Delta hedging minimizes risk by adjusting a derivatives position to remain neutral against small price movements in the underlying asset, utilizing options to offset potential losses. Portfolio insurance, typically involving dynamic hedging strategies, protects overall investment value from market downturns by systematically buying or selling asset derivatives as market conditions change. Explore further to understand how these strategies can safeguard investments in volatile markets.

Why it is important

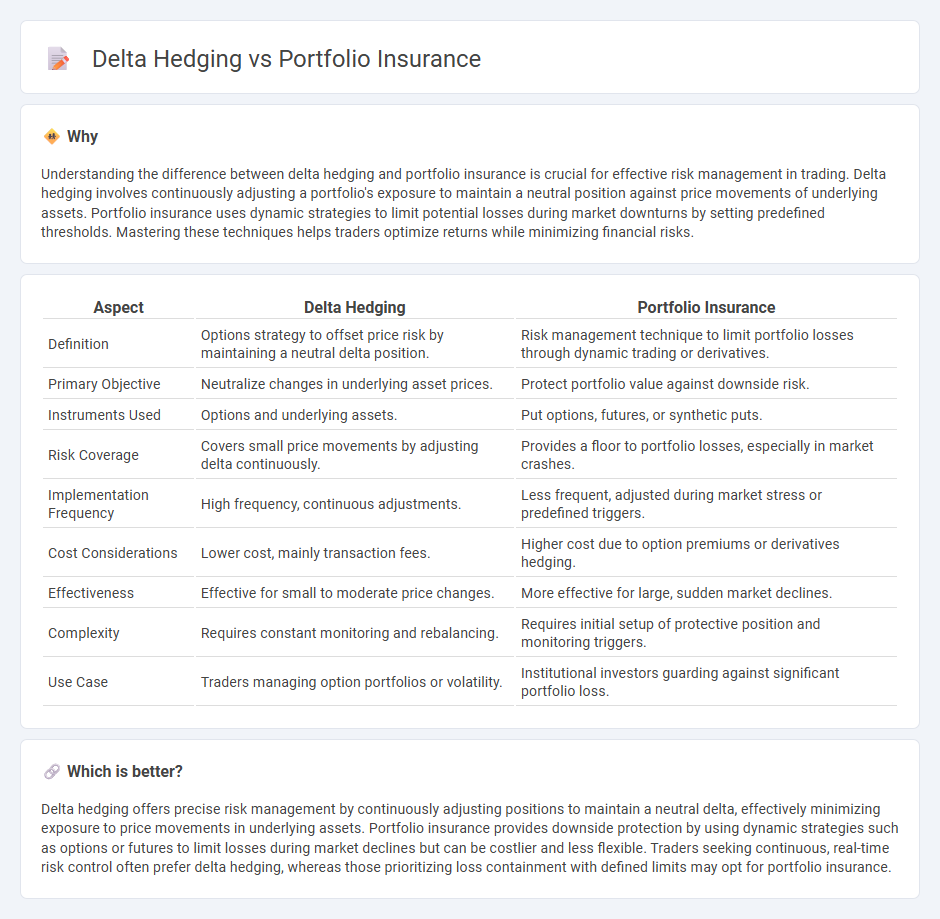

Understanding the difference between delta hedging and portfolio insurance is crucial for effective risk management in trading. Delta hedging involves continuously adjusting a portfolio's exposure to maintain a neutral position against price movements of underlying assets. Portfolio insurance uses dynamic strategies to limit potential losses during market downturns by setting predefined thresholds. Mastering these techniques helps traders optimize returns while minimizing financial risks.

Comparison Table

| Aspect | Delta Hedging | Portfolio Insurance |

|---|---|---|

| Definition | Options strategy to offset price risk by maintaining a neutral delta position. | Risk management technique to limit portfolio losses through dynamic trading or derivatives. |

| Primary Objective | Neutralize changes in underlying asset prices. | Protect portfolio value against downside risk. |

| Instruments Used | Options and underlying assets. | Put options, futures, or synthetic puts. |

| Risk Coverage | Covers small price movements by adjusting delta continuously. | Provides a floor to portfolio losses, especially in market crashes. |

| Implementation Frequency | High frequency, continuous adjustments. | Less frequent, adjusted during market stress or predefined triggers. |

| Cost Considerations | Lower cost, mainly transaction fees. | Higher cost due to option premiums or derivatives hedging. |

| Effectiveness | Effective for small to moderate price changes. | More effective for large, sudden market declines. |

| Complexity | Requires constant monitoring and rebalancing. | Requires initial setup of protective position and monitoring triggers. |

| Use Case | Traders managing option portfolios or volatility. | Institutional investors guarding against significant portfolio loss. |

Which is better?

Delta hedging offers precise risk management by continuously adjusting positions to maintain a neutral delta, effectively minimizing exposure to price movements in underlying assets. Portfolio insurance provides downside protection by using dynamic strategies such as options or futures to limit losses during market declines but can be costlier and less flexible. Traders seeking continuous, real-time risk control often prefer delta hedging, whereas those prioritizing loss containment with defined limits may opt for portfolio insurance.

Connection

Delta hedging and portfolio insurance are interconnected strategies that manage risk in trading by offsetting potential losses through dynamic adjustment of asset positions. Delta hedging involves continuously rebalancing options and underlying assets to maintain a neutral delta, minimizing exposure to price fluctuations. Portfolio insurance employs delta hedging techniques to protect a portfolio's value during market downturns, ensuring downside risk mitigation while preserving upside potential.

Key Terms

Dynamic Hedging

Portfolio insurance involves strategies such as dynamic hedging to protect against downside risk by continuously adjusting the portfolio's exposure to the underlying asset's price movements. Delta hedging, a core component of dynamic hedging, entails regularly rebalancing the hedge ratio to maintain a delta-neutral position, reducing sensitivity to market fluctuations. Explore further to understand how dynamic hedging techniques optimize risk management within portfolio insurance frameworks.

Options

Portfolio insurance uses options to limit downside risk by establishing a floor value on the portfolio, typically through protective puts or dynamic hedging strategies. Delta hedging adjusts the options position continuously to maintain a neutral portfolio delta, reducing exposure to price fluctuations in the underlying asset. Explore the nuances and practical applications of portfolio insurance and delta hedging in options trading to enhance your risk management skills.

Market Risk

Portfolio insurance mitigates market risk by employing dynamic hedging strategies that adjust exposure to maintain a floor value during downside movements. Delta hedging balances portfolios by continuously offsetting options' sensitivity to asset price changes, reducing directional risk but requiring frequent rebalancing. Explore deeper insights on how these techniques manage market risk amid volatility.

Source and External Links

Portfolio insurance - Wikipedia - Portfolio insurance is a hedging strategy developed to limit losses from a declining stock index by dynamically selling futures to maintain a target stock-to-cash ratio, thus protecting downside risk without selling the underlying stocks themselves.

The Performance of Option-Based Portfolio Insurance on a Dividend ... - Option-based portfolio insurance is a dynamic investment strategy designed to guarantee the portfolio value stays above a predetermined floor at maturity, limiting downside risk while allowing some upside participation by using put options and bonds.

Portfolio insurance: what investors need to know | Features | IPE - Portfolio insurance provides upside participation in risky assets while guaranteeing a minimum return over a set time horizon, but typically requires giving up some upside potential and involves optionalities and use of liquid futures markets for hedging.

dowidth.com

dowidth.com