Liquidity sweep involves executing a series of smaller trades to absorb available liquidity across multiple price levels, minimizing market impact and signaling risk. Block trade refers to a single, large transaction conducted privately to avoid price disruption and maintain confidentiality between parties. Explore detailed strategies to optimize trading efficiency and market impact.

Why it is important

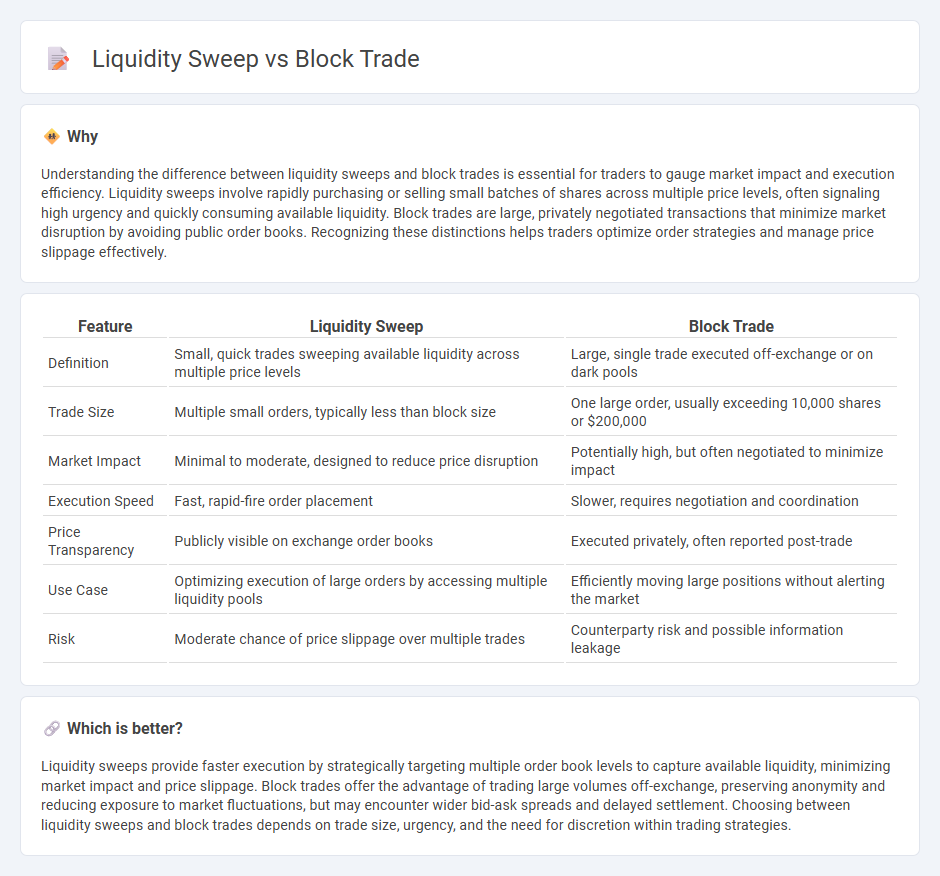

Understanding the difference between liquidity sweeps and block trades is essential for traders to gauge market impact and execution efficiency. Liquidity sweeps involve rapidly purchasing or selling small batches of shares across multiple price levels, often signaling high urgency and quickly consuming available liquidity. Block trades are large, privately negotiated transactions that minimize market disruption by avoiding public order books. Recognizing these distinctions helps traders optimize order strategies and manage price slippage effectively.

Comparison Table

| Feature | Liquidity Sweep | Block Trade |

|---|---|---|

| Definition | Small, quick trades sweeping available liquidity across multiple price levels | Large, single trade executed off-exchange or on dark pools |

| Trade Size | Multiple small orders, typically less than block size | One large order, usually exceeding 10,000 shares or $200,000 |

| Market Impact | Minimal to moderate, designed to reduce price disruption | Potentially high, but often negotiated to minimize impact |

| Execution Speed | Fast, rapid-fire order placement | Slower, requires negotiation and coordination |

| Price Transparency | Publicly visible on exchange order books | Executed privately, often reported post-trade |

| Use Case | Optimizing execution of large orders by accessing multiple liquidity pools | Efficiently moving large positions without alerting the market |

| Risk | Moderate chance of price slippage over multiple trades | Counterparty risk and possible information leakage |

Which is better?

Liquidity sweeps provide faster execution by strategically targeting multiple order book levels to capture available liquidity, minimizing market impact and price slippage. Block trades offer the advantage of trading large volumes off-exchange, preserving anonymity and reducing exposure to market fluctuations, but may encounter wider bid-ask spreads and delayed settlement. Choosing between liquidity sweeps and block trades depends on trade size, urgency, and the need for discretion within trading strategies.

Connection

Liquidity sweeps involve executing a series of rapid trades to access hidden or fragmented liquidity pools across multiple venues, enhancing market depth. Block trades, consisting of large-volume transactions negotiated privately to minimize market impact, often rely on liquidity sweeps to efficiently match sizable orders without significant price disruption. The connection lies in using liquidity sweeps to facilitate block trades by aggregating sufficient counterparties and maintaining optimal execution conditions.

Key Terms

Order Size

Block trades involve large order sizes executed in a single transaction to minimize market impact, typically in the realm of thousands to millions of shares. Liquidity sweeps break down large orders into smaller fragments, aggressively accessing multiple liquidity pools to quickly fill the total order without causing significant price disruption. Explore further to understand how order size strategies influence market dynamics and trading efficiency.

Market Impact

Block trades involve large-volume transactions executed off the public order book to minimize market impact and price volatility. Liquidity sweeps aggressively consume available orders across multiple price levels, often leading to higher immediate market impact due to rapid order execution. Explore detailed strategies to manage market impact effectively in block trades and liquidity sweeps.

Execution Speed

Block trades involve executing large orders swiftly by matching buyers and sellers directly, minimizing market impact and providing rapid execution speed compared to standard trades. Liquidity sweeps, on the other hand, aggressively target multiple liquidity pools simultaneously to fill large buy or sell orders quickly, often causing temporary price fluctuations due to their speed and breadth. Explore more to understand how execution speed variations in these methods affect market dynamics and trading strategies.

Source and External Links

Block Trades - What is a Block Trade? - CME Group - Block trades are privately and bilaterally negotiated large futures, options, or combination transactions that meet certain quantity thresholds and are executed apart from the public auction market to avoid market disruption.

What is Block Trade: Know its Benefits and Features | Tata Moneyfy - A block trade involves buying or selling many securities in a single private transaction that helps large investors avoid significant price changes and market disruption, often executed through dark pools or direct negotiation with brokers.

Guide to Block Trades - SoFi - Block trades are large-volume trades usually conducted by institutional investors that are often broken into smaller trades and executed privately to prevent market impact, and they are legal but not regulated by the SEC.

dowidth.com

dowidth.com