Social sentiment analysis trading leverages real-time data from social media platforms to capture market moods and investor emotions, enabling rapid decision-making based on crowd behavior. Swing trading relies on technical analysis and price patterns to hold positions over several days or weeks, aiming to capitalize on medium-term market trends. Discover the key differences and advantages of each approach to enhance your trading strategy.

Why it is important

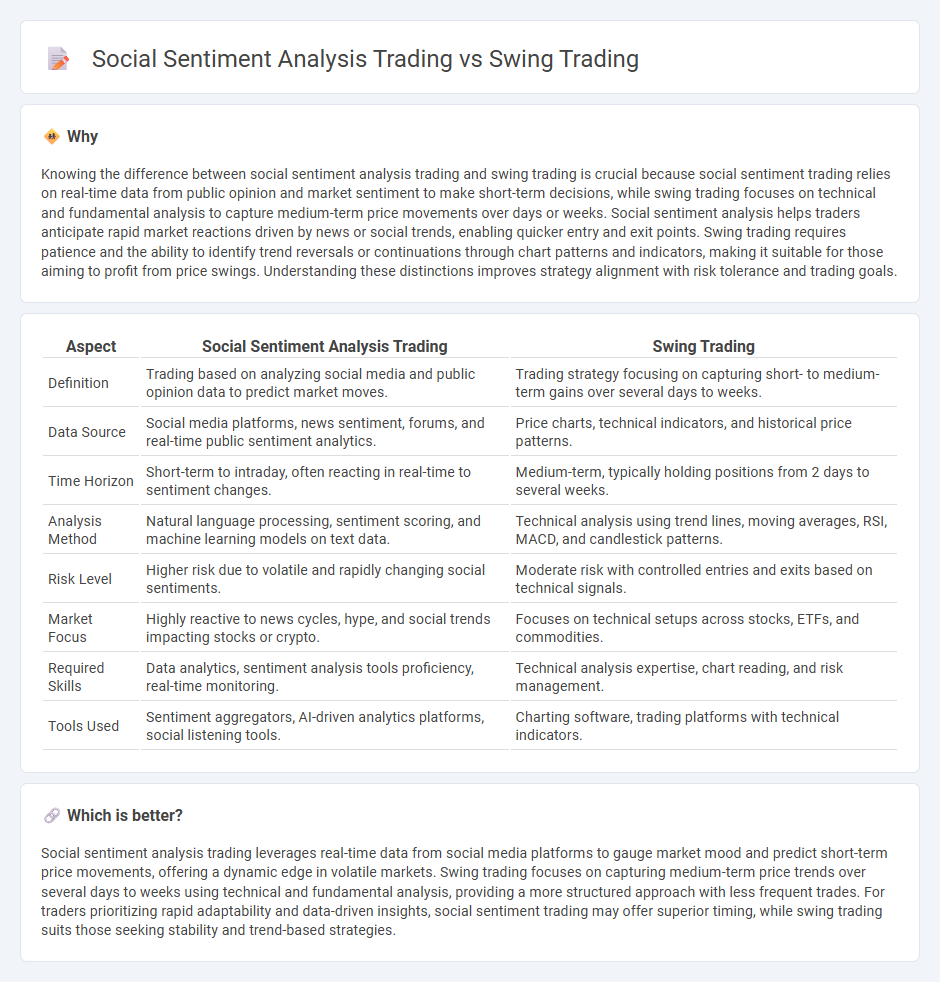

Knowing the difference between social sentiment analysis trading and swing trading is crucial because social sentiment trading relies on real-time data from public opinion and market sentiment to make short-term decisions, while swing trading focuses on technical and fundamental analysis to capture medium-term price movements over days or weeks. Social sentiment analysis helps traders anticipate rapid market reactions driven by news or social trends, enabling quicker entry and exit points. Swing trading requires patience and the ability to identify trend reversals or continuations through chart patterns and indicators, making it suitable for those aiming to profit from price swings. Understanding these distinctions improves strategy alignment with risk tolerance and trading goals.

Comparison Table

| Aspect | Social Sentiment Analysis Trading | Swing Trading |

|---|---|---|

| Definition | Trading based on analyzing social media and public opinion data to predict market moves. | Trading strategy focusing on capturing short- to medium-term gains over several days to weeks. |

| Data Source | Social media platforms, news sentiment, forums, and real-time public sentiment analytics. | Price charts, technical indicators, and historical price patterns. |

| Time Horizon | Short-term to intraday, often reacting in real-time to sentiment changes. | Medium-term, typically holding positions from 2 days to several weeks. |

| Analysis Method | Natural language processing, sentiment scoring, and machine learning models on text data. | Technical analysis using trend lines, moving averages, RSI, MACD, and candlestick patterns. |

| Risk Level | Higher risk due to volatile and rapidly changing social sentiments. | Moderate risk with controlled entries and exits based on technical signals. |

| Market Focus | Highly reactive to news cycles, hype, and social trends impacting stocks or crypto. | Focuses on technical setups across stocks, ETFs, and commodities. |

| Required Skills | Data analytics, sentiment analysis tools proficiency, real-time monitoring. | Technical analysis expertise, chart reading, and risk management. |

| Tools Used | Sentiment aggregators, AI-driven analytics platforms, social listening tools. | Charting software, trading platforms with technical indicators. |

Which is better?

Social sentiment analysis trading leverages real-time data from social media platforms to gauge market mood and predict short-term price movements, offering a dynamic edge in volatile markets. Swing trading focuses on capturing medium-term price trends over several days to weeks using technical and fundamental analysis, providing a more structured approach with less frequent trades. For traders prioritizing rapid adaptability and data-driven insights, social sentiment trading may offer superior timing, while swing trading suits those seeking stability and trend-based strategies.

Connection

Social sentiment analysis enhances swing trading by providing real-time insights into market mood and investor behavior, allowing traders to identify potential entry and exit points more effectively. By analyzing social media trends, news sentiment, and public opinion, swing traders can anticipate short- to medium-term price movements and adjust their strategies accordingly. Integrating social sentiment data improves risk management and decision-making in swing trading, leading to more informed and potentially profitable trades.

Key Terms

Entry/Exit Timing

Swing trading relies on technical indicators and chart patterns to determine precise entry and exit points, typically holding positions from several days to weeks to capitalize on medium-term price movements. Social sentiment analysis trading uses real-time data from social media trends, news, and investor sentiment to identify shifts in market mood that can signal ideal entry and exit timings, often aiming for quicker trades based on crowd psychology. Explore advanced strategies in timing your trades by learning more about how these methods optimize market opportunities.

Crowd Psychology

Swing trading capitalizes on price fluctuations over days or weeks by analyzing technical indicators and market momentum, while social sentiment analysis trading leverages crowd psychology extracted from social media, news, and forums to predict market moves. Understanding crowd psychology enables traders to identify herd behavior and market sentiment extremes, providing unique entry and exit signals distinct from traditional chart patterns. Explore the nuances of these strategies to enhance trading decisions and harness the power of market psychology.

Price Momentum

Swing trading capitalizes on short- to medium-term price momentum by identifying and riding trends over several days to weeks, relying heavily on technical indicators like moving averages and RSI. Social sentiment analysis trading enhances momentum strategies by incorporating real-time data from social media and news platforms to gauge market psychology and predict potential price swings. Explore how integrating social sentiment can refine momentum-based swing trading techniques for improved market timing.

Source and External Links

Swing trading - Swing trading is a speculative strategy where an asset is held from one or more days to profit from price swings, typically held longer than a day trade but shorter than buy-and-hold, often using technical or fundamental analysis combined with rule-based trading systems to determine entry and exit points.

Swing trading: Strategies and insights for successful trading - Swing trading profits from short-term price changes by buying dips and shorting rallies, relying mainly on technical analysis and appealing to traders comfortable with moving in and out of positions over days or weeks, positioned between day trading and long-term trend trading.

Swing Trading Stocks: Strategies and Indicators - Swing traders use entry and exit signals often based on support and resistance, price patterns, and indicators like moving averages; they typically trade with the broader trend and decide beforehand when to enter, exit, and how much to trade for effective money management.

dowidth.com

dowidth.com