Market making involves providing liquidity by simultaneously placing buy and sell orders to profit from the bid-ask spread, requiring deep market knowledge and rapid decision-making. Copy trading enables investors to replicate the strategies of successful traders automatically, offering a hands-off approach that leverages expert insights. Explore the key differences and benefits of market making and copy trading to enhance your trading strategy.

Why it is important

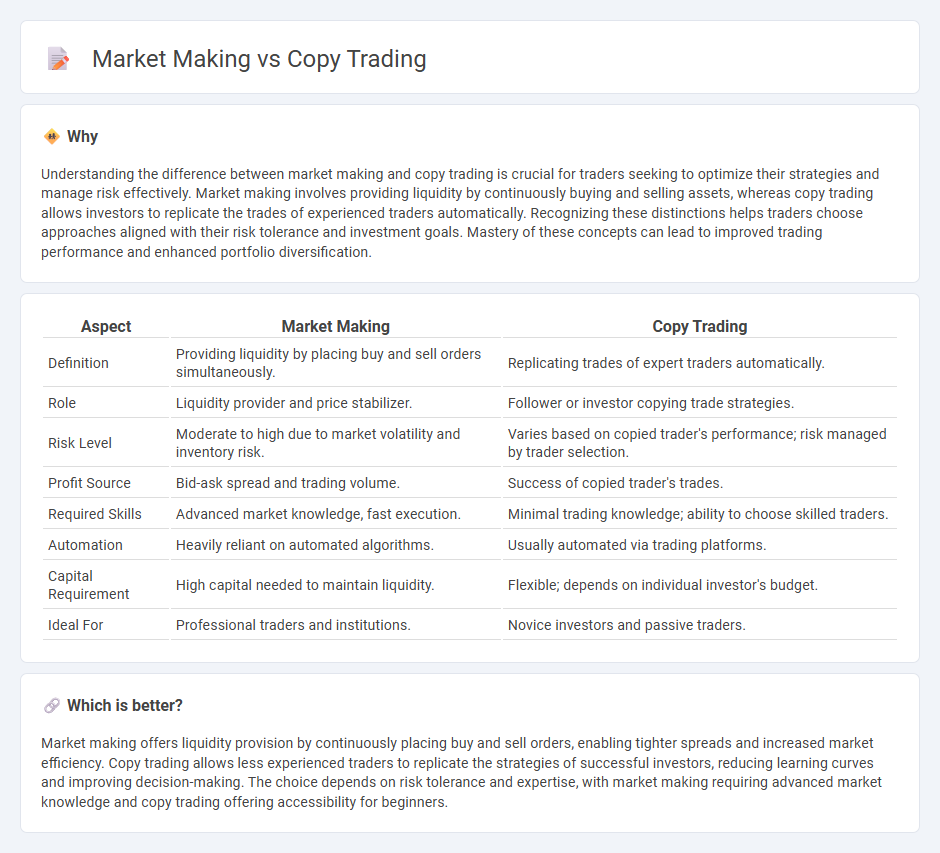

Understanding the difference between market making and copy trading is crucial for traders seeking to optimize their strategies and manage risk effectively. Market making involves providing liquidity by continuously buying and selling assets, whereas copy trading allows investors to replicate the trades of experienced traders automatically. Recognizing these distinctions helps traders choose approaches aligned with their risk tolerance and investment goals. Mastery of these concepts can lead to improved trading performance and enhanced portfolio diversification.

Comparison Table

| Aspect | Market Making | Copy Trading |

|---|---|---|

| Definition | Providing liquidity by placing buy and sell orders simultaneously. | Replicating trades of expert traders automatically. |

| Role | Liquidity provider and price stabilizer. | Follower or investor copying trade strategies. |

| Risk Level | Moderate to high due to market volatility and inventory risk. | Varies based on copied trader's performance; risk managed by trader selection. |

| Profit Source | Bid-ask spread and trading volume. | Success of copied trader's trades. |

| Required Skills | Advanced market knowledge, fast execution. | Minimal trading knowledge; ability to choose skilled traders. |

| Automation | Heavily reliant on automated algorithms. | Usually automated via trading platforms. |

| Capital Requirement | High capital needed to maintain liquidity. | Flexible; depends on individual investor's budget. |

| Ideal For | Professional traders and institutions. | Novice investors and passive traders. |

Which is better?

Market making offers liquidity provision by continuously placing buy and sell orders, enabling tighter spreads and increased market efficiency. Copy trading allows less experienced traders to replicate the strategies of successful investors, reducing learning curves and improving decision-making. The choice depends on risk tolerance and expertise, with market making requiring advanced market knowledge and copy trading offering accessibility for beginners.

Connection

Market making provides liquidity by continuously quoting buy and sell prices, which stabilizes price movements and enhances market efficiency. Copy trading leverages this liquidity by allowing investors to replicate the strategies of successful traders, often including market makers. The connection lies in market making's role in creating a liquid environment that copy traders depend on for timely order execution and reduced slippage.

Key Terms

**Copy Trading:**

Copy trading enables investors to automatically replicate the trades of experienced traders, providing a hands-off approach to market participation and risk management. This strategy leverages social trading platforms, enhancing portfolio diversification and allowing traders to capitalize on expert insights without extensive market knowledge. Explore the benefits and risks of copy trading to determine if it suits your investment goals.

Signal Provider

Signal providers in copy trading generate trade signals based on their market analysis, enabling followers to replicate their strategies automatically. In market making, signal providers facilitate liquidity by continuously quoting buy and sell prices, profiting from the bid-ask spread rather than price movements. Explore deeper insights into these roles to enhance your trading strategy understanding.

Portfolio Allocation

Copy trading allows investors to replicate the portfolio allocations of experienced traders, enabling diversified exposure without manual management. Market making involves providing liquidity by continuously quoting buy and sell prices, often requiring strategic capital allocation to manage risk and inventory. Explore deeper insights into portfolio allocation strategies within these trading approaches to enhance your investment decisions.

Source and External Links

Copy trading - Wikipedia - Copy trading allows individuals to automatically replicate the trades of selected investors, linking a portion of the copier's funds to the chosen trader's account so that trades, stop losses, and take profits are copied proportionally and can be managed or stopped by the copier.

Copy Trading | Copy the Best Traders in 2025 - AvaTrade - Copy trading is an automated system where less experienced traders ("copiers") replicate the trades of expert traders ("signal providers") based on their performance and risk profile, offering a hands-off way to trade while differentiating it from mirror and social trading.

What is Copy Trading, How Does it Work ... - PrimeXBT - Copy trading enables investors to automatically duplicate trades of experienced traders to save time and potentially profit without analyzing markets themselves, with platforms allowing customization of capital allocation and risk tolerance per trade.

dowidth.com

dowidth.com