A gamma squeeze occurs when traders buy options, forcing market makers to buy the underlying asset and driving prices sharply higher, often resulting in rapid price spikes. Circuit breakers are regulatory measures designed to temporarily halt trading during extreme price movements to prevent market panic and provide stability. Explore how gamma squeezes interact with circuit breakers to better understand market volatility controls.

Why it is important

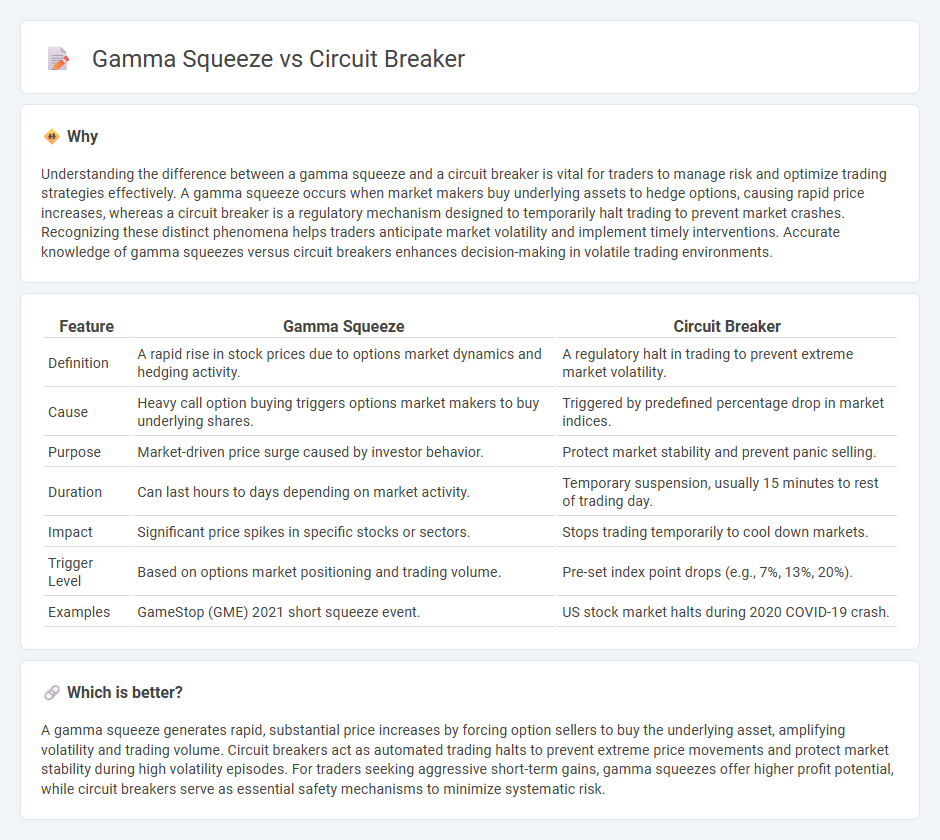

Understanding the difference between a gamma squeeze and a circuit breaker is vital for traders to manage risk and optimize trading strategies effectively. A gamma squeeze occurs when market makers buy underlying assets to hedge options, causing rapid price increases, whereas a circuit breaker is a regulatory mechanism designed to temporarily halt trading to prevent market crashes. Recognizing these distinct phenomena helps traders anticipate market volatility and implement timely interventions. Accurate knowledge of gamma squeezes versus circuit breakers enhances decision-making in volatile trading environments.

Comparison Table

| Feature | Gamma Squeeze | Circuit Breaker |

|---|---|---|

| Definition | A rapid rise in stock prices due to options market dynamics and hedging activity. | A regulatory halt in trading to prevent extreme market volatility. |

| Cause | Heavy call option buying triggers options market makers to buy underlying shares. | Triggered by predefined percentage drop in market indices. |

| Purpose | Market-driven price surge caused by investor behavior. | Protect market stability and prevent panic selling. |

| Duration | Can last hours to days depending on market activity. | Temporary suspension, usually 15 minutes to rest of trading day. |

| Impact | Significant price spikes in specific stocks or sectors. | Stops trading temporarily to cool down markets. |

| Trigger Level | Based on options market positioning and trading volume. | Pre-set index point drops (e.g., 7%, 13%, 20%). |

| Examples | GameStop (GME) 2021 short squeeze event. | US stock market halts during 2020 COVID-19 crash. |

Which is better?

A gamma squeeze generates rapid, substantial price increases by forcing option sellers to buy the underlying asset, amplifying volatility and trading volume. Circuit breakers act as automated trading halts to prevent extreme price movements and protect market stability during high volatility episodes. For traders seeking aggressive short-term gains, gamma squeezes offer higher profit potential, while circuit breakers serve as essential safety mechanisms to minimize systematic risk.

Connection

Gamma squeeze occurs when rapid increases in options buying force market makers to buy the underlying stock, causing sharp price surges that can trigger trading halts. Circuit breakers are triggered by these extreme price movements to temporarily pause trading and reduce volatility. Both mechanisms interact by the gamma squeeze driving sudden price spikes, while circuit breakers aim to stabilize the market during such events.

Key Terms

**Circuit Breaker:**

Circuit breakers are regulatory measures that temporarily halt trading on stock exchanges to prevent excessive market volatility during sharp price declines, triggering automatic pauses when indices fall by predetermined percentages like 7%, 13%, or 20%. These safeguards aim to stabilize markets by allowing traders to assess information and reduce panic selling, contrasting with a gamma squeeze, which is a rapid price surge caused by heavy options market activity forcing market makers to buy underlying stocks. Explore the mechanics and impact of circuit breakers to better understand their critical role in maintaining market stability.

Trading Halt

Circuit breakers and gamma squeezes both trigger trading halts but differ fundamentally in cause and mechanism; circuit breakers are regulatory tools that pause trading during extreme market volatility to stabilize prices, while gamma squeezes result from heavy options buying forcing market makers to buy underlying assets, driving prices sharply higher. During a circuit breaker event, exchanges impose temporary halts based on predefined percentage declines in major indices, aiming to prevent panic selling and allow market reassessment. Explore how these mechanisms impact market dynamics and investor strategies in detail.

Price Limits

Circuit breakers are regulatory mechanisms that halt trading temporarily when price declines exceed predefined thresholds, preventing extreme volatility in stock markets. Gamma squeezes occur when rapid buying of options forces market makers to purchase underlying stocks to hedge, driving prices sharply higher within short timeframes. Explore deeper insights on how price limits impact trading dynamics and volatility control.

Source and External Links

How Circuit Breakers Work - Electronics | HowStuffWorks - A circuit breaker is a resettable electrical safety switch that interrupts the flow of current automatically when it exceeds safe levels, using either an electromagnet or a bimetallic strip to break the circuit and protect wiring from damage.

Circuit Breaker Basics - ABB Electrification U.S. - Circuit breakers are electrical safety devices that automatically interrupt current to prevent damage from overloads, ground faults, or short circuits, and consist of components like contacts, arc chutes, trip mechanism, and an operating mechanism.

Circuit breaker - Wikipedia - A circuit breaker is a safety device designed to protect an electrical circuit from damage by interrupting current flow when current exceeds a preset threshold, often using thermal and magnetic elements and including newer solid-state technology for faster response.

dowidth.com

dowidth.com