On-chain analytics provide insights based on blockchain data such as transaction history, wallet activity, and token flows, offering transparency and real-time metrics for trading decisions. Volume analysis examines trading volume across exchanges to identify market strength, trend confirmation, and potential reversals, crucial for understanding market sentiment. Discover how combining on-chain analytics with volume analysis can enhance trading strategies and improve market prediction accuracy.

Why it is important

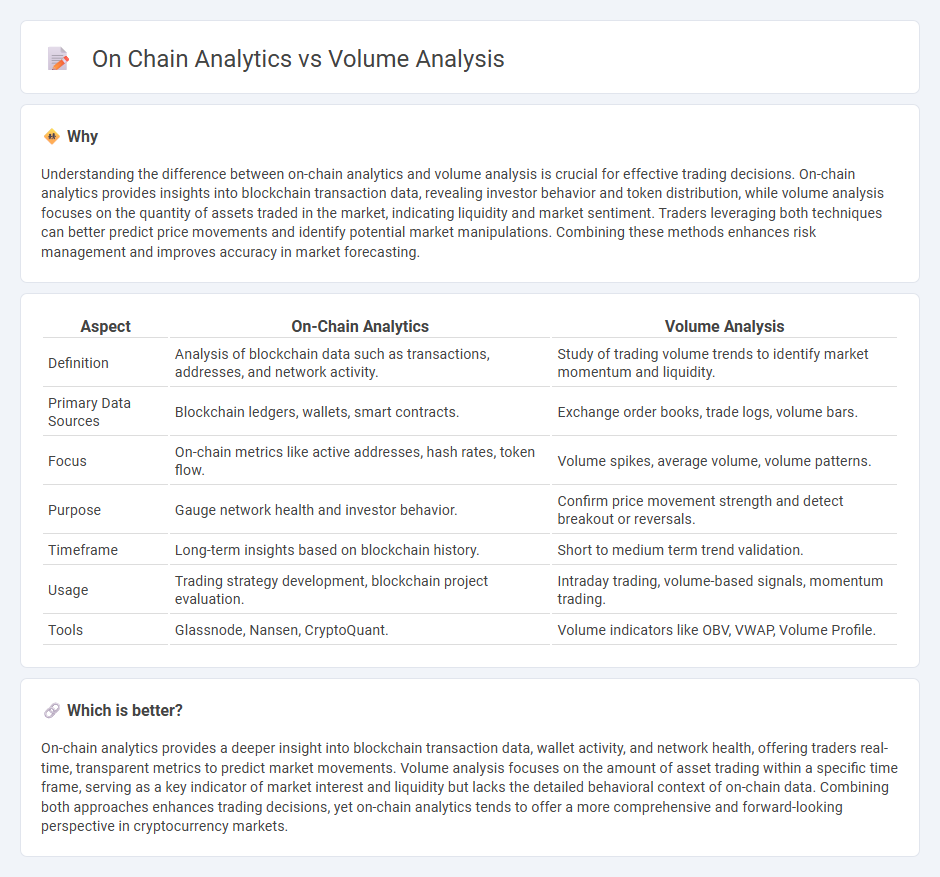

Understanding the difference between on-chain analytics and volume analysis is crucial for effective trading decisions. On-chain analytics provides insights into blockchain transaction data, revealing investor behavior and token distribution, while volume analysis focuses on the quantity of assets traded in the market, indicating liquidity and market sentiment. Traders leveraging both techniques can better predict price movements and identify potential market manipulations. Combining these methods enhances risk management and improves accuracy in market forecasting.

Comparison Table

| Aspect | On-Chain Analytics | Volume Analysis |

|---|---|---|

| Definition | Analysis of blockchain data such as transactions, addresses, and network activity. | Study of trading volume trends to identify market momentum and liquidity. |

| Primary Data Sources | Blockchain ledgers, wallets, smart contracts. | Exchange order books, trade logs, volume bars. |

| Focus | On-chain metrics like active addresses, hash rates, token flow. | Volume spikes, average volume, volume patterns. |

| Purpose | Gauge network health and investor behavior. | Confirm price movement strength and detect breakout or reversals. |

| Timeframe | Long-term insights based on blockchain history. | Short to medium term trend validation. |

| Usage | Trading strategy development, blockchain project evaluation. | Intraday trading, volume-based signals, momentum trading. |

| Tools | Glassnode, Nansen, CryptoQuant. | Volume indicators like OBV, VWAP, Volume Profile. |

Which is better?

On-chain analytics provides a deeper insight into blockchain transaction data, wallet activity, and network health, offering traders real-time, transparent metrics to predict market movements. Volume analysis focuses on the amount of asset trading within a specific time frame, serving as a key indicator of market interest and liquidity but lacks the detailed behavioral context of on-chain data. Combining both approaches enhances trading decisions, yet on-chain analytics tends to offer a more comprehensive and forward-looking perspective in cryptocurrency markets.

Connection

On-chain analytics provide detailed insights into blockchain transactions, revealing the behavior of addresses and smart contracts, while volume analysis measures the amount of asset traded over a specific period. By combining on-chain data with trading volume, traders can identify market trends, liquidity shifts, and potential price movements with greater accuracy. This integrated approach enhances decision-making by correlating transactional activity on the blockchain with trading volume patterns in various exchanges.

Key Terms

**Volume Analysis:**

Volume analysis evaluates trading activity by measuring the number of assets exchanged over a specific period, providing insights into market strength and potential price movements. This method helps identify trends, confirm breakouts, and detect reversals by interpreting volume spikes or declines. Discover how volume analysis can enhance your trading strategy through in-depth insights.

Trading Volume

Trading volume represents the total quantity of an asset exchanged within a specified time frame, serving as a key indicator of market activity and liquidity. On-chain analytics provide a deeper understanding by examining blockchain transaction data, wallet activity, and on-chain metrics that reveal investor behavior and network health. Explore how combining trading volume with on-chain insights can optimize market strategies and decision-making.

Order Book

Volume analysis evaluates trading activity by examining the total number of assets exchanged within a given period, providing insights into market momentum and liquidity. On-chain analytics offers a granular view by tracking blockchain transactions, wallet activities, and token movements to assess market behavior beyond mere volume figures. Explore the detailed interplay between volume analysis and on-chain order book data to enhance your trading strategies.

Source and External Links

Volume Analysis - Definition, Significance in Trading - Volume analysis examines the total number of securities traded over a time period, helping traders confirm trends and assess market enthusiasm or momentum based on volume changes accompanying price movements.

Technical Analysis Explained: Volume Analysis in Futures - Volume analysis validates price action by confirming trends or signaling potential reversals, with scenarios like price and volume rising together indicating bullish confirmation, or volume decreasing despite price rises suggesting weakening momentum.

Mastering Volume Analysis: Top Trading Strategies for Success - Volume analysis helps identify support and resistance levels through volume accumulation at price points, revealing areas of liquidity and institutional activity that are often more reliable than moving averages or other indicators.

dowidth.com

dowidth.com