Modular blockchains trading offers enhanced scalability and customization by separating consensus, execution, and settlement layers, allowing for more efficient transaction processing compared to traditional decentralized exchanges (DEXs) that operate on a single blockchain layer. This separation reduces congestion and lowers fees, improving liquidity and user experience in trading activities. Discover how modular blockchain architectures are revolutionizing decentralized finance platforms and transforming trading dynamics.

Why it is important

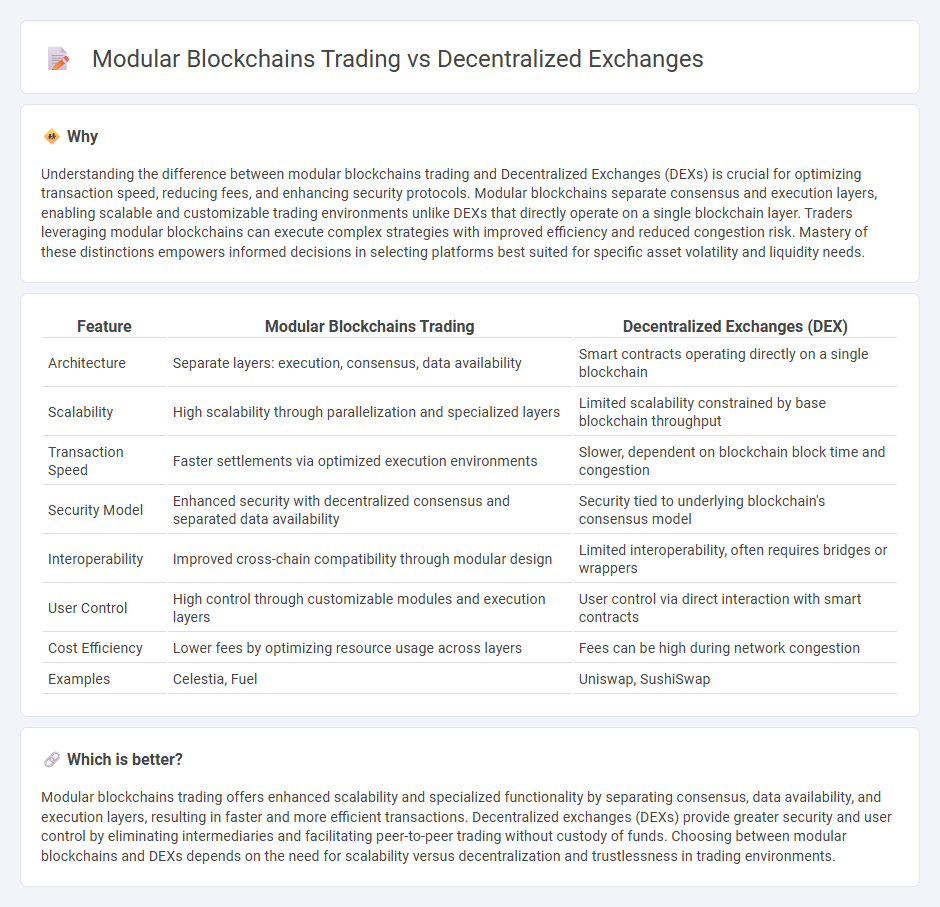

Understanding the difference between modular blockchains trading and Decentralized Exchanges (DEXs) is crucial for optimizing transaction speed, reducing fees, and enhancing security protocols. Modular blockchains separate consensus and execution layers, enabling scalable and customizable trading environments unlike DEXs that directly operate on a single blockchain layer. Traders leveraging modular blockchains can execute complex strategies with improved efficiency and reduced congestion risk. Mastery of these distinctions empowers informed decisions in selecting platforms best suited for specific asset volatility and liquidity needs.

Comparison Table

| Feature | Modular Blockchains Trading | Decentralized Exchanges (DEX) |

|---|---|---|

| Architecture | Separate layers: execution, consensus, data availability | Smart contracts operating directly on a single blockchain |

| Scalability | High scalability through parallelization and specialized layers | Limited scalability constrained by base blockchain throughput |

| Transaction Speed | Faster settlements via optimized execution environments | Slower, dependent on blockchain block time and congestion |

| Security Model | Enhanced security with decentralized consensus and separated data availability | Security tied to underlying blockchain's consensus model |

| Interoperability | Improved cross-chain compatibility through modular design | Limited interoperability, often requires bridges or wrappers |

| User Control | High control through customizable modules and execution layers | User control via direct interaction with smart contracts |

| Cost Efficiency | Lower fees by optimizing resource usage across layers | Fees can be high during network congestion |

| Examples | Celestia, Fuel | Uniswap, SushiSwap |

Which is better?

Modular blockchains trading offers enhanced scalability and specialized functionality by separating consensus, data availability, and execution layers, resulting in faster and more efficient transactions. Decentralized exchanges (DEXs) provide greater security and user control by eliminating intermediaries and facilitating peer-to-peer trading without custody of funds. Choosing between modular blockchains and DEXs depends on the need for scalability versus decentralization and trustlessness in trading environments.

Connection

Modular blockchains enhance trading by enabling specialized layers for consensus, data availability, and execution, which improves scalability and reduces transaction costs on decentralized exchanges (DEXs). Decentralized exchanges leverage these modular architectures to offer faster, more secure, and trustless trading experiences without relying on centralized intermediaries. This integration drives liquidity aggregation, cross-chain asset swaps, and improved user autonomy in the decentralized finance (DeFi) ecosystem.

Key Terms

Liquidity Pools

Liquidity pools on decentralized exchanges (DEXs) enable seamless, trustless trading by aggregating user funds to facilitate asset swaps without traditional order books. Modular blockchains enhance this mechanism by optimizing scalability, interoperability, and transaction finality, thereby improving the efficiency and accessibility of liquidity pools across multiple blockchain ecosystems. Explore how combining DEX liquidity pools with modular blockchain architecture revolutionizes decentralized trading.

Cross-Chain Interoperability

Decentralized exchanges (DEXs) enhance liquidity and user control by enabling direct peer-to-peer trading on blockchain networks without intermediaries. Modular blockchains with cross-chain interoperability protocols facilitate seamless asset transfers and data communication across different blockchain ecosystems, broadening trading capabilities beyond single-chain limitations. Explore how advancements in interoperability are revolutionizing decentralized finance and expanding cross-chain trading opportunities.

Automated Market Makers (AMMs)

Decentralized exchanges (DEXs) primarily utilize Automated Market Makers (AMMs) to facilitate trustless and continuous trading of digital assets without traditional order books. Modular blockchains enhance AMM efficiency by segregating consensus, execution, and data availability layers, reducing latency and improving scalability for seamless trading experiences. Explore how these innovations transform liquidity provision and market dynamics in decentralized finance ecosystems.

Source and External Links

Best DEX Decentralized exchanges - A decentralized exchange (DEX) is a cryptocurrency trading platform with no central authority, enabling peer-to-peer trading of tokens directly from user wallets; examples include GMX, Hyperliquid, 1inch.exchange, Aevo, AirSwap, Balancer, and Bancor, each offering unique features like spot and perpetual trading, liquidity pools, and derivatives options.

What is a DEX? - DEXs are peer-to-peer marketplaces running on smart contracts that facilitate direct crypto-to-crypto trades via liquidity pools without intermediaries, offering transparency and security as transactions settle on the blockchain rather than an exchange's internal database.

What Is a DEX? Decentralized Exchange Platforms - Gemini - DEX platforms automate trading through smart contracts where users maintain control of private keys, with trades executed trustlessly and recorded on the blockchain, providing a non-custodial alternative to centralized exchanges and supporting broad access via apps and web interfaces.

dowidth.com

dowidth.com