Social sentiment analysis trading leverages real-time data from social media platforms, news, and online forums to gauge market sentiment and predict price movements. Statistical arbitrage trading uses quantitative models and historical price data to identify and exploit price inefficiencies between related assets. Explore deeper insights into how these trading strategies can enhance investment decision-making.

Why it is important

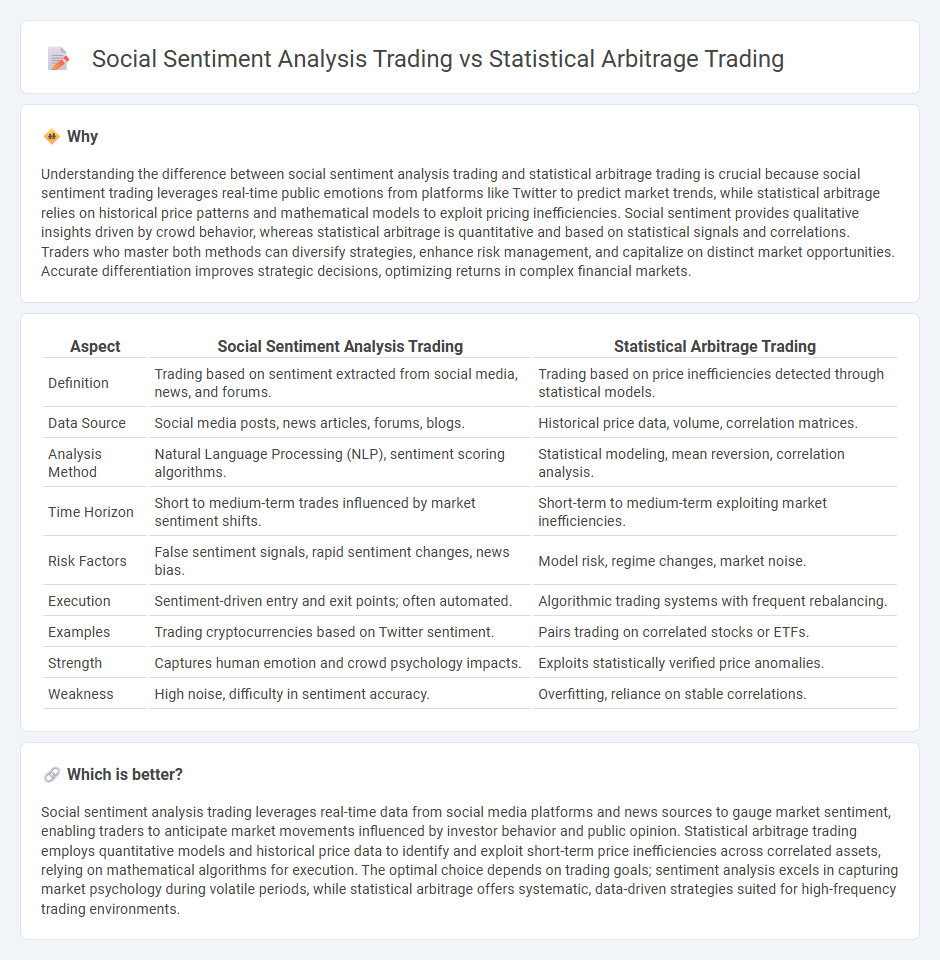

Understanding the difference between social sentiment analysis trading and statistical arbitrage trading is crucial because social sentiment trading leverages real-time public emotions from platforms like Twitter to predict market trends, while statistical arbitrage relies on historical price patterns and mathematical models to exploit pricing inefficiencies. Social sentiment provides qualitative insights driven by crowd behavior, whereas statistical arbitrage is quantitative and based on statistical signals and correlations. Traders who master both methods can diversify strategies, enhance risk management, and capitalize on distinct market opportunities. Accurate differentiation improves strategic decisions, optimizing returns in complex financial markets.

Comparison Table

| Aspect | Social Sentiment Analysis Trading | Statistical Arbitrage Trading |

|---|---|---|

| Definition | Trading based on sentiment extracted from social media, news, and forums. | Trading based on price inefficiencies detected through statistical models. |

| Data Source | Social media posts, news articles, forums, blogs. | Historical price data, volume, correlation matrices. |

| Analysis Method | Natural Language Processing (NLP), sentiment scoring algorithms. | Statistical modeling, mean reversion, correlation analysis. |

| Time Horizon | Short to medium-term trades influenced by market sentiment shifts. | Short-term to medium-term exploiting market inefficiencies. |

| Risk Factors | False sentiment signals, rapid sentiment changes, news bias. | Model risk, regime changes, market noise. |

| Execution | Sentiment-driven entry and exit points; often automated. | Algorithmic trading systems with frequent rebalancing. |

| Examples | Trading cryptocurrencies based on Twitter sentiment. | Pairs trading on correlated stocks or ETFs. |

| Strength | Captures human emotion and crowd psychology impacts. | Exploits statistically verified price anomalies. |

| Weakness | High noise, difficulty in sentiment accuracy. | Overfitting, reliance on stable correlations. |

Which is better?

Social sentiment analysis trading leverages real-time data from social media platforms and news sources to gauge market sentiment, enabling traders to anticipate market movements influenced by investor behavior and public opinion. Statistical arbitrage trading employs quantitative models and historical price data to identify and exploit short-term price inefficiencies across correlated assets, relying on mathematical algorithms for execution. The optimal choice depends on trading goals; sentiment analysis excels in capturing market psychology during volatile periods, while statistical arbitrage offers systematic, data-driven strategies suited for high-frequency trading environments.

Connection

Social sentiment analysis trading and statistical arbitrage trading both leverage quantitative data to enhance decision-making in financial markets. Social sentiment analysis uses natural language processing to gauge market mood from social media and news, providing timely insights that can signal price movements. Statistical arbitrage exploits these sentiment-driven inefficiencies by applying mathematical models to identify pricing anomalies and execute high-frequency trades.

Key Terms

Statistical Arbitrage Trading:

Statistical arbitrage trading relies on quantitative models and historical price data to identify mispricings between related financial instruments, enabling traders to exploit short-term market inefficiencies. This strategy uses mean reversion, pair trading, and machine learning algorithms to generate consistent returns with controlled risk by capitalizing on statistical relationships rather than market sentiments. Explore the nuances of statistical arbitrage to enhance your trading strategy with data-driven precision.

Mean Reversion

Statistical arbitrage trading relies on mean reversion by identifying price deviations from historical averages and executing trades to profit from the expected return to the mean, utilizing quantitative models and high-frequency data. Social sentiment analysis trading incorporates data from social media and news feeds to gauge market sentiment, influencing mean reversion strategies by anticipating shifts in trader behavior and asset pricing. Explore the integration of these methodologies for deeper insights into enhancing mean reversion trading effectiveness.

Cointegration

Statistical arbitrage trading leverages cointegration to identify and exploit price inefficiencies between correlated cryptocurrency pairs, ensuring mean-reverting strategies generate consistent returns. Social sentiment analysis trading uses real-time data from social media to anticipate market movements, but often lacks the rigorous mathematical foundation like cointegration for stable pair selection. Explore how integrating cointegration with sentiment data can enhance crypto trading strategies for more robust performance.

Source and External Links

Statistical Arbitrage: Strategies, Risks, and How It Works - Statistical arbitrage is a trading strategy based on statistical mispricing of assets, typically involving pairs trading where traders exploit price divergences of similar stocks expecting them to revert back, focusing on identifying pairs through advanced time series analysis and specifying entry-exit points to leverage market positions.

Statistical Arbitrage - MATLAB & Simulink - MathWorks - Statistical arbitrage is a computationally intensive algorithmic trading approach using statistical models for simultaneous buying and selling, often based on mean reversion and cointegration principles, typically implemented by hedge funds and using advanced data and machine learning techniques for portfolio optimization and risk management.

Statistical arbitrage - Wikipedia - Statistical arbitrage is a class of short-term trading strategies using mean reversion models on broadly diversified portfolios, typically beta-neutral and quantitatively driven, evolving from pairs trading and requiring automation to handle high turnover and small profit margins across many securities.

dowidth.com

dowidth.com