Zero knowledge proof trading enhances security by enabling transactions without revealing sensitive information, reducing the risk of data breaches. Custodial trading relies on third-party entities to manage assets and private keys, increasing vulnerability to hacks and loss of control. Explore the differences and benefits of these trading methods to optimize your investment strategy.

Why it is important

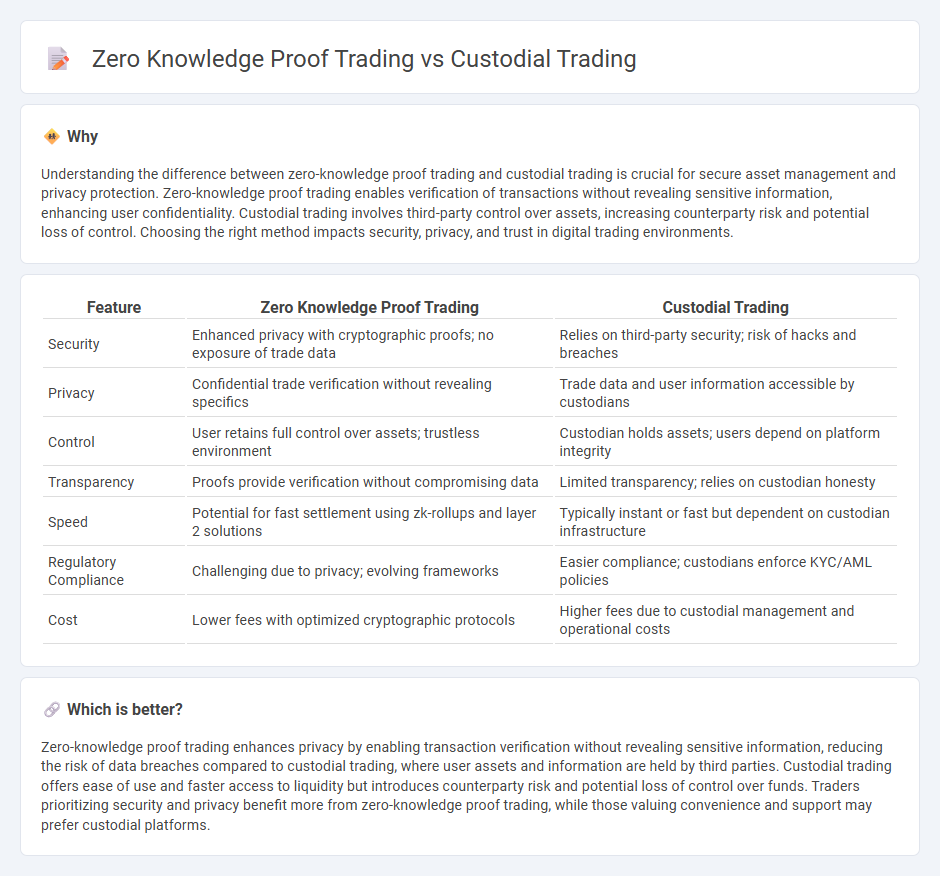

Understanding the difference between zero-knowledge proof trading and custodial trading is crucial for secure asset management and privacy protection. Zero-knowledge proof trading enables verification of transactions without revealing sensitive information, enhancing user confidentiality. Custodial trading involves third-party control over assets, increasing counterparty risk and potential loss of control. Choosing the right method impacts security, privacy, and trust in digital trading environments.

Comparison Table

| Feature | Zero Knowledge Proof Trading | Custodial Trading |

|---|---|---|

| Security | Enhanced privacy with cryptographic proofs; no exposure of trade data | Relies on third-party security; risk of hacks and breaches |

| Privacy | Confidential trade verification without revealing specifics | Trade data and user information accessible by custodians |

| Control | User retains full control over assets; trustless environment | Custodian holds assets; users depend on platform integrity |

| Transparency | Proofs provide verification without compromising data | Limited transparency; relies on custodian honesty |

| Speed | Potential for fast settlement using zk-rollups and layer 2 solutions | Typically instant or fast but dependent on custodian infrastructure |

| Regulatory Compliance | Challenging due to privacy; evolving frameworks | Easier compliance; custodians enforce KYC/AML policies |

| Cost | Lower fees with optimized cryptographic protocols | Higher fees due to custodial management and operational costs |

Which is better?

Zero-knowledge proof trading enhances privacy by enabling transaction verification without revealing sensitive information, reducing the risk of data breaches compared to custodial trading, where user assets and information are held by third parties. Custodial trading offers ease of use and faster access to liquidity but introduces counterparty risk and potential loss of control over funds. Traders prioritizing security and privacy benefit more from zero-knowledge proof trading, while those valuing convenience and support may prefer custodial platforms.

Connection

Zero knowledge proof trading enhances security and privacy in custodial trading by enabling verification of transactions without revealing sensitive information. Custodial trading platforms leverage zero knowledge proofs to maintain user confidentiality while ensuring compliance and preventing fraud. This integration fosters trust in custodial services by combining transparent verification with private asset management.

Key Terms

Asset custody

Custodial trading relies on third-party entities to securely hold digital assets, increasing risks of hacks or mismanagement due to centralized control. Zero-knowledge proof trading enhances asset custody by enabling private and verifiable transactions without exposing sensitive information, offering greater security and user control. Explore how zero-knowledge proof technology revolutionizes asset custody in trading platforms.

Privacy

Custodial trading platforms manage user assets directly, which can compromise privacy due to centralized control and potential data breaches. Zero Knowledge Proof (ZKP) trading leverages cryptographic methods enabling users to prove transaction validity without revealing sensitive information, boosting privacy and security in decentralized finance (DeFi). Explore how ZKP trading reshapes privacy standards in trading environments.

Trustlessness

Custodial trading relies on third-party intermediaries to hold and manage assets, introducing counterparty risk and reducing trustlessness in transactions. Zero knowledge proof trading leverages cryptographic techniques to validate trades without revealing sensitive information, enabling trustless, secure, and private asset exchanges. Explore how zero knowledge proofs transform decentralized finance by enhancing trustless trading mechanisms.

Source and External Links

What is a custodial account? Investment accounts for kids - Ally - A custodial brokerage account is an investment account managed by an adult on behalf of a minor, allowing the custodian to buy and sell assets like stocks and bonds until the child reaches legal age when ownership transfers to them, with two main types: UGMA and UTMA accounts.

Custodial Account for Minors | What We Offer - E*Trade - Custodial accounts allow adults to manage a child's investment portfolio until the child comes of age (18 or 21 depending on the state), with tax benefits and no contribution limits, after which the assets become the child's property.

UGMA & UTMA accounts | Tips for custodial accounts | Fidelity - Custodial accounts are taxable brokerage accounts opened by an adult for a minor, with no contribution limits and tax advantages on earnings, and the custodian controls the account until the child reaches the age specified by state law when the assets transfer to the child.

dowidth.com

dowidth.com