Order book imbalance measures the difference between buy and sell orders at various price levels, indicating potential price movements. Market depth represents the volume of buy and sell orders at different prices, reflecting liquidity and market strength. Explore further to understand how analyzing these metrics enhances trading strategies.

Why it is important

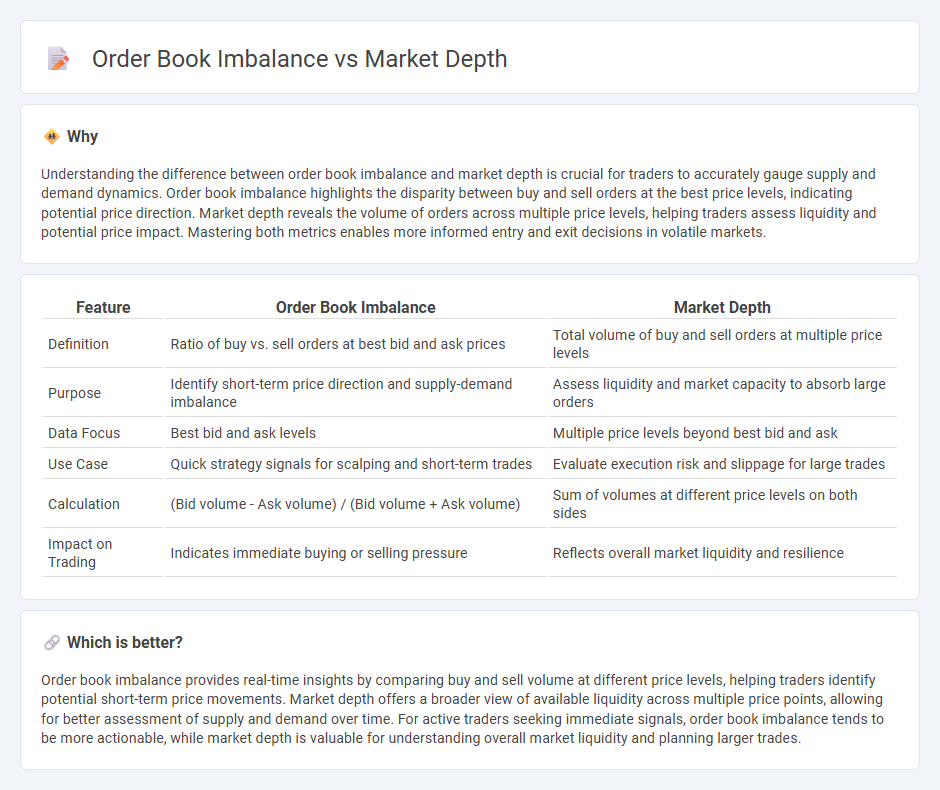

Understanding the difference between order book imbalance and market depth is crucial for traders to accurately gauge supply and demand dynamics. Order book imbalance highlights the disparity between buy and sell orders at the best price levels, indicating potential price direction. Market depth reveals the volume of orders across multiple price levels, helping traders assess liquidity and potential price impact. Mastering both metrics enables more informed entry and exit decisions in volatile markets.

Comparison Table

| Feature | Order Book Imbalance | Market Depth |

|---|---|---|

| Definition | Ratio of buy vs. sell orders at best bid and ask prices | Total volume of buy and sell orders at multiple price levels |

| Purpose | Identify short-term price direction and supply-demand imbalance | Assess liquidity and market capacity to absorb large orders |

| Data Focus | Best bid and ask levels | Multiple price levels beyond best bid and ask |

| Use Case | Quick strategy signals for scalping and short-term trades | Evaluate execution risk and slippage for large trades |

| Calculation | (Bid volume - Ask volume) / (Bid volume + Ask volume) | Sum of volumes at different price levels on both sides |

| Impact on Trading | Indicates immediate buying or selling pressure | Reflects overall market liquidity and resilience |

Which is better?

Order book imbalance provides real-time insights by comparing buy and sell volume at different price levels, helping traders identify potential short-term price movements. Market depth offers a broader view of available liquidity across multiple price points, allowing for better assessment of supply and demand over time. For active traders seeking immediate signals, order book imbalance tends to be more actionable, while market depth is valuable for understanding overall market liquidity and planning larger trades.

Connection

Order book imbalance measures the difference between buy and sell orders, revealing potential price direction, while market depth displays the volume of orders at various price levels, indicating liquidity. A significant imbalance in the order book often signals a shift in market depth, impacting price volatility and traders' decision-making processes. Analyzing both metrics helps traders anticipate market movements and optimize trade execution strategies.

Key Terms

Bid-Ask Spread

Market depth reflects the quantity of buy and sell orders at various price levels, revealing liquidity and potential price movements, while order book imbalance measures the disparity between bid and ask volumes, highlighting market sentiment. The Bid-Ask Spread, the difference between the highest bid and lowest ask prices, directly impacts both concepts by influencing transaction costs and price volatility. Explore further to understand how analyzing Bid-Ask Spread enhances trading strategies.

Order Flow

Market depth represents the volume of buy and sell orders at various price levels within the order book, providing insight into liquidity and potential price movements. Order book imbalance quantifies the difference between bid and ask volumes, indicating the dominant market sentiment and potential order flow direction. Explore deeper how analyzing order flow through these metrics can enhance trading strategies and decision-making.

Liquidity

Market depth reveals the volume of buy and sell orders at various price levels, providing insight into liquidity and potential price stability. Order book imbalance highlights the disparity between buy and sell order quantities, signaling shifts in supply and demand dynamics that influence market liquidity. Explore how these metrics impact trading strategies and liquidity management to optimize market execution.

Source and External Links

2025 Trader's Guide to Market Depth - Market depth, or DOM, shows real-time buy and sell orders at various prices, helping traders assess market sentiment, liquidity, and predict price changes to improve trading strategies.

Market Depth - Definition, How It's Used, Examples - Market depth measures the market's ability to handle large orders without impacting price significantly, based on the volume of open orders in the limit order book, indicating liquidity and potential price movement.

Depth of market (DOM): what it is and how traders can use it - Depth of market is a tool showing buy and sell quantities at different prices, providing insight on supply, demand, and liquidity, vital for traders to manage orders and understand market dynamics.

dowidth.com

dowidth.com