Market making involves providing liquidity by continuously quoting buy and sell prices, profiting from the bid-ask spread in various financial markets. Order flow trading focuses on analyzing the flow of buy and sell orders to predict short-term price movements and capitalize on market sentiment. Explore the distinct strategies and benefits of market making versus order flow trading to enhance your trading approach.

Why it is important

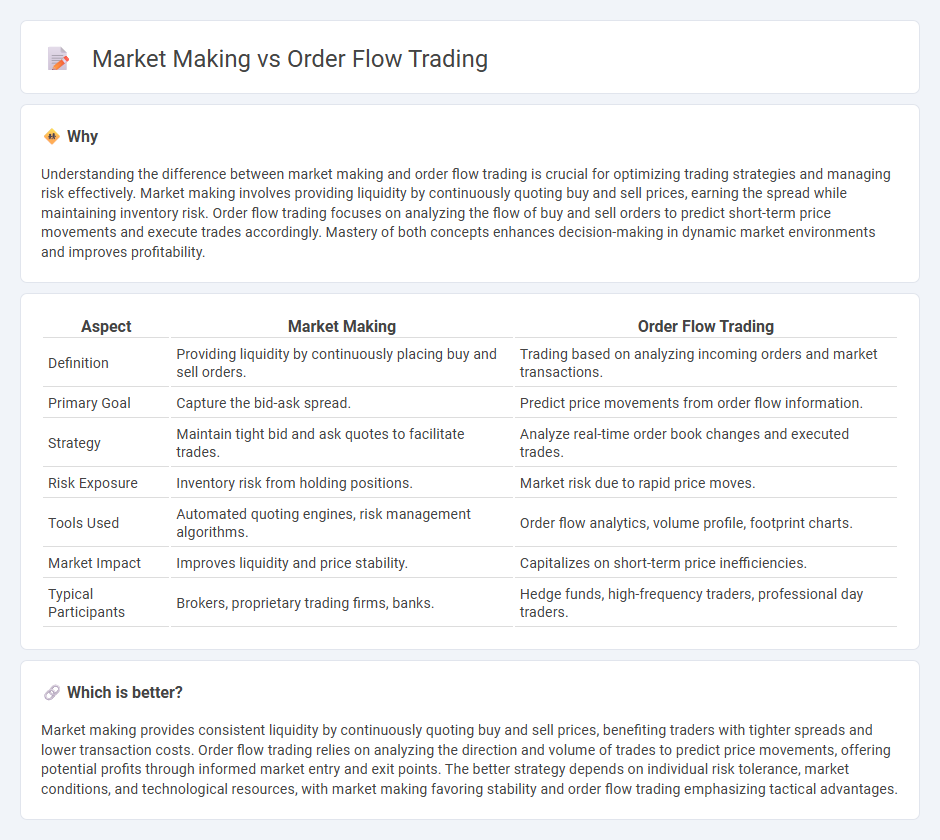

Understanding the difference between market making and order flow trading is crucial for optimizing trading strategies and managing risk effectively. Market making involves providing liquidity by continuously quoting buy and sell prices, earning the spread while maintaining inventory risk. Order flow trading focuses on analyzing the flow of buy and sell orders to predict short-term price movements and execute trades accordingly. Mastery of both concepts enhances decision-making in dynamic market environments and improves profitability.

Comparison Table

| Aspect | Market Making | Order Flow Trading |

|---|---|---|

| Definition | Providing liquidity by continuously placing buy and sell orders. | Trading based on analyzing incoming orders and market transactions. |

| Primary Goal | Capture the bid-ask spread. | Predict price movements from order flow information. |

| Strategy | Maintain tight bid and ask quotes to facilitate trades. | Analyze real-time order book changes and executed trades. |

| Risk Exposure | Inventory risk from holding positions. | Market risk due to rapid price moves. |

| Tools Used | Automated quoting engines, risk management algorithms. | Order flow analytics, volume profile, footprint charts. |

| Market Impact | Improves liquidity and price stability. | Capitalizes on short-term price inefficiencies. |

| Typical Participants | Brokers, proprietary trading firms, banks. | Hedge funds, high-frequency traders, professional day traders. |

Which is better?

Market making provides consistent liquidity by continuously quoting buy and sell prices, benefiting traders with tighter spreads and lower transaction costs. Order flow trading relies on analyzing the direction and volume of trades to predict price movements, offering potential profits through informed market entry and exit points. The better strategy depends on individual risk tolerance, market conditions, and technological resources, with market making favoring stability and order flow trading emphasizing tactical advantages.

Connection

Market making and order flow trading are interconnected through their reliance on liquidity and price discovery in financial markets. Market makers provide continuous bid and ask quotes, facilitating efficient order execution, while order flow traders analyze the direction and volume of trades to anticipate price movements. This interplay enhances market depth and enables traders to make informed decisions based on real-time transaction data.

Key Terms

**Order Flow Trading:**

Order flow trading analyzes real-time transaction data and market liquidity to predict price movements by interpreting buy and sell orders within the order book. This technique leverages tools such as volume profile, footprint charts, and time and sales to gain insights into market sentiment and potential reversals. Explore deeper to understand how order flow trading strategies can enhance precision in dynamic markets.

Order Book

Order flow trading analyzes the order book to identify buying and selling pressure, leveraging real-time trade data to predict short-term price movements. Market making involves continuously posting bid and ask orders around the current price, profiting from the bid-ask spread while providing liquidity to the market. Explore in-depth strategies and tools to master order flow trading and market making in the order book context.

Liquidity Taker

Order flow trading concentrates on analyzing the real-time buying and selling pressure from liquidity takers who execute market orders, directly impacting price moves and market depth. Market making involves placing limit orders as liquidity providers to profit from bid-ask spreads while managing inventory risk. Explore the dynamics between liquidity takers and makers to optimize trading strategies and enhance market efficiency.

Source and External Links

Technical Analysis vs. Order Flow: Techniques and Tools - Order flow trading involves analyzing the real-time flow of buy and sell orders, including their size and aggressiveness, primarily by reading the order book and analyzing volume clusters to identify support and resistance levels for better prediction of price movements.

Lesson 1 - The Basics of Order Flow & Volume Analysis - Order flow trading focuses on the interaction between limit orders and market orders, where the execution and withdrawal of limit orders create buying or selling pressure that moves markets, allowing traders to infer market direction based on these dynamics.

Order Flow Trading & Volumetric Bars - Order flow trading tools visualize buying and selling pressure with features like volumetric bars, order flow market depth, volume profiles, and cumulative delta to identify support and resistance, momentum, and market strength confirmations in real time.

dowidth.com

dowidth.com