High-frequency scalp bots execute rapid trades exploiting minimal price fluctuations, maximizing profits through sheer volume and speed, while mean reversion bots capitalize on price deviations from historical averages, assuming prices will revert to their mean. Each bot type utilizes distinct algorithms and risk management strategies tailored to specific market conditions and trading goals. Explore deeper to understand which approach best suits your trading strategy and market environment.

Why it is important

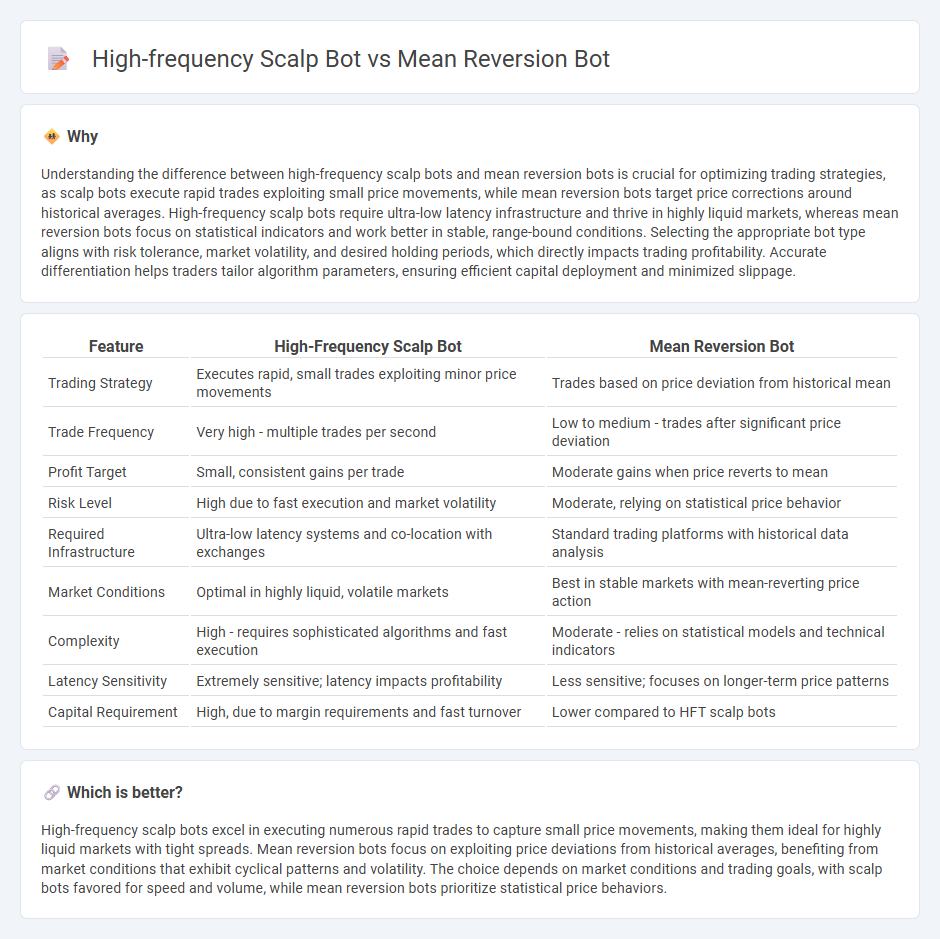

Understanding the difference between high-frequency scalp bots and mean reversion bots is crucial for optimizing trading strategies, as scalp bots execute rapid trades exploiting small price movements, while mean reversion bots target price corrections around historical averages. High-frequency scalp bots require ultra-low latency infrastructure and thrive in highly liquid markets, whereas mean reversion bots focus on statistical indicators and work better in stable, range-bound conditions. Selecting the appropriate bot type aligns with risk tolerance, market volatility, and desired holding periods, which directly impacts trading profitability. Accurate differentiation helps traders tailor algorithm parameters, ensuring efficient capital deployment and minimized slippage.

Comparison Table

| Feature | High-Frequency Scalp Bot | Mean Reversion Bot |

|---|---|---|

| Trading Strategy | Executes rapid, small trades exploiting minor price movements | Trades based on price deviation from historical mean |

| Trade Frequency | Very high - multiple trades per second | Low to medium - trades after significant price deviation |

| Profit Target | Small, consistent gains per trade | Moderate gains when price reverts to mean |

| Risk Level | High due to fast execution and market volatility | Moderate, relying on statistical price behavior |

| Required Infrastructure | Ultra-low latency systems and co-location with exchanges | Standard trading platforms with historical data analysis |

| Market Conditions | Optimal in highly liquid, volatile markets | Best in stable markets with mean-reverting price action |

| Complexity | High - requires sophisticated algorithms and fast execution | Moderate - relies on statistical models and technical indicators |

| Latency Sensitivity | Extremely sensitive; latency impacts profitability | Less sensitive; focuses on longer-term price patterns |

| Capital Requirement | High, due to margin requirements and fast turnover | Lower compared to HFT scalp bots |

Which is better?

High-frequency scalp bots excel in executing numerous rapid trades to capture small price movements, making them ideal for highly liquid markets with tight spreads. Mean reversion bots focus on exploiting price deviations from historical averages, benefiting from market conditions that exhibit cyclical patterns and volatility. The choice depends on market conditions and trading goals, with scalp bots favored for speed and volume, while mean reversion bots prioritize statistical price behaviors.

Connection

High-frequency scalp bots and mean reversion bots connect through their focus on exploiting short-term price movements in the trading market. High-frequency scalp bots execute numerous rapid trades to profit from small price fluctuations, while mean reversion bots capitalize on price deviations returning to an average value. Both rely on algorithmic strategies and real-time data analysis to optimize trading efficiency and reduce market risk.

Key Terms

Mean Reversion

Mean Reversion bots capitalize on the statistical tendency of asset prices to revert to their historical average, executing trades when prices deviate significantly from these mean values. Unlike high-frequency scalp bots that rely on rapid order execution and minute price discrepancies, mean reversion strategies leverage larger timeframes and calculated entry points to exploit market inefficiencies. Discover how mean reversion bots can provide a strategic edge in volatile markets through advanced statistical modeling and trend analysis.

Volatility

Mean reversion bots capitalize on statistical patterns by identifying asset prices that deviate significantly from historical averages, thriving in stable but volatile markets where frequent price oscillations occur. High-frequency scalp bots execute rapid trades to exploit minor price movements and capture small profits within highly volatile environments, demanding ultra-low latency and advanced risk management. Explore detailed comparisons of algorithmic strategies to understand how volatility influences their performance and deployment.

Order Execution Speed

Order execution speed critically defines the performance difference between mean reversion bots and high-frequency scalp bots, as scalp bots rely on ultra-fast, low-latency trades to capitalize on small price movements within milliseconds. Mean reversion bots prioritize accuracy and pattern confirmation over speed, making them less sensitive to execution delays compared to scalp bots that require near-instantaneous order processing to capture brief market inefficiencies. Explore detailed comparisons on optimizing order execution speed for both strategies to enhance trading profitability.

Source and External Links

Mean Reversion Trading Bot that analyzes historical prices ... - GitHub - This bot uses moving average indicators and connects to Bybit API for real-time trading, storing data in MySQL and making trade decisions based on mean reversion strategy analysis of historical prices and closing prices.

Mean Reversion in Crypto: Strategy Guide & Tools by 3Commas - Mean reversion bots automate buying low and selling high by trading against short-term market extremes, ideal for sideways range-bound markets, with various bot types supporting multi-indicator setups and TradingView strategy integrations.

Mean reversion crypto trading bot - code review - A fully configurable cryptocurrency mean reversion trading bot built with Rust, integrating Binance API for real and simulation trading modes, featuring command-line interface and strategy setup via TOML configuration files.

dowidth.com

dowidth.com