Risk reversal is an options strategy involving simultaneous purchase of an out-of-the-money call and sale of an out-of-the-money put, primarily used to hedge or express directional views on an asset's price movement. Calendar spreads involve buying and selling options with the same strike price but different expiration dates to capitalize on time decay and volatility differences. Explore deeper insights on how these strategies can optimize your trading portfolio.

Why it is important

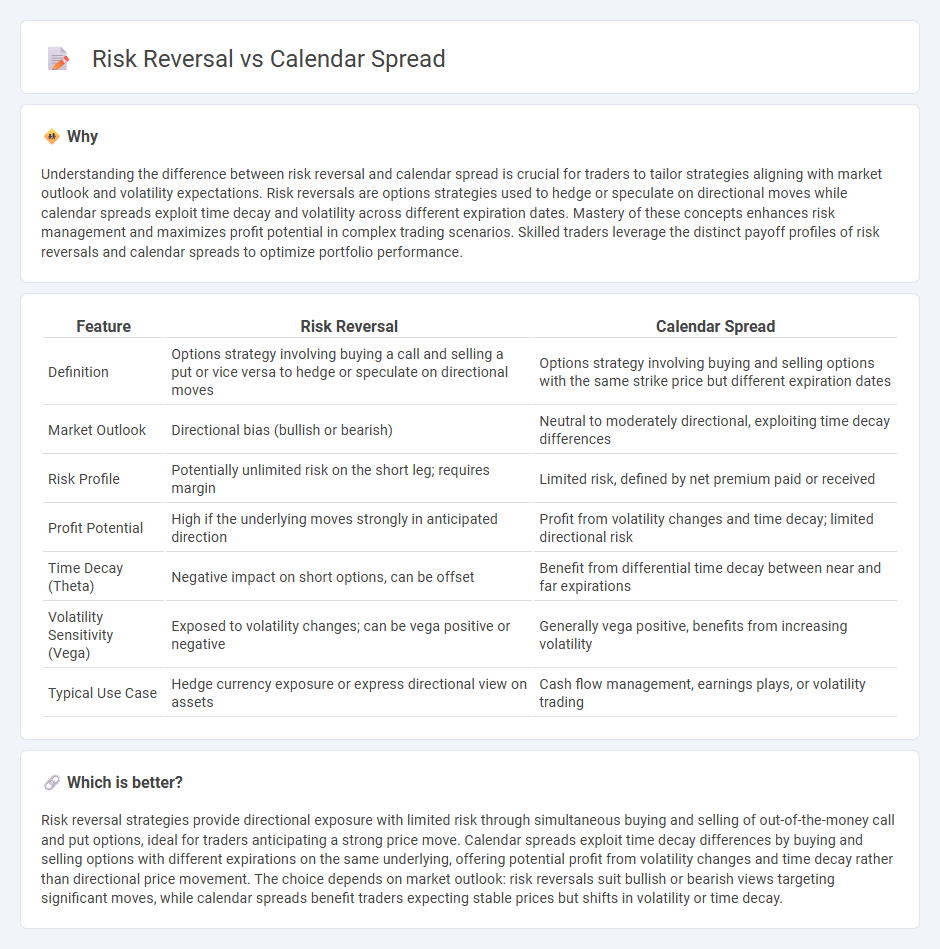

Understanding the difference between risk reversal and calendar spread is crucial for traders to tailor strategies aligning with market outlook and volatility expectations. Risk reversals are options strategies used to hedge or speculate on directional moves while calendar spreads exploit time decay and volatility across different expiration dates. Mastery of these concepts enhances risk management and maximizes profit potential in complex trading scenarios. Skilled traders leverage the distinct payoff profiles of risk reversals and calendar spreads to optimize portfolio performance.

Comparison Table

| Feature | Risk Reversal | Calendar Spread |

|---|---|---|

| Definition | Options strategy involving buying a call and selling a put or vice versa to hedge or speculate on directional moves | Options strategy involving buying and selling options with the same strike price but different expiration dates |

| Market Outlook | Directional bias (bullish or bearish) | Neutral to moderately directional, exploiting time decay differences |

| Risk Profile | Potentially unlimited risk on the short leg; requires margin | Limited risk, defined by net premium paid or received |

| Profit Potential | High if the underlying moves strongly in anticipated direction | Profit from volatility changes and time decay; limited directional risk |

| Time Decay (Theta) | Negative impact on short options, can be offset | Benefit from differential time decay between near and far expirations |

| Volatility Sensitivity (Vega) | Exposed to volatility changes; can be vega positive or negative | Generally vega positive, benefits from increasing volatility |

| Typical Use Case | Hedge currency exposure or express directional view on assets | Cash flow management, earnings plays, or volatility trading |

Which is better?

Risk reversal strategies provide directional exposure with limited risk through simultaneous buying and selling of out-of-the-money call and put options, ideal for traders anticipating a strong price move. Calendar spreads exploit time decay differences by buying and selling options with different expirations on the same underlying, offering potential profit from volatility changes and time decay rather than directional price movement. The choice depends on market outlook: risk reversals suit bullish or bearish views targeting significant moves, while calendar spreads benefit traders expecting stable prices but shifts in volatility or time decay.

Connection

Risk reversal and calendar spread are both options trading strategies used to manage market exposure and hedge risks. Risk reversal involves buying a call option and selling a put option to capitalize on directional moves, while calendar spreads use options with different expiration dates to exploit time decay and volatility differences. Both strategies can be combined to tailor risk profiles and optimize trading performance in volatile markets.

Key Terms

Expiration Dates

Calendar spreads involve buying and selling options of the same strike price but different expiration dates, exploiting time decay and volatility differences to optimize profit. Risk reversals consist of purchasing an out-of-the-money call and selling an out-of-the-money put (or vice versa) with the same expiration, focusing on directional market bias rather than time decay. Explore the nuances of expiration date impacts on these strategies to enhance your options trading expertise.

Strike Prices

Calendar spreads involve buying and selling options with the same strike price but different expiration dates, optimizing time decay and volatility differences. Risk reversals consist of simultaneously buying a call option and selling a put option (or vice versa) with different strike prices, designed to hedge directional risk or speculate on price movements. Explore detailed strike price strategies for calendar spreads and risk reversals to enhance your options trading approach.

Directional Bias

A calendar spread involves simultaneously buying and selling options with the same strike price but different expiration dates, allowing traders to benefit from time decay and implied volatility changes with limited directional bias. Risk reversals combine a long call and a short put (or vice versa) at different strike prices, expressing a strong directional bias on the underlying asset. To explore which strategy aligns best with your market outlook and risk tolerance, learn more about their applications and performance in varied market conditions.

Source and External Links

Calendar spread - Wikipedia - A calendar spread, also known as a time spread or horizontal spread, involves simultaneously buying and selling options or futures on the same underlying with the same strike price but different expiration dates, typically buying a longer-term and selling a near-term contract to exploit differences in implied volatility and time decay.

What is a Calendar Spread Option? - tastylive - A calendar spread is a low-risk, directionally neutral options strategy designed to profit from time decay and increases in implied volatility by buying longer-dated options and selling shorter-dated ones at the same strike price.

Option Calendar Spreads - CME Group - Buying a calendar spread involves selling a near-term option and buying a longer-term option with the same strike, allowing traders to minimize loss potential while capturing profit potential from stable market conditions or anticipated increases in volatility after the near-term expiration.

dowidth.com

dowidth.com