Atomic swaps enable direct peer-to-peer cryptocurrency trading without intermediaries, enhancing security and reducing dependence on centralized exchanges. Centralized exchanges offer user-friendly interfaces and high liquidity but require users to trust third parties with asset custody. Explore the key differences between atomic swaps and centralized exchanges to optimize your trading strategy.

Why it is important

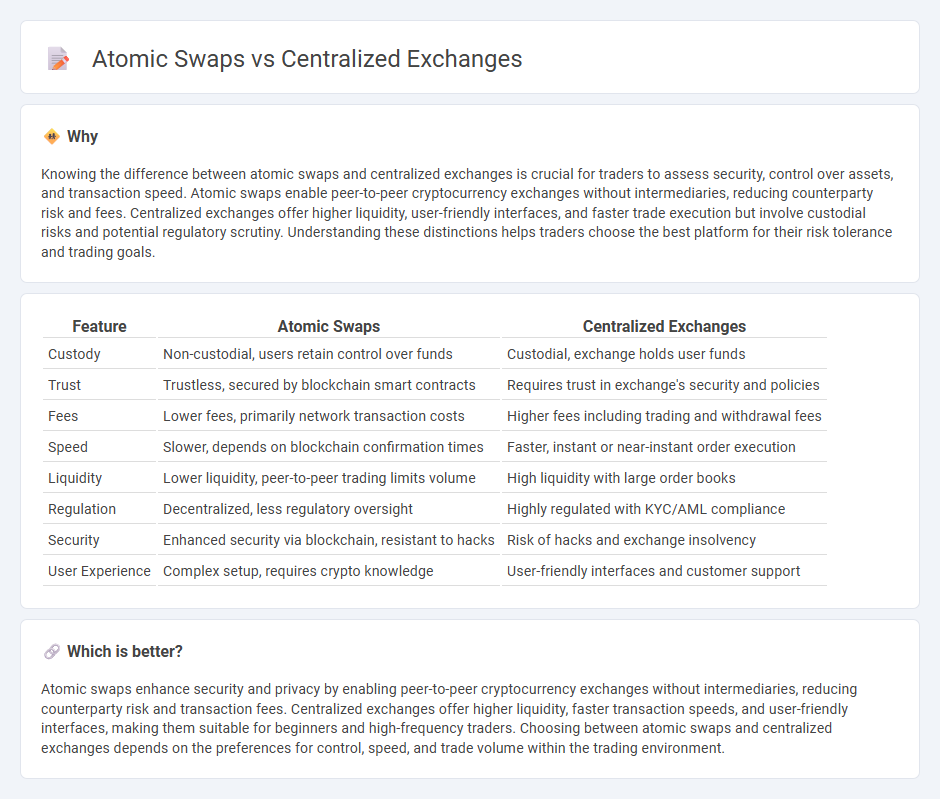

Knowing the difference between atomic swaps and centralized exchanges is crucial for traders to assess security, control over assets, and transaction speed. Atomic swaps enable peer-to-peer cryptocurrency exchanges without intermediaries, reducing counterparty risk and fees. Centralized exchanges offer higher liquidity, user-friendly interfaces, and faster trade execution but involve custodial risks and potential regulatory scrutiny. Understanding these distinctions helps traders choose the best platform for their risk tolerance and trading goals.

Comparison Table

| Feature | Atomic Swaps | Centralized Exchanges |

|---|---|---|

| Custody | Non-custodial, users retain control over funds | Custodial, exchange holds user funds |

| Trust | Trustless, secured by blockchain smart contracts | Requires trust in exchange's security and policies |

| Fees | Lower fees, primarily network transaction costs | Higher fees including trading and withdrawal fees |

| Speed | Slower, depends on blockchain confirmation times | Faster, instant or near-instant order execution |

| Liquidity | Lower liquidity, peer-to-peer trading limits volume | High liquidity with large order books |

| Regulation | Decentralized, less regulatory oversight | Highly regulated with KYC/AML compliance |

| Security | Enhanced security via blockchain, resistant to hacks | Risk of hacks and exchange insolvency |

| User Experience | Complex setup, requires crypto knowledge | User-friendly interfaces and customer support |

Which is better?

Atomic swaps enhance security and privacy by enabling peer-to-peer cryptocurrency exchanges without intermediaries, reducing counterparty risk and transaction fees. Centralized exchanges offer higher liquidity, faster transaction speeds, and user-friendly interfaces, making them suitable for beginners and high-frequency traders. Choosing between atomic swaps and centralized exchanges depends on the preferences for control, speed, and trade volume within the trading environment.

Connection

Atomic swaps enable direct peer-to-peer cryptocurrency trading without intermediaries, contrasting with centralized exchanges that facilitate trades through managed order books and custody services. Centralized exchanges often integrate atomic swap technology to enhance liquidity and offer seamless cross-chain transactions. This fusion bridges decentralized protocols with centralized infrastructure, optimizing trading efficiency and security.

Key Terms

Custodianship

Centralized exchanges rely on third-party custodians who hold users' private keys and assets, creating potential risks such as hacking or mismanagement. Atomic swaps eliminate the need for intermediaries by enabling direct peer-to-peer trades across different blockchains, ensuring users retain full control over their funds throughout the transaction process. Explore the fundamental differences in custodianship and security to determine which option aligns with your trading needs.

Order Book

Order books in centralized exchanges provide real-time visibility of buy and sell orders, facilitating high liquidity and efficient price discovery for traders. Atomic swaps operate without centralized order books, relying on trustless smart contracts to enable direct peer-to-peer cryptocurrency exchanges across different blockchains. Explore detailed comparisons to understand how order book mechanisms impact trading experiences in both systems.

Trustless Settlement

Centralized exchanges rely on a trusted intermediary to hold users' funds and facilitate trades, creating vulnerabilities related to security breaches and regulatory control. Atomic swaps enable direct peer-to-peer cryptocurrency exchanges on separate blockchains without intermediaries, ensuring trustless settlements through smart contracts and cryptographic proofs. Explore how atomic swaps can revolutionize decentralized trading and reduce reliance on centralized custodians.

Source and External Links

Cryptocurrency Exchanges - Overview, Advantages, Top 10 - Centralized cryptocurrency exchanges (CEX) act as intermediaries between buyers and sellers, earning through commissions and transaction fees, and operate like stock exchanges but for digital assets, using order books and matching engines to facilitate trades.

Centralized Crypto Exchanges Examined - Gemini - Centralized exchanges are regulated platforms that hold users' private keys and enable buying and selling of cryptocurrencies, usually with fiat currency, offering a secure and user-friendly entry point to the crypto market despite competition from decentralized exchanges.

Centralized vs. Decentralized Crypto Exchanges - CoinLedger - Centralized exchanges are ideal for beginners due to ease of use for buying, selling, and trading crypto, with major players like Coinbase and Binance being centralized and operated by corporate entities.

dowidth.com

dowidth.com