Paper trading competitions simulate real market conditions using virtual funds to let participants test strategies and compete without financial risk. Demo trading platforms provide a risk-free environment for beginners to practice order execution and market analysis with real-time data. Explore the differences and benefits of both methods to enhance your trading skills effectively.

Why it is important

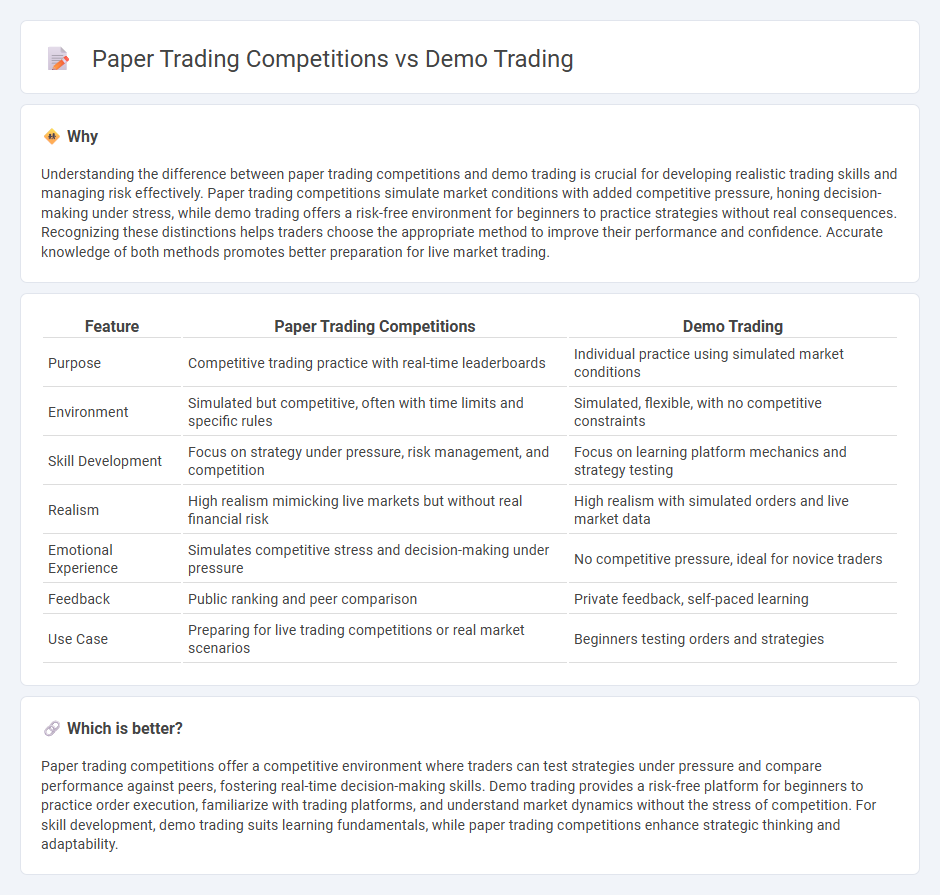

Understanding the difference between paper trading competitions and demo trading is crucial for developing realistic trading skills and managing risk effectively. Paper trading competitions simulate market conditions with added competitive pressure, honing decision-making under stress, while demo trading offers a risk-free environment for beginners to practice strategies without real consequences. Recognizing these distinctions helps traders choose the appropriate method to improve their performance and confidence. Accurate knowledge of both methods promotes better preparation for live market trading.

Comparison Table

| Feature | Paper Trading Competitions | Demo Trading |

|---|---|---|

| Purpose | Competitive trading practice with real-time leaderboards | Individual practice using simulated market conditions |

| Environment | Simulated but competitive, often with time limits and specific rules | Simulated, flexible, with no competitive constraints |

| Skill Development | Focus on strategy under pressure, risk management, and competition | Focus on learning platform mechanics and strategy testing |

| Realism | High realism mimicking live markets but without real financial risk | High realism with simulated orders and live market data |

| Emotional Experience | Simulates competitive stress and decision-making under pressure | No competitive pressure, ideal for novice traders |

| Feedback | Public ranking and peer comparison | Private feedback, self-paced learning |

| Use Case | Preparing for live trading competitions or real market scenarios | Beginners testing orders and strategies |

Which is better?

Paper trading competitions offer a competitive environment where traders can test strategies under pressure and compare performance against peers, fostering real-time decision-making skills. Demo trading provides a risk-free platform for beginners to practice order execution, familiarize with trading platforms, and understand market dynamics without the stress of competition. For skill development, demo trading suits learning fundamentals, while paper trading competitions enhance strategic thinking and adaptability.

Connection

Paper trading competitions utilize demo trading platforms to simulate real market conditions, enabling participants to practice strategies without financial risk. These competitions foster skill development and performance evaluation by providing a risk-free environment identical to live trading. Demo trading serves as the foundational tool for paper trading contests, enhancing trader confidence and strategy refinement.

Key Terms

Simulation

Demo trading simulates real market conditions using virtual funds, allowing traders to practice strategies without financial risk. Paper trading competitions emphasize theoretical execution by manually recording trades on a simulated platform, focusing on precision and analysis. Explore detailed differences and benefits of each simulation method to enhance your trading skills.

Real-time market data

Demo trading competitions simulate real-time market conditions with virtual funds, allowing participants to practice strategies without financial risk while using live market data feeds. Paper trading competitions also use simulated funds but may rely on delayed or historical data, limiting the ability to respond to real-time price fluctuations and market events. Explore more on how accessing real-time market data in competitions enhances trading skills and decision-making.

Performance ranking

Demo trading competitions offer a real-time simulation of market conditions, allowing participants to test strategies with virtual funds while competing against others based on performance rankings. Paper trading competitions involve simulated trades without market dynamics, focusing primarily on accuracy and strategy development without real-time pressure on rankings. Explore more to understand how each competition type impacts performance assessment and trader development.

Source and External Links

Demo Trading Account | Binary Options Demo - Practice risk-free trading with $10,000 in virtual funds on Nadex's regulated platform, trying binary options, knock-outs, and call spreads with full access to analysis tools and both desktop and mobile trading.

Practice on a Demo Trading Account - Sharpen your trading skills with Exness's risk-free demo account, testing strategies and mastering platform tools across global markets using MetaTrader or the Exness Trade App on desktop or mobile.

Demo Trading Account: Try IG's Paper Trading Simulator - Simulate real trading with access to over 17,000 markets, practise stocks, forex, and CFDs without financial risk, and learn to use the IG or MetaTrader platform in a virtual environment.

dowidth.com

dowidth.com