Degen trading involves high-risk, speculative trades often driven by short-term hype or volatile market conditions, targeting unpredictable gains. Scalping focuses on executing numerous small trades to profit from minor price fluctuations, prioritizing speed and precision over large market movements. Explore the strategic differences and risk profiles of degen trading versus scalping to refine your trading approach.

Why it is important

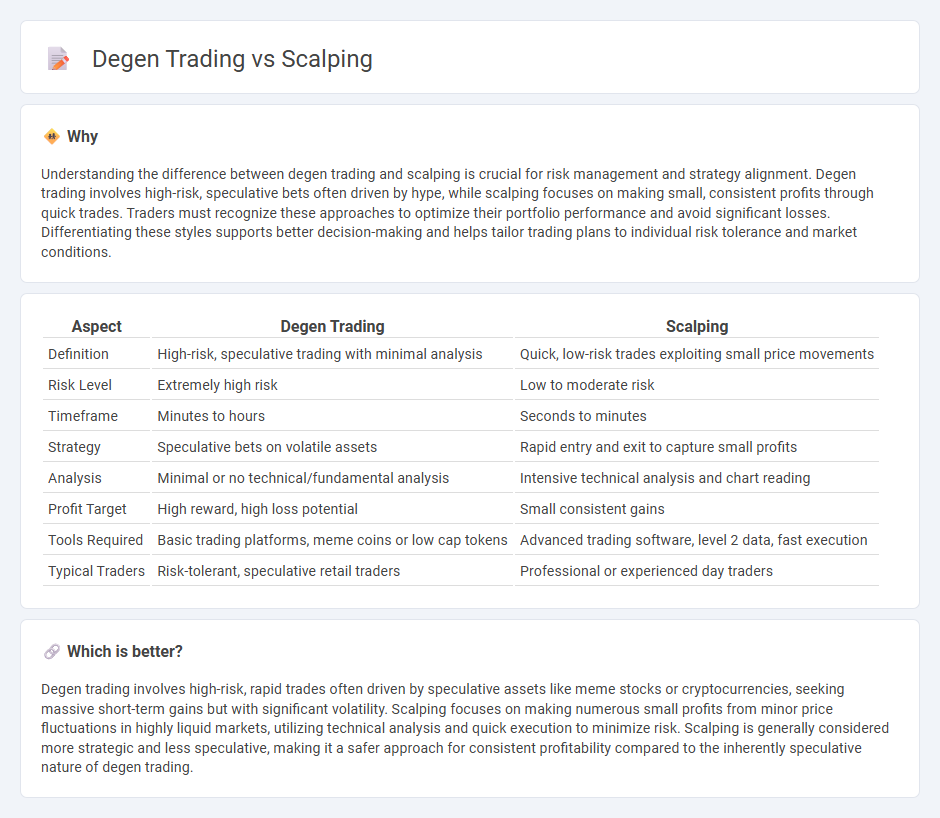

Understanding the difference between degen trading and scalping is crucial for risk management and strategy alignment. Degen trading involves high-risk, speculative bets often driven by hype, while scalping focuses on making small, consistent profits through quick trades. Traders must recognize these approaches to optimize their portfolio performance and avoid significant losses. Differentiating these styles supports better decision-making and helps tailor trading plans to individual risk tolerance and market conditions.

Comparison Table

| Aspect | Degen Trading | Scalping |

|---|---|---|

| Definition | High-risk, speculative trading with minimal analysis | Quick, low-risk trades exploiting small price movements |

| Risk Level | Extremely high risk | Low to moderate risk |

| Timeframe | Minutes to hours | Seconds to minutes |

| Strategy | Speculative bets on volatile assets | Rapid entry and exit to capture small profits |

| Analysis | Minimal or no technical/fundamental analysis | Intensive technical analysis and chart reading |

| Profit Target | High reward, high loss potential | Small consistent gains |

| Tools Required | Basic trading platforms, meme coins or low cap tokens | Advanced trading software, level 2 data, fast execution |

| Typical Traders | Risk-tolerant, speculative retail traders | Professional or experienced day traders |

Which is better?

Degen trading involves high-risk, rapid trades often driven by speculative assets like meme stocks or cryptocurrencies, seeking massive short-term gains but with significant volatility. Scalping focuses on making numerous small profits from minor price fluctuations in highly liquid markets, utilizing technical analysis and quick execution to minimize risk. Scalping is generally considered more strategic and less speculative, making it a safer approach for consistent profitability compared to the inherently speculative nature of degen trading.

Connection

Degen trading and scalping both involve high-frequency, high-risk strategies aimed at capitalizing on short-term market volatility. Degen traders often engage in rapid, speculative trades without extensive research, mirroring scalpers' focus on quick, small-profit trades executed within seconds to minutes. Both approaches demand acute market awareness, fast decision-making, and strong risk management to navigate the volatile conditions prevalent in cryptocurrency and stock markets.

Key Terms

Timeframe

Scalping involves executing numerous trades within very short timeframes, often seconds to minutes, aiming for small but consistent profits, whereas degen trading typically features high-risk, high-reward trades on speculative assets with less regard for timing precision. Scalpers rely heavily on technical analysis and market liquidity, while degen traders may focus on trending cryptocurrencies or tokens with volatile price action. Explore more to understand which trading style suits your risk tolerance and market strategy.

Risk management

Scalping involves quick trades with tight stop-losses to minimize risk and protect capital, emphasizing disciplined entry and exit points. Degen trading takes on high risk with speculative bets and large position sizes, often ignoring traditional risk management strategies. Explore the key differences in risk management techniques for both to enhance your trading performance.

Position sizing

Scalping emphasizes precise position sizing to minimize risk and capitalize on small, quick price movements, often using tight stop-loss orders to protect capital. Degen trading typically involves larger, more reckless position sizes, leading to higher potential gains but significantly increased risk of rapid losses. Explore in-depth strategies for effective position sizing to optimize your trading approach.

Source and External Links

Scalping (Day Trading Technique) - Corporate Finance Institute - Scalping is a day trading strategy where traders buy and sell an individual stock multiple times within the same day aiming to make many small profits from rapid trades on volatile stocks.

Scalping (trading) - Wikipedia - Scalping in trading is either a legitimate short-term arbitrage strategy exploiting small price gaps in markets or can refer to fraudulent market manipulation, with scalpers acting like market makers to profit from bid-ask spreads.

What is a scalping strategy in the stock market and how does it work? - Scalping uses fast buying and selling with technical indicators like RSI, MACD, and moving averages to identify short-term price trends and reversal points for quick profits.

dowidth.com

dowidth.com