Grid trading involves placing buy and sell orders at regular intervals around a set price to profit from market volatility, while arbitrage exploits price differences of the same asset across different markets or exchanges for risk-free gains. Grid trading capitalizes on range-bound market movements, whereas arbitrage depends on market inefficiencies and rapid execution. Explore the nuances and strategies behind grid trading and arbitrage to optimize your trading approach.

Why it is important

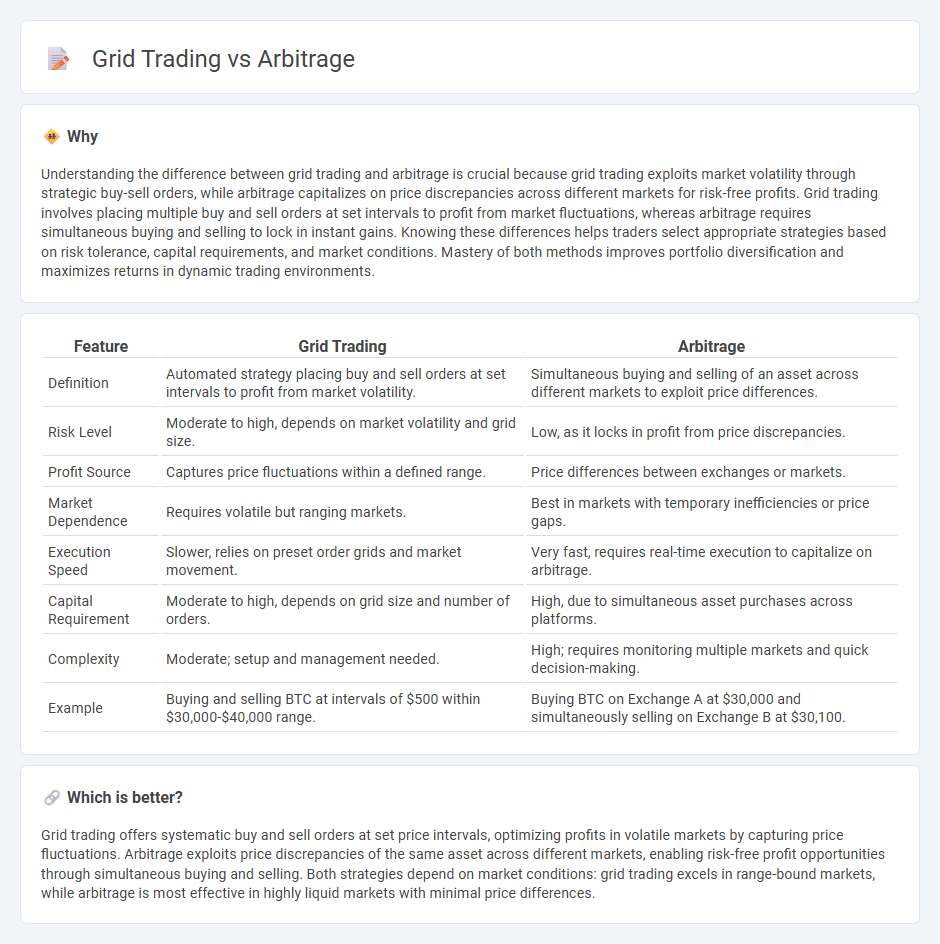

Understanding the difference between grid trading and arbitrage is crucial because grid trading exploits market volatility through strategic buy-sell orders, while arbitrage capitalizes on price discrepancies across different markets for risk-free profits. Grid trading involves placing multiple buy and sell orders at set intervals to profit from market fluctuations, whereas arbitrage requires simultaneous buying and selling to lock in instant gains. Knowing these differences helps traders select appropriate strategies based on risk tolerance, capital requirements, and market conditions. Mastery of both methods improves portfolio diversification and maximizes returns in dynamic trading environments.

Comparison Table

| Feature | Grid Trading | Arbitrage |

|---|---|---|

| Definition | Automated strategy placing buy and sell orders at set intervals to profit from market volatility. | Simultaneous buying and selling of an asset across different markets to exploit price differences. |

| Risk Level | Moderate to high, depends on market volatility and grid size. | Low, as it locks in profit from price discrepancies. |

| Profit Source | Captures price fluctuations within a defined range. | Price differences between exchanges or markets. |

| Market Dependence | Requires volatile but ranging markets. | Best in markets with temporary inefficiencies or price gaps. |

| Execution Speed | Slower, relies on preset order grids and market movement. | Very fast, requires real-time execution to capitalize on arbitrage. |

| Capital Requirement | Moderate to high, depends on grid size and number of orders. | High, due to simultaneous asset purchases across platforms. |

| Complexity | Moderate; setup and management needed. | High; requires monitoring multiple markets and quick decision-making. |

| Example | Buying and selling BTC at intervals of $500 within $30,000-$40,000 range. | Buying BTC on Exchange A at $30,000 and simultaneously selling on Exchange B at $30,100. |

Which is better?

Grid trading offers systematic buy and sell orders at set price intervals, optimizing profits in volatile markets by capturing price fluctuations. Arbitrage exploits price discrepancies of the same asset across different markets, enabling risk-free profit opportunities through simultaneous buying and selling. Both strategies depend on market conditions: grid trading excels in range-bound markets, while arbitrage is most effective in highly liquid markets with minimal price differences.

Connection

Grid trading and arbitrage are connected through their strategies to capitalize on market inefficiencies and price fluctuations. Grid trading involves placing buy and sell orders at set intervals to profit from market volatility, while arbitrage exploits price differences of the same asset across different markets or exchanges. Both methods aim to generate consistent returns by leveraging systematic approaches to trading without relying on market direction predictions.

Key Terms

Price Inefficiency (Arbitrage)

Arbitrage exploits price inefficiencies across different markets or exchanges by simultaneously buying low and selling high to secure risk-free profits, leveraging real-time data and fast execution. This strategy requires significant capital and low latency systems to capitalize on fleeting discrepancies before they vanish. Explore detailed comparisons and optimal use cases to enhance your trading strategy knowledge.

Buy/Sell Orders (Grid Trading)

Grid trading involves placing multiple buy and sell orders at predefined price intervals to capitalize on market fluctuations, creating a structured range where profits can be secured regardless of market direction. In contrast, arbitrage exploits price discrepancies between different markets or instruments without relying on continuous buy/sell orders, aiming for risk-free profit from price convergence. Explore the nuances of buy/sell order strategies within grid trading for optimized market entry and exit.

Market Spread

Market spread analysis plays a crucial role in arbitrage and grid trading strategies, as arbitrage exploits price differences of the same asset across multiple markets to generate risk-free profits. Grid trading operates by placing buy and sell orders at predefined intervals around a set price, profiting from regular market fluctuations within a certain spread range. Explore detailed comparisons to understand how market spread impacts profitability and risk management in both trading methods.

Source and External Links

Arbitrage - Wikipedia - Arbitrage is the practice of simultaneously buying and selling an asset in two or more markets to profit from price differences, generally considered risk-free in theory but may carry some risks in practice; it causes price convergence across markets.

Arbitrage Definition and Meaning - Arbitrage involves buying a product or asset at a lower price in one market and simultaneously selling it at a higher price in another, leveraging market inefficiencies to maximize profit, commonly used in finance, retail, and logistics.

What Is Arbitrage? 3 Strategies to Know - Harvard Business School - Arbitrage is an investment strategy of simultaneously buying and selling assets in different markets to exploit price differences, with key types including pure arbitrage, merger arbitrage, and convertible arbitrage, often used by sophisticated investors.

dowidth.com

dowidth.com