Social sentiment analysis trading leverages real-time data from social media platforms to gauge market mood and predict price movements with greater agility. News-based trading relies on traditional news outlets and official announcements to inform investment decisions, often reacting slower to market shifts. Explore the advantages and limitations of each approach to enhance your trading strategy.

Why it is important

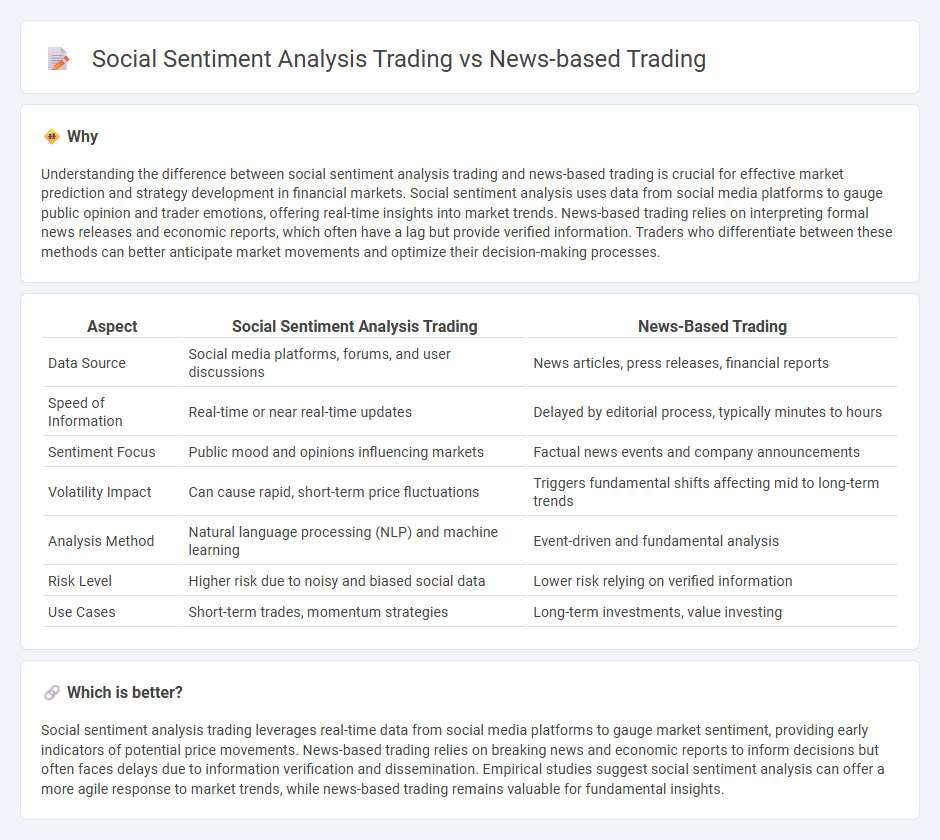

Understanding the difference between social sentiment analysis trading and news-based trading is crucial for effective market prediction and strategy development in financial markets. Social sentiment analysis uses data from social media platforms to gauge public opinion and trader emotions, offering real-time insights into market trends. News-based trading relies on interpreting formal news releases and economic reports, which often have a lag but provide verified information. Traders who differentiate between these methods can better anticipate market movements and optimize their decision-making processes.

Comparison Table

| Aspect | Social Sentiment Analysis Trading | News-Based Trading |

|---|---|---|

| Data Source | Social media platforms, forums, and user discussions | News articles, press releases, financial reports |

| Speed of Information | Real-time or near real-time updates | Delayed by editorial process, typically minutes to hours |

| Sentiment Focus | Public mood and opinions influencing markets | Factual news events and company announcements |

| Volatility Impact | Can cause rapid, short-term price fluctuations | Triggers fundamental shifts affecting mid to long-term trends |

| Analysis Method | Natural language processing (NLP) and machine learning | Event-driven and fundamental analysis |

| Risk Level | Higher risk due to noisy and biased social data | Lower risk relying on verified information |

| Use Cases | Short-term trades, momentum strategies | Long-term investments, value investing |

Which is better?

Social sentiment analysis trading leverages real-time data from social media platforms to gauge market sentiment, providing early indicators of potential price movements. News-based trading relies on breaking news and economic reports to inform decisions but often faces delays due to information verification and dissemination. Empirical studies suggest social sentiment analysis can offer a more agile response to market trends, while news-based trading remains valuable for fundamental insights.

Connection

Social sentiment analysis trading leverages public opinion and emotional trends extracted from social media platforms to predict market movements, while news-based trading focuses on real-time reactions to breaking news events that impact asset prices. Both strategies utilize natural language processing and machine learning algorithms to analyze unstructured textual data, enhancing decision-making accuracy and forecasting market volatility. Integrating these approaches allows traders to capture comprehensive market sentiment and respond swiftly to information-driven price fluctuations.

Key Terms

**News-based trading:**

News-based trading leverages real-time information from financial news, earnings reports, and market-moving announcements to make informed investment decisions. Traders analyze headline sentiment, event timing, and source credibility to quickly capitalize on price fluctuations driven by breaking news. Explore deeper strategies and tools for mastering news-based trading to enhance portfolio performance.

Event-driven

News-based trading leverages real-time information from economic reports, corporate announcements, and geopolitical events to capitalize on market-moving data. Social sentiment analysis trading utilizes algorithms to interpret public opinion and mood from social media platforms, offering insights into collective investor behavior during pivotal events. Explore how integrating these event-driven strategies can enhance trading precision and risk management.

Headlines

News-based trading leverages real-time headlines from trusted financial news sources to make swift investment decisions, prioritizing factual updates on market-moving events such as earnings reports, mergers, or economic data releases. Social sentiment analysis trading evaluates sentiments expressed in social media posts and forums, capturing investor emotions and potential market trends that may not be immediately reflected in news headlines. Explore more about how integrating these strategies can enhance trading accuracy and timing.

Source and External Links

News Based Trading - Quantra by QuantInsti - News-based trading involves exploiting temporary mispricing of securities caused by new information not yet reflected in prices, using sentiment analysis algorithms to assess news impact and make trading decisions.

News Trading Strategies | How To Trade The News | AvaTrade - News trading is an event-driven strategy that takes advantage of price volatility triggered by economic data releases or headlines, typically involving short-term trades based on market reactions to specific news events.

Trading the news - Wikipedia - Trading the news refers to buying or selling financial instruments immediately after significant events or announcements, with methods ranging from manual trading to automated algorithmic systems that analyze live news feeds for market-moving information.

dowidth.com

dowidth.com