Funded account programs provide traders with capital from a proprietary firm, allowing them to trade without risking their own money while sharing profits based on performance metrics and risk management rules. Copy trading enables investors to automatically replicate the trades of experienced traders in real time, offering diversification and passive income opportunities with minimal active management. Discover how funded account programs and copy trading strategies can optimize your trading success and risk exposure.

Why it is important

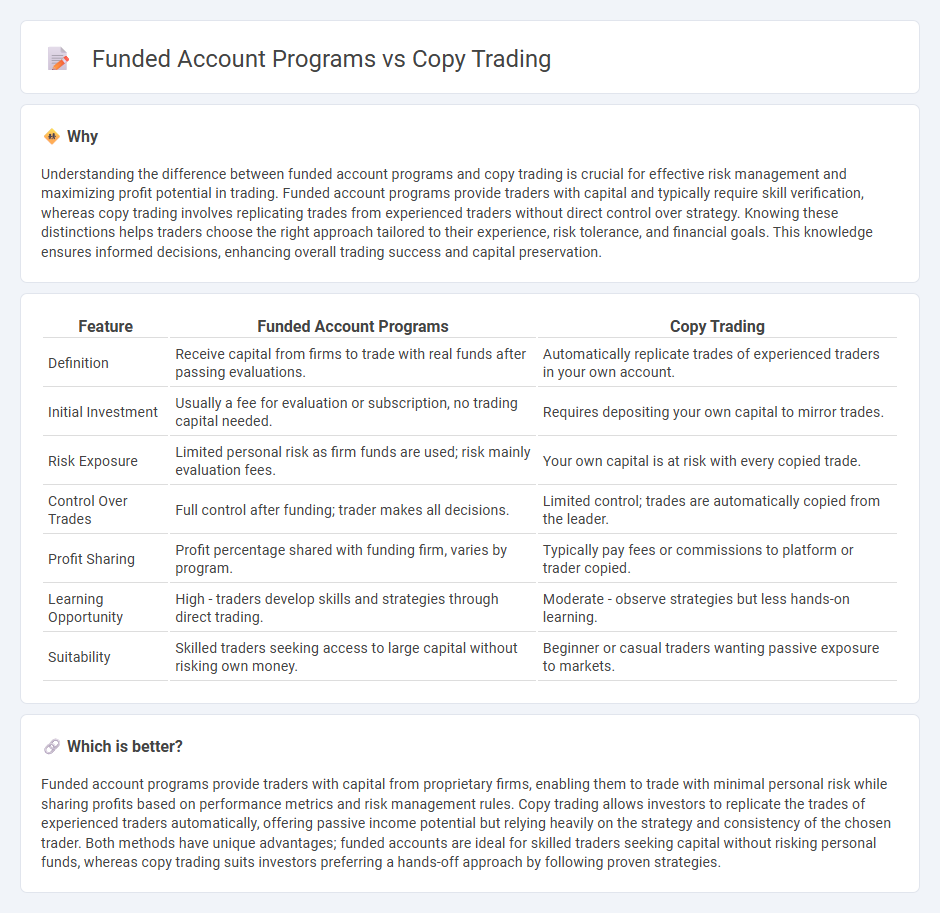

Understanding the difference between funded account programs and copy trading is crucial for effective risk management and maximizing profit potential in trading. Funded account programs provide traders with capital and typically require skill verification, whereas copy trading involves replicating trades from experienced traders without direct control over strategy. Knowing these distinctions helps traders choose the right approach tailored to their experience, risk tolerance, and financial goals. This knowledge ensures informed decisions, enhancing overall trading success and capital preservation.

Comparison Table

| Feature | Funded Account Programs | Copy Trading |

|---|---|---|

| Definition | Receive capital from firms to trade with real funds after passing evaluations. | Automatically replicate trades of experienced traders in your own account. |

| Initial Investment | Usually a fee for evaluation or subscription, no trading capital needed. | Requires depositing your own capital to mirror trades. |

| Risk Exposure | Limited personal risk as firm funds are used; risk mainly evaluation fees. | Your own capital is at risk with every copied trade. |

| Control Over Trades | Full control after funding; trader makes all decisions. | Limited control; trades are automatically copied from the leader. |

| Profit Sharing | Profit percentage shared with funding firm, varies by program. | Typically pay fees or commissions to platform or trader copied. |

| Learning Opportunity | High - traders develop skills and strategies through direct trading. | Moderate - observe strategies but less hands-on learning. |

| Suitability | Skilled traders seeking access to large capital without risking own money. | Beginner or casual traders wanting passive exposure to markets. |

Which is better?

Funded account programs provide traders with capital from proprietary firms, enabling them to trade with minimal personal risk while sharing profits based on performance metrics and risk management rules. Copy trading allows investors to replicate the trades of experienced traders automatically, offering passive income potential but relying heavily on the strategy and consistency of the chosen trader. Both methods have unique advantages; funded accounts are ideal for skilled traders seeking capital without risking personal funds, whereas copy trading suits investors preferring a hands-off approach by following proven strategies.

Connection

Funded account programs provide traders with capital to trade without risking their own money, creating an opportunity to demonstrate skill and generate profits. Copy trading enables investors to automatically replicate trades from successful traders, many of whom participate in these funded account programs. This connection allows copy traders to leverage proven strategies from skilled traders backed by funded accounts, enhancing potential returns while minimizing individual risk.

Key Terms

Signal Provider (Copy Trading)

Signal providers in copy trading offer real-time trade alerts that allow followers to mirror their strategies automatically on platforms like eToro and ZuluTrade, generating passive income based on proven performance. Funded account programs, by contrast, provide traders with capital to trade under specific risk management rules, focusing more on individual trading skills than social trading dynamics. Explore the differences further to determine which trading approach aligns best with your financial goals and risk tolerance.

Profit Split (Funded Account Programs)

Profit split in funded account programs typically ranges from 70% to 90%, allowing traders to retain the majority of their earnings while the firm covers initial risks and capital. Unlike copy trading, where profits are distributed based on follower investments and platform fees, funded accounts emphasize direct trader performance with structured payout schedules. Explore detailed comparisons to understand which profit model maximizes your trading potential.

Risk Management

Copy trading involves replicating the trades of experienced investors, exposing users to market risks tied directly to the original trader's decisions, while funded account programs often implement strict risk management protocols, including controlled drawdowns and leveraged limits to protect capital. Evaluating the risk tolerance, drawdown limitations, and stop-loss strategies in each method helps determine which approach aligns better with an individual's risk appetite and financial goals. Explore detailed comparisons to understand how each model manages exposure and capital preservation effectively.

Source and External Links

Copy trading - Wikipedia - Copy trading enables individuals to automatically copy trades made by selected investors, linking a portion of their funds to the copied trader's account so that all trading actions are duplicated proportionally, allowing for delegated portfolio management without transferring actual capital.

Copy Trading | Copy the Best Traders in 2025 - AvaTrade - Copy trading allows less experienced traders to automatically replicate trades of expert traders, combining automation and personal control, making it a user-friendly way to enter financial markets by following individuals based on risk preferences and past performance.

What is Copy Trading, How Does it Work - PrimeXBT - Copy trading involves automatically copying the trades of successful traders on trading platforms, where users can allocate capital and control risk per trade, offering convenience to novices and busy traders by simplifying market participation.

dowidth.com

dowidth.com