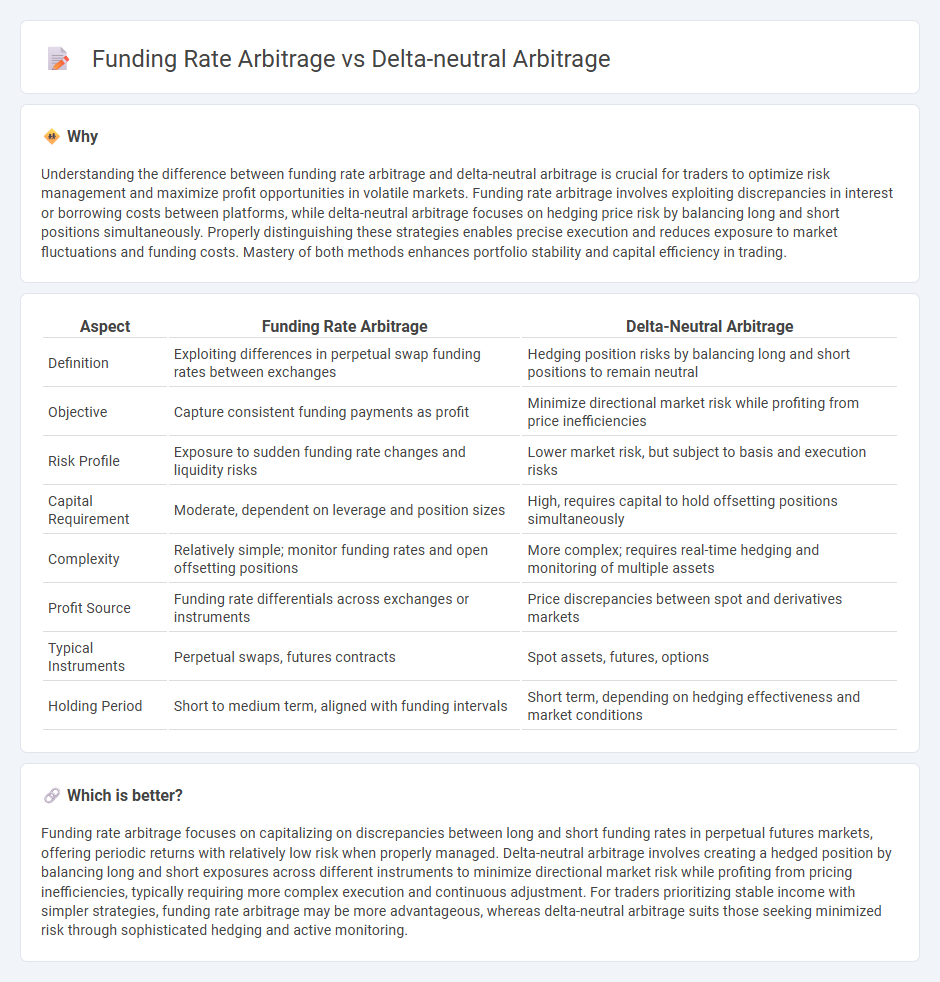

Understanding the difference between funding rate arbitrage and delta-neutral arbitrage is crucial for traders to optimize risk management and maximize profit opportunities in volatile markets. Funding rate arbitrage involves exploiting discrepancies in interest or borrowing costs between platforms, while delta-neutral arbitrage focuses on hedging price risk by balancing long and short positions simultaneously. Properly distinguishing these strategies enables precise execution and reduces exposure to market fluctuations and funding costs. Mastery of both methods enhances portfolio stability and capital efficiency in trading.

Comparison Table

| Aspect | Funding Rate Arbitrage | Delta-Neutral Arbitrage |

|---|---|---|

| Definition | Exploiting differences in perpetual swap funding rates between exchanges | Hedging position risks by balancing long and short positions to remain neutral |

| Objective | Capture consistent funding payments as profit | Minimize directional market risk while profiting from price inefficiencies |

| Risk Profile | Exposure to sudden funding rate changes and liquidity risks | Lower market risk, but subject to basis and execution risks |

| Capital Requirement | Moderate, dependent on leverage and position sizes | High, requires capital to hold offsetting positions simultaneously |

| Complexity | Relatively simple; monitor funding rates and open offsetting positions | More complex; requires real-time hedging and monitoring of multiple assets |

| Profit Source | Funding rate differentials across exchanges or instruments | Price discrepancies between spot and derivatives markets |

| Typical Instruments | Perpetual swaps, futures contracts | Spot assets, futures, options |

| Holding Period | Short to medium term, aligned with funding intervals | Short term, depending on hedging effectiveness and market conditions |

Which is better?

Funding rate arbitrage focuses on capitalizing on discrepancies between long and short funding rates in perpetual futures markets, offering periodic returns with relatively low risk when properly managed. Delta-neutral arbitrage involves creating a hedged position by balancing long and short exposures across different instruments to minimize directional market risk while profiting from pricing inefficiencies, typically requiring more complex execution and continuous adjustment. For traders prioritizing stable income with simpler strategies, funding rate arbitrage may be more advantageous, whereas delta-neutral arbitrage suits those seeking minimized risk through sophisticated hedging and active monitoring.

Connection

Funding rate arbitrage and delta-neutral arbitrage are connected through their common goal of exploiting price inefficiencies while minimizing exposure to market risk. Funding rate arbitrage capitalizes on differences in perpetual contract funding rates between exchanges, whereas delta-neutral arbitrage balances long and short positions to hedge directional market movements. Both strategies rely on precise hedging techniques and real-time market analysis to maintain risk-neutral positions and secure consistent profits.

Key Terms

**Delta-neutral arbitrage:**

Delta-neutral arbitrage involves executing offsetting trades in related assets to maintain a portfolio with zero net delta, effectively minimizing exposure to price movements while capitalizing on pricing inefficiencies. This strategy often employs options and underlying asset positions to exploit discrepancies in implied volatility, interest rates, or dividend yields across markets. Explore more about delta-neutral arbitrage strategies, risk management techniques, and real-world applications to enhance your trading insights.

Hedging

Delta-neutral arbitrage involves hedging by maintaining a balanced portfolio with offsetting positions in underlying assets and derivatives to minimize directional risk. Funding rate arbitrage capitalizes on discrepancies in lending rates between different crypto exchanges, focusing primarily on interest rate differentials rather than price hedging. Explore more to understand how these strategies optimize risk and returns through sophisticated hedging techniques.

Synthetic positions

Delta-neutral arbitrage involves creating synthetic positions that maintain zero sensitivity to underlying asset price movements by balancing long and short exposures, often using options and futures to lock in riskless profits. Funding rate arbitrage exploits discrepancies in the cost of carry between perpetual swaps and spot markets, synthesizing positions that capture positive funding payments without directional market risk. Explore in-depth strategies to optimize returns from synthetic delta-neutral and funding rate arbitrage while managing execution risks effectively.

Source and External Links

Arbitrage Funding Rate Strategies: A Delta-Neutral Approach for ... - Delta-neutral arbitrage involves holding both long and short positions to offset market movement impacts, allowing traders to earn steady returns primarily by capturing funding rate payments rather than relying on price trends.

Delta-Neutral Trading Setups: A Guide to Risk-Free Returns - This arbitrage strategy exploits price discrepancies between related securities while maintaining zero delta exposure through a combination of options and stock positions, protecting against directional price movements and focusing on other profit drivers like volatility and time decay.

Delta-Neutral Portfolio Construction - QuestDB - Delta-neutral arbitrage is implemented by constructing portfolios with a net delta of zero through dynamic or static hedging, balancing positive and negative delta positions using options, futures, and underlying assets to neutralize exposure to directional price risk while isolating other factors.

dowidth.com

dowidth.com