Tokenized assets represent ownership of real-world items like real estate or commodities through blockchain technology, offering enhanced liquidity and transparency compared to traditional fiat currency, which is government-issued and widely accepted for everyday transactions. While fiat currency relies on centralized banking systems and regulatory frameworks, tokenized assets provide decentralized and programmable financial instruments that can be traded 24/7 across global markets. Explore the potential of tokenized assets to revolutionize traditional trading methods and diversify investment portfolios.

Why it is important

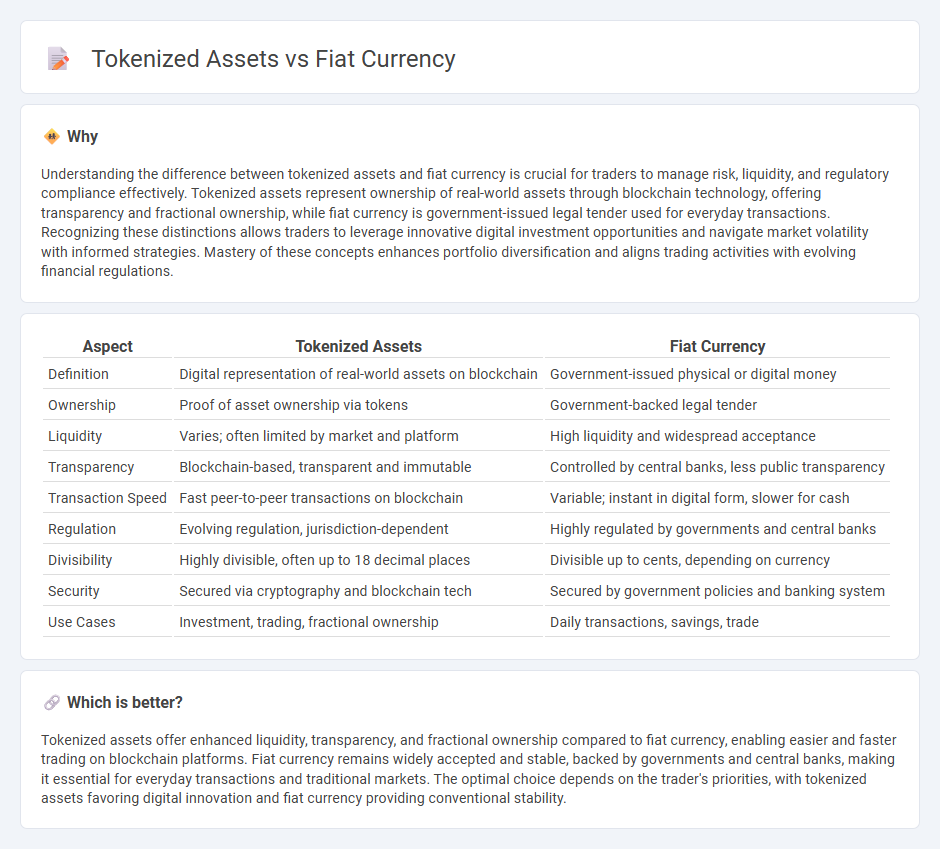

Understanding the difference between tokenized assets and fiat currency is crucial for traders to manage risk, liquidity, and regulatory compliance effectively. Tokenized assets represent ownership of real-world assets through blockchain technology, offering transparency and fractional ownership, while fiat currency is government-issued legal tender used for everyday transactions. Recognizing these distinctions allows traders to leverage innovative digital investment opportunities and navigate market volatility with informed strategies. Mastery of these concepts enhances portfolio diversification and aligns trading activities with evolving financial regulations.

Comparison Table

| Aspect | Tokenized Assets | Fiat Currency |

|---|---|---|

| Definition | Digital representation of real-world assets on blockchain | Government-issued physical or digital money |

| Ownership | Proof of asset ownership via tokens | Government-backed legal tender |

| Liquidity | Varies; often limited by market and platform | High liquidity and widespread acceptance |

| Transparency | Blockchain-based, transparent and immutable | Controlled by central banks, less public transparency |

| Transaction Speed | Fast peer-to-peer transactions on blockchain | Variable; instant in digital form, slower for cash |

| Regulation | Evolving regulation, jurisdiction-dependent | Highly regulated by governments and central banks |

| Divisibility | Highly divisible, often up to 18 decimal places | Divisible up to cents, depending on currency |

| Security | Secured via cryptography and blockchain tech | Secured by government policies and banking system |

| Use Cases | Investment, trading, fractional ownership | Daily transactions, savings, trade |

Which is better?

Tokenized assets offer enhanced liquidity, transparency, and fractional ownership compared to fiat currency, enabling easier and faster trading on blockchain platforms. Fiat currency remains widely accepted and stable, backed by governments and central banks, making it essential for everyday transactions and traditional markets. The optimal choice depends on the trader's priorities, with tokenized assets favoring digital innovation and fiat currency providing conventional stability.

Connection

Tokenized assets represent real-world or digital assets on a blockchain, enabling seamless conversion and trading against fiat currency through regulated exchanges and digital wallets. Fiat currency acts as the primary medium for purchasing tokenized assets, facilitating liquidity and price discovery in tokenized markets. Integration of fiat payment systems with blockchain technology ensures efficient settlement, compliance with financial regulations, and broader accessibility to tokenized asset trading.

Key Terms

Liquidity

Fiat currency offers high liquidity due to widespread acceptance and cash-like properties in global markets, enabling instant transactions and easy exchange for goods and services. Tokenized assets leverage blockchain technology to provide enhanced liquidity in traditionally illiquid markets by allowing fractional ownership and faster peer-to-peer trading through smart contracts. Explore how tokenized assets transform liquidity dynamics beyond conventional fiat models.

Custody

Fiat currency custody typically involves centralized banks and regulated financial institutions ensuring security and compliance with anti-money laundering laws, whereas tokenized assets require blockchain-based custody solutions such as hardware wallets, multi-signature wallets, or custodial services offering smart contract-backed security and transparency. Custody of tokenized assets brings challenges like private key management, regulatory uncertainty, and interoperability between different blockchain platforms, demanding advanced cryptographic safeguards and insured custody providers. Explore the evolving landscape of custody solutions for tokenized assets and fiat currency to understand their unique risks and best practices.

Settlement

Fiat currency settlement relies on centralized banking systems, often resulting in delayed transaction processing and higher intermediary costs. Tokenized asset settlements leverage blockchain technology to enable near-instantaneous, transparent transfers with reduced fees and enhanced security through decentralized ledger protocols. Explore how tokenization is revolutionizing financial settlements and redefining asset liquidity.

Source and External Links

Fiat currency | TRM Glossary - Fiat currency is government-issued money that holds value based on trust and legal recognition, not backed by a physical commodity, and managed by central banks to maintain economic stability.

Fiat Money - Corporate Finance Institute - Fiat currency lacks intrinsic value and cannot be redeemed for physical commodities, relying instead on government decree and management of supply to ensure its use as legal tender.

Fiat Money: Definition, History, and How It Works - Business Insider - Fiat money is currency backed by public faith in the issuing government rather than physical assets, allowing governments to influence the economy by controlling its supply.

dowidth.com

dowidth.com