Liquidity sweeps execute large orders rapidly by checking multiple price points across the market to capture available liquidity, minimizing market impact and slippage. Closing auctions consolidate buy and sell orders at the end of the trading day to determine a single clearing price, ensuring orderly market close and price discovery. Explore further to understand how liquidity sweeps and closing auctions impact trading strategies and market efficiency.

Why it is important

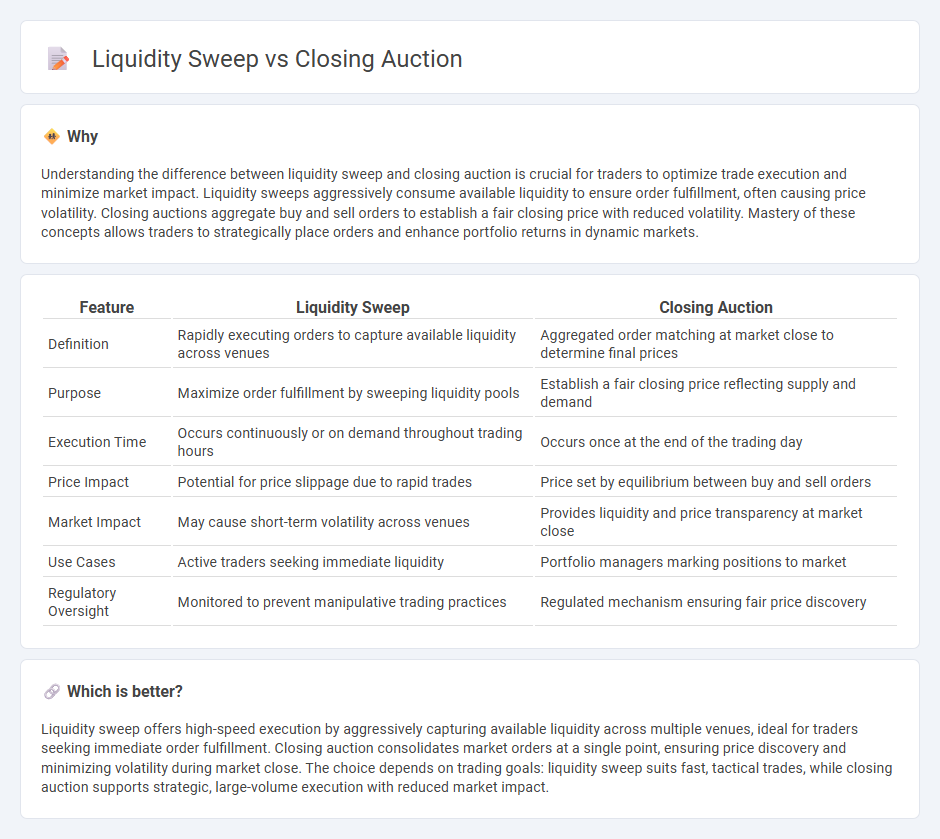

Understanding the difference between liquidity sweep and closing auction is crucial for traders to optimize trade execution and minimize market impact. Liquidity sweeps aggressively consume available liquidity to ensure order fulfillment, often causing price volatility. Closing auctions aggregate buy and sell orders to establish a fair closing price with reduced volatility. Mastery of these concepts allows traders to strategically place orders and enhance portfolio returns in dynamic markets.

Comparison Table

| Feature | Liquidity Sweep | Closing Auction |

|---|---|---|

| Definition | Rapidly executing orders to capture available liquidity across venues | Aggregated order matching at market close to determine final prices |

| Purpose | Maximize order fulfillment by sweeping liquidity pools | Establish a fair closing price reflecting supply and demand |

| Execution Time | Occurs continuously or on demand throughout trading hours | Occurs once at the end of the trading day |

| Price Impact | Potential for price slippage due to rapid trades | Price set by equilibrium between buy and sell orders |

| Market Impact | May cause short-term volatility across venues | Provides liquidity and price transparency at market close |

| Use Cases | Active traders seeking immediate liquidity | Portfolio managers marking positions to market |

| Regulatory Oversight | Monitored to prevent manipulative trading practices | Regulated mechanism ensuring fair price discovery |

Which is better?

Liquidity sweep offers high-speed execution by aggressively capturing available liquidity across multiple venues, ideal for traders seeking immediate order fulfillment. Closing auction consolidates market orders at a single point, ensuring price discovery and minimizing volatility during market close. The choice depends on trading goals: liquidity sweep suits fast, tactical trades, while closing auction supports strategic, large-volume execution with reduced market impact.

Connection

A liquidity sweep in trading involves quickly executing large orders across multiple price levels to capture available liquidity, which helps reduce market impact. The closing auction consolidates these liquidity sweeps by aggregating buy and sell orders at the end of the trading day, determining a final closing price through price-time priority. This connection ensures efficient price discovery and optimal order execution during market close.

Key Terms

Order Matching

The closing auction consolidates buy and sell orders at the market's close to establish a single equilibrium price, optimizing price discovery through collective order matching. Liquidity sweep aggressively matches resting large orders across multiple price levels, aiming to quickly execute trades by consuming available liquidity, often causing short-term price impact. Explore detailed mechanisms behind order matching strategies in closing auctions and liquidity sweeps to better understand their market impacts.

Price Discovery

The closing auction plays a crucial role in price discovery by consolidating all buy and sell orders at market close to establish a single closing price, reflecting the true market value of a security. Liquidity sweeps aggressively execute large orders across multiple price levels to capture available liquidity, which can temporarily impact price but often lead to less efficient price discovery compared to auctions. Explore how these mechanisms influence market transparency and investor strategies in depth.

Market Impact

The closing auction plays a crucial role in determining the final market price by aggregating buy and sell orders, which minimizes market impact through price discovery. In contrast, liquidity sweeps aggressively consume available liquidity across multiple price levels, potentially causing significant price fluctuations and higher market impact. Explore detailed strategies and data analysis to understand how each mechanism affects market efficiency.

Source and External Links

Into the Close: Unpacking U.S. Closing Auction Dynamics - The closing auction is the largest liquidity event of the trading day, where buy and sell orders are matched at a single clearing price to establish the official end-of-day price, with specific order submission deadlines on Nasdaq and NYSE to manage auction workflow and minimize price impact.

Closing Auction Session (CAS) - HKEX - A closing auction allows execution at the closing price by pooling buy and sell orders to form a consensus price, conducted in timed phases including reference price fixing, order input, no-cancellation, and random closing periods lasting around 8 to 10 minutes.

An Insider's Guide to the NYSE Closing Auction - The NYSE closing auction, the busiest trading period in U.S. equities, blends technology and human judgment to determine the day's critical closing price, with Designated Market Makers facilitating price discovery and offsetting auction imbalances to ensure fair market functioning.

dowidth.com

dowidth.com