Retail flow chasing involves individual investors reacting swiftly to market trends by following the trading activity of retail participants, while block trades refer to large, privately negotiated transactions typically executed by institutional investors to minimize market impact. Understanding the dynamics between retail flow chasing and block trades reveals how market liquidity and price volatility are influenced by different trader behaviors. Explore how mastering these concepts can enhance your trading strategy and market insights.

Why it is important

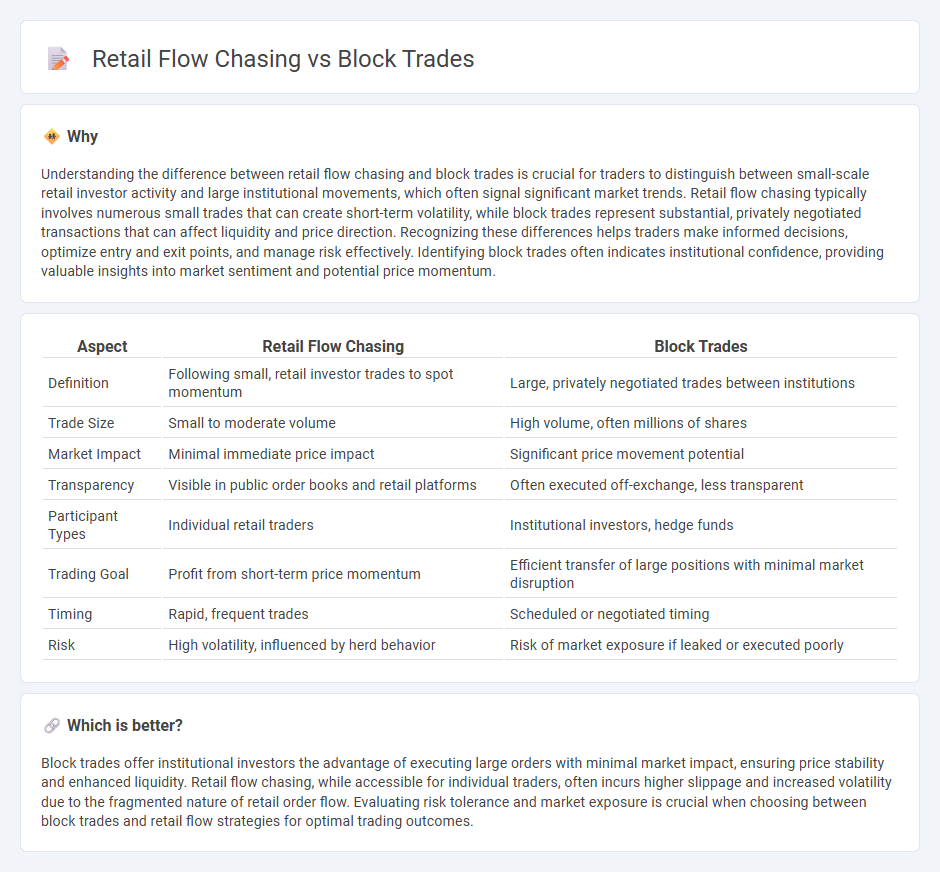

Understanding the difference between retail flow chasing and block trades is crucial for traders to distinguish between small-scale retail investor activity and large institutional movements, which often signal significant market trends. Retail flow chasing typically involves numerous small trades that can create short-term volatility, while block trades represent substantial, privately negotiated transactions that can affect liquidity and price direction. Recognizing these differences helps traders make informed decisions, optimize entry and exit points, and manage risk effectively. Identifying block trades often indicates institutional confidence, providing valuable insights into market sentiment and potential price momentum.

Comparison Table

| Aspect | Retail Flow Chasing | Block Trades |

|---|---|---|

| Definition | Following small, retail investor trades to spot momentum | Large, privately negotiated trades between institutions |

| Trade Size | Small to moderate volume | High volume, often millions of shares |

| Market Impact | Minimal immediate price impact | Significant price movement potential |

| Transparency | Visible in public order books and retail platforms | Often executed off-exchange, less transparent |

| Participant Types | Individual retail traders | Institutional investors, hedge funds |

| Trading Goal | Profit from short-term price momentum | Efficient transfer of large positions with minimal market disruption |

| Timing | Rapid, frequent trades | Scheduled or negotiated timing |

| Risk | High volatility, influenced by herd behavior | Risk of market exposure if leaked or executed poorly |

Which is better?

Block trades offer institutional investors the advantage of executing large orders with minimal market impact, ensuring price stability and enhanced liquidity. Retail flow chasing, while accessible for individual traders, often incurs higher slippage and increased volatility due to the fragmented nature of retail order flow. Evaluating risk tolerance and market exposure is crucial when choosing between block trades and retail flow strategies for optimal trading outcomes.

Connection

Retail flow chasing influences market liquidity by amplifying order imbalances, which can trigger significant block trades as institutional investors seek to capitalize on or mitigate price movements. Block trades often occur in response to heightened retail activity to enable large volume transactions without causing excessive market disruption. This interplay affects price discovery and volatility, with retail flow serving as a signal for institutions to execute sizable trades efficiently.

Key Terms

Order Size

Block trades typically involve large order sizes executed by institutional investors, resulting in significant market impact and liquidity shifts. Retail flow chasing, on the other hand, targets smaller order sizes generated by individual traders, often leading to increased volatility due to fragmented market orders. Explore how order size influences trading strategies and market dynamics to optimize your investment approach.

Liquidity

Block trades involve large, privately negotiated transactions between institutional investors, providing substantial liquidity without significantly impacting market prices. Retail flow chasing, driven by smaller, frequent trades from individual investors, can increase market volatility and fragment liquidity across multiple price levels. Explore deeper insights into how liquidity dynamics differentiate block trades from retail flow chasing.

Market Impact

Block trades involve large volumes of securities exchanged between institutional investors, significantly affecting market prices due to their substantial size and limited liquidity. Retail flow chasing refers to institutional strategies that track smaller, retail investor transactions to anticipate short-term market movements, often resulting in rapid price shifts within highly liquid stocks. Explore deeper insights on their distinct market impacts and strategic applications.

Source and External Links

Block Trades - What is a Block Trade? - CME Group - Block trades are privately and bilaterally negotiated futures, options, or combination transactions meeting specific quantity thresholds, executed apart from public auction markets under regulatory Rule 526.

Guide to Block Trades - SoFi - Block trades consist of large-volume purchases or sales of financial assets, typically by institutional investors, conducted privately to minimize market impact, often executed through block trade facilities or dark pools.

Block Trades - CME Group - Block trades allow private negotiation of large transactions at a single price, executed apart from public markets with real-time alerts available for such trades.

dowidth.com

dowidth.com