Synthetic positions replicate the payoff of holding the underlying asset using combinations of options, enabling tailored risk exposure without direct ownership. Collars involve owning the underlying asset while simultaneously buying protective puts and selling call options to limit downside risk and cap potential gains. Explore how these strategies can optimize trading portfolios and risk management techniques.

Why it is important

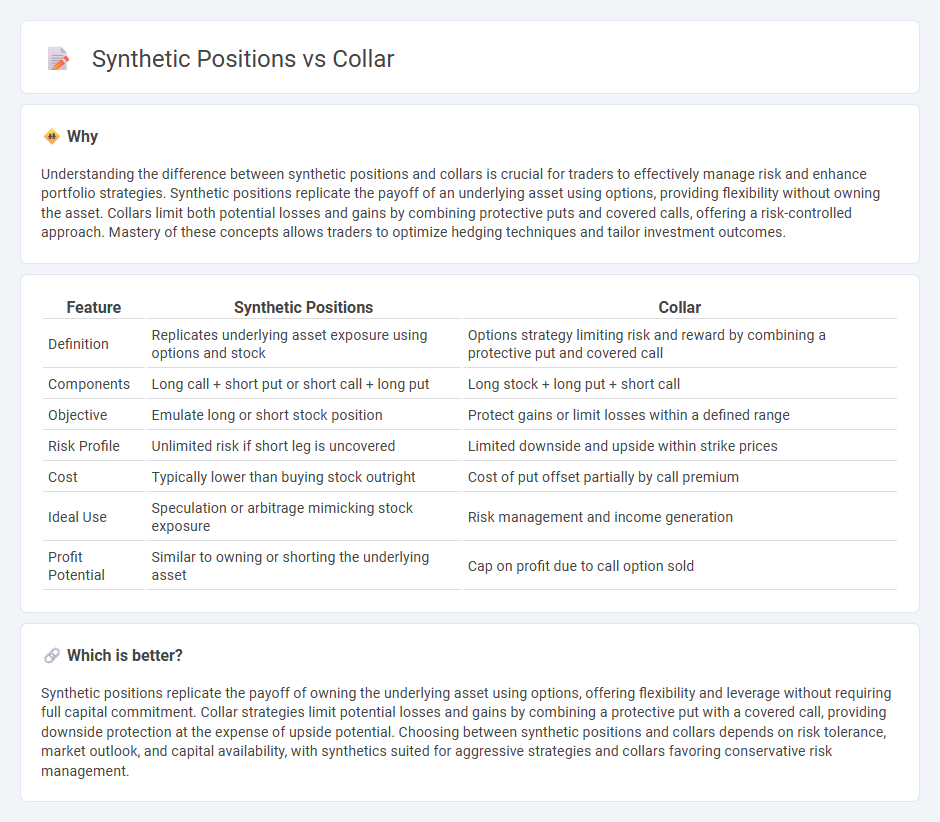

Understanding the difference between synthetic positions and collars is crucial for traders to effectively manage risk and enhance portfolio strategies. Synthetic positions replicate the payoff of an underlying asset using options, providing flexibility without owning the asset. Collars limit both potential losses and gains by combining protective puts and covered calls, offering a risk-controlled approach. Mastery of these concepts allows traders to optimize hedging techniques and tailor investment outcomes.

Comparison Table

| Feature | Synthetic Positions | Collar |

|---|---|---|

| Definition | Replicates underlying asset exposure using options and stock | Options strategy limiting risk and reward by combining a protective put and covered call |

| Components | Long call + short put or short call + long put | Long stock + long put + short call |

| Objective | Emulate long or short stock position | Protect gains or limit losses within a defined range |

| Risk Profile | Unlimited risk if short leg is uncovered | Limited downside and upside within strike prices |

| Cost | Typically lower than buying stock outright | Cost of put offset partially by call premium |

| Ideal Use | Speculation or arbitrage mimicking stock exposure | Risk management and income generation |

| Profit Potential | Similar to owning or shorting the underlying asset | Cap on profit due to call option sold |

Which is better?

Synthetic positions replicate the payoff of owning the underlying asset using options, offering flexibility and leverage without requiring full capital commitment. Collar strategies limit potential losses and gains by combining a protective put with a covered call, providing downside protection at the expense of upside potential. Choosing between synthetic positions and collars depends on risk tolerance, market outlook, and capital availability, with synthetics suited for aggressive strategies and collars favoring conservative risk management.

Connection

Synthetic positions and collar strategies are connected through their use in replicating specific payoff profiles while managing risk in trading. A synthetic position mimics the payoff of a security by using combinations of options and underlying assets, similar to collars that limit downside risk by holding the underlying asset while buying protective puts and selling call options. Both techniques optimize risk-return profiles, enabling traders to hedge or speculate with controlled exposure.

Key Terms

Options (Put and Call)

Collar strategies combine holding an underlying asset with purchasing protective puts and selling call options to limit downside risk while capping potential gains. Synthetic positions replicate the payoff of owning or shorting the underlying asset by using combinations of put and call options, such as creating a synthetic long stock by buying a call and selling a put at the same strike price. Explore how these options-based strategies can optimize risk management and leverage in different market conditions.

Hedging

Collar and synthetic positions are key strategies in hedging to manage risk and protect investment portfolios. Collars involve holding an underlying asset, buying a protective put, and selling a call option, effectively limiting downside risk while capping upside potential. Explore detailed comparisons of collar versus synthetic positions to optimize your hedging approach and maximize risk-adjusted returns.

Payoff Structure

Collar positions combine holding the underlying asset with simultaneously buying a protective put and selling a call option, creating a defined payoff range that limits both potential losses and gains. Synthetic positions replicate the payoff of owning the underlying asset by combining options, such as a long call and short put, without owning the actual security, exposing the trader to unlimited upside and downside risk. Explore the distinct risk-reward profiles and strategic uses of collar versus synthetic positions to optimize your options trading strategy.

Source and External Links

Collar (clothing) - A collar is the part of a shirt, dress, coat, or blouse that fastens around or frames the neck, coming in styles like standing, turnover, or flat, and can be stiffened or soft.

Collar - The term "collar" can refer broadly to human neckwear (including clothing collars and clerical collars) and animal collars such as dog collars, cat collars, and tracking collars.

COLLAR | Cambridge Dictionary - A collar is a strap made of leather or other material placed around the neck of an animal, especially dogs and cats; it also means the neckline band on clothing.

dowidth.com

dowidth.com