Trade journaling software enhances decision-making by accurately recording and analyzing past trades, improving overall trading performance. Strategy builder tools empower traders to design, test, and optimize trading strategies with historical market data before live implementation. Explore how combining these tools can elevate your trading success.

Why it is important

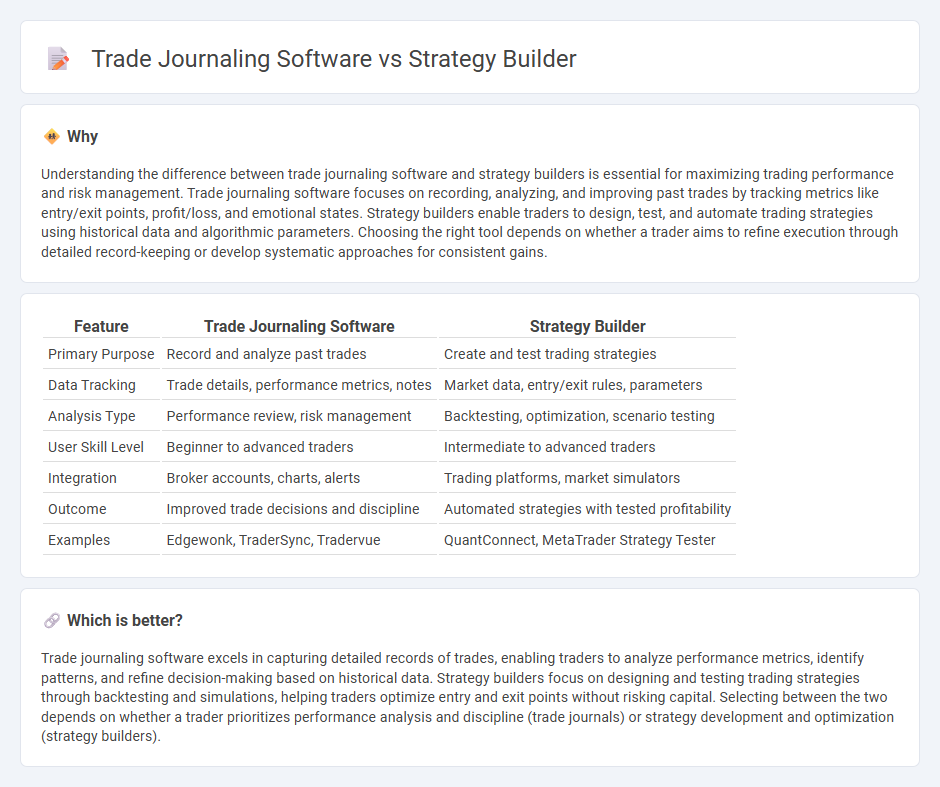

Understanding the difference between trade journaling software and strategy builders is essential for maximizing trading performance and risk management. Trade journaling software focuses on recording, analyzing, and improving past trades by tracking metrics like entry/exit points, profit/loss, and emotional states. Strategy builders enable traders to design, test, and automate trading strategies using historical data and algorithmic parameters. Choosing the right tool depends on whether a trader aims to refine execution through detailed record-keeping or develop systematic approaches for consistent gains.

Comparison Table

| Feature | Trade Journaling Software | Strategy Builder |

|---|---|---|

| Primary Purpose | Record and analyze past trades | Create and test trading strategies |

| Data Tracking | Trade details, performance metrics, notes | Market data, entry/exit rules, parameters |

| Analysis Type | Performance review, risk management | Backtesting, optimization, scenario testing |

| User Skill Level | Beginner to advanced traders | Intermediate to advanced traders |

| Integration | Broker accounts, charts, alerts | Trading platforms, market simulators |

| Outcome | Improved trade decisions and discipline | Automated strategies with tested profitability |

| Examples | Edgewonk, TraderSync, Tradervue | QuantConnect, MetaTrader Strategy Tester |

Which is better?

Trade journaling software excels in capturing detailed records of trades, enabling traders to analyze performance metrics, identify patterns, and refine decision-making based on historical data. Strategy builders focus on designing and testing trading strategies through backtesting and simulations, helping traders optimize entry and exit points without risking capital. Selecting between the two depends on whether a trader prioritizes performance analysis and discipline (trade journals) or strategy development and optimization (strategy builders).

Connection

Trade journaling software systematically records and analyzes trading performance data, providing insights into patterns and mistakes. Strategy builders use this historical trade data to develop, test, and refine trading strategies by simulating various market conditions. Integrating trade journaling with strategy builders enhances decision-making accuracy and adaptive strategy optimization for improved trading outcomes.

Key Terms

**Strategy Builder:**

Strategy builder software empowers traders to create, test, and optimize trading plans using historical data and customizable parameters, enhancing decision-making and risk management. These platforms integrate advanced algorithms and backtesting tools to simulate performance before live implementation, reducing potential losses and improving efficiency. Explore detailed comparisons and benefits of strategy builder tools to elevate your trading approach.

Backtesting

Strategy builder software offers advanced backtesting capabilities by allowing traders to design, test, and optimize trading strategies using historical market data, enhancing performance analysis. Trade journaling software primarily focuses on recording trades and performance metrics but often lacks sophisticated backtesting tools necessary for strategy refinement. Explore further to discover which tool best supports your trading goals and backtesting needs.

Algorithmic Rules

Strategy builder software streamlines the creation and testing of algorithmic trading rules by enabling users to define, backtest, and optimize strategies without extensive coding. Trade journaling software primarily focuses on recording live trades, tracking performance, and analyzing discretionary decisions rather than rule automation. Explore our detailed comparison to understand which tool best enhances your algorithmic trading process.

Source and External Links

About the Options Strategy Builder | Robinhood - The Options Strategy Builder helps you learn about, customize, and build a wide range of basic and advanced options trading strategies such as single-leg strategies, vertical spreads, straddles, strangles, and calendar spreads directly within Robinhood's platform.

Help Guide - Strategy Builder - NinjaTrader 8 - NinjaTrader's Strategy Builder is a tool used to create NinjaScript-based automated trading strategies, allowing users to build, backtest, and run trading systems without writing code.

Strategy Builder - IBKR Guides - The Strategy Builder in IBKR Desktop enables quick construction of complex, multi-leg options strategies by adding legs from the option chain, adjusting buy/sell settings, and submitting orders within the trading platform.

dowidth.com

dowidth.com