Market making involves providing liquidity by continuously quoting buy and sell prices, aiming to profit from the bid-ask spread while managing inventory risk. Directional trading focuses on predicting market trends and taking positions based on anticipated price movements to maximize returns. Explore the key differences and strategies behind market making and directional trading to enhance your trading approach.

Why it is important

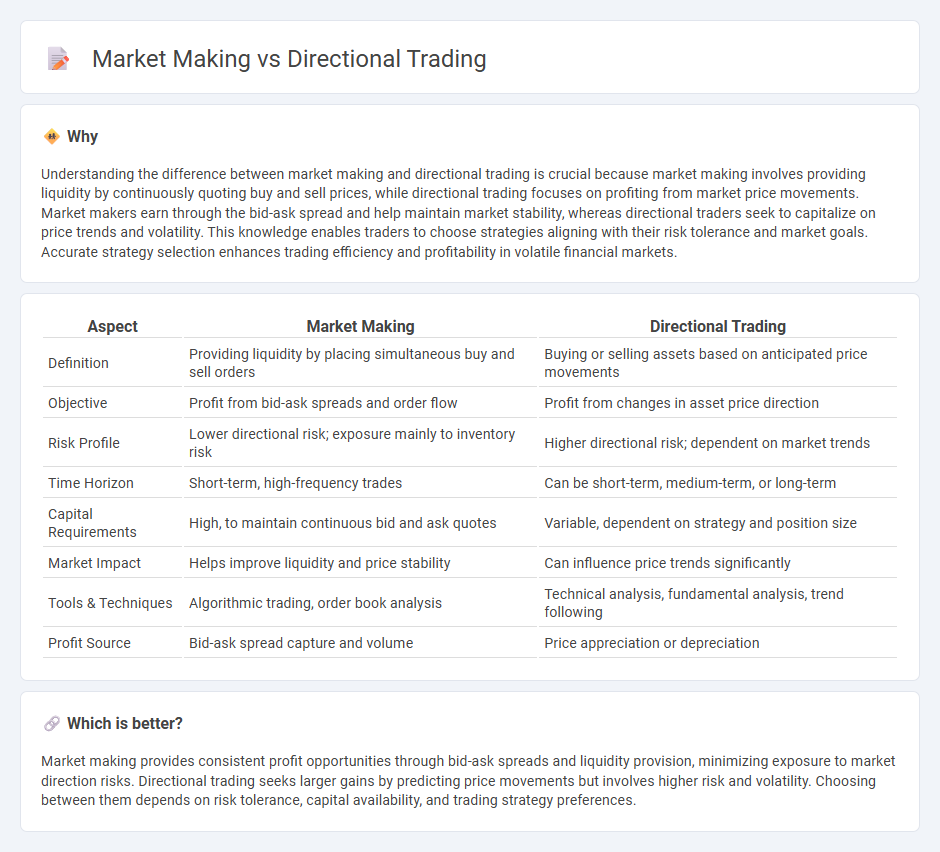

Understanding the difference between market making and directional trading is crucial because market making involves providing liquidity by continuously quoting buy and sell prices, while directional trading focuses on profiting from market price movements. Market makers earn through the bid-ask spread and help maintain market stability, whereas directional traders seek to capitalize on price trends and volatility. This knowledge enables traders to choose strategies aligning with their risk tolerance and market goals. Accurate strategy selection enhances trading efficiency and profitability in volatile financial markets.

Comparison Table

| Aspect | Market Making | Directional Trading |

|---|---|---|

| Definition | Providing liquidity by placing simultaneous buy and sell orders | Buying or selling assets based on anticipated price movements |

| Objective | Profit from bid-ask spreads and order flow | Profit from changes in asset price direction |

| Risk Profile | Lower directional risk; exposure mainly to inventory risk | Higher directional risk; dependent on market trends |

| Time Horizon | Short-term, high-frequency trades | Can be short-term, medium-term, or long-term |

| Capital Requirements | High, to maintain continuous bid and ask quotes | Variable, dependent on strategy and position size |

| Market Impact | Helps improve liquidity and price stability | Can influence price trends significantly |

| Tools & Techniques | Algorithmic trading, order book analysis | Technical analysis, fundamental analysis, trend following |

| Profit Source | Bid-ask spread capture and volume | Price appreciation or depreciation |

Which is better?

Market making provides consistent profit opportunities through bid-ask spreads and liquidity provision, minimizing exposure to market direction risks. Directional trading seeks larger gains by predicting price movements but involves higher risk and volatility. Choosing between them depends on risk tolerance, capital availability, and trading strategy preferences.

Connection

Market making involves providing liquidity by continuously quoting buy and sell prices, which creates a stable trading environment for directional traders aiming to profit from asset price movements. Directional trading relies on the price discovery facilitated by market makers, as their bid-ask spreads and order flows influence short-term market trends. Effective interplay between market making and directional trading enhances market efficiency and trading volume.

Key Terms

Directional Bias

Directional trading prioritizes establishing a position based on anticipated market movement, leveraging a directional bias to capture profits from price trends. Market making involves providing liquidity by simultaneously placing buy and sell orders, profiting primarily from bid-ask spreads rather than directional price changes. Explore the strategic advantages and risk profiles of directional bias to deepen your understanding of these trading methodologies.

Bid-Ask Spread

Directional trading involves speculating on the future price movement of an asset, aiming to profit from upward or downward trends, while market making centers on providing liquidity by continuously quoting buy (bid) and sell (ask) prices to capture the bid-ask spread. The bid-ask spread represents the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept, serving as a critical source of revenue for market makers. Explore detailed strategies and risk considerations to understand how these trading approaches impact market dynamics and profitability.

Inventory Risk

Directional trading involves taking positions based on anticipated market trends, exposing traders to significant inventory risk if the market moves against their forecasts. Market making, by contrast, continuously provides liquidity by quoting buy and sell prices, managing inventory risk through rapid adjustments and hedging to maintain balanced exposure. Explore more strategies to effectively manage inventory risk in various trading approaches.

Source and External Links

Directional Trading Explored (2025): Mechanics, Significance - Directional trading involves taking positions based on forecasts of market price movements, using technical and fundamental analysis to predict whether prices will rise or fall and profiting from those trends accordingly.

What are Directional Trading Strategies? - Directional trading strategies are based on a trader's view of the market or a stock, involving buying (going long) if bullish or selling (going short) if bearish, to capitalize on expected price movements.

Directional Trading Strategies - Overview, Types - These strategies bet on market direction using positions like long or short, and can include options strategies such as bull call spreads which combine buying and selling calls at different strike prices to reduce risk and cost.

dowidth.com

dowidth.com