Copy trading enables investors to replicate the strategies of experienced traders by automatically copying their live trades, providing a hands-off approach to market participation. Algorithmic trading uses pre-programmed instructions and mathematical models to execute high-speed, precise trades based on complex market data analysis. Discover more about how copy trading and algorithmic trading can transform your investment strategy.

Why it is important

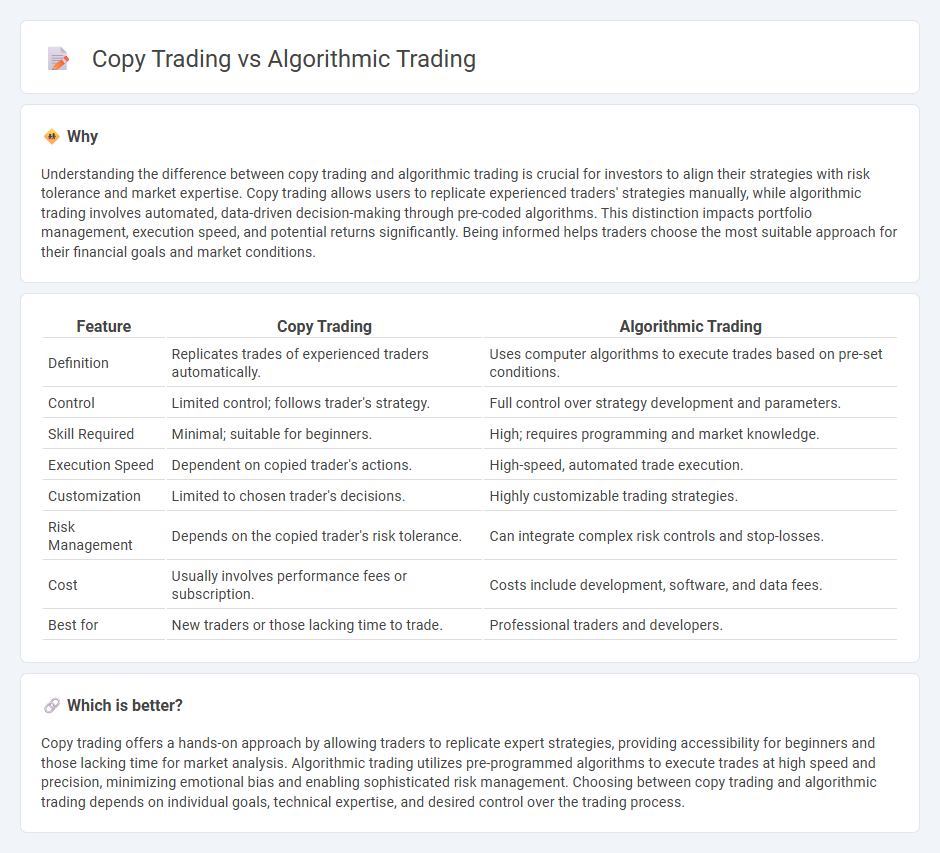

Understanding the difference between copy trading and algorithmic trading is crucial for investors to align their strategies with risk tolerance and market expertise. Copy trading allows users to replicate experienced traders' strategies manually, while algorithmic trading involves automated, data-driven decision-making through pre-coded algorithms. This distinction impacts portfolio management, execution speed, and potential returns significantly. Being informed helps traders choose the most suitable approach for their financial goals and market conditions.

Comparison Table

| Feature | Copy Trading | Algorithmic Trading |

|---|---|---|

| Definition | Replicates trades of experienced traders automatically. | Uses computer algorithms to execute trades based on pre-set conditions. |

| Control | Limited control; follows trader's strategy. | Full control over strategy development and parameters. |

| Skill Required | Minimal; suitable for beginners. | High; requires programming and market knowledge. |

| Execution Speed | Dependent on copied trader's actions. | High-speed, automated trade execution. |

| Customization | Limited to chosen trader's decisions. | Highly customizable trading strategies. |

| Risk Management | Depends on the copied trader's risk tolerance. | Can integrate complex risk controls and stop-losses. |

| Cost | Usually involves performance fees or subscription. | Costs include development, software, and data fees. |

| Best for | New traders or those lacking time to trade. | Professional traders and developers. |

Which is better?

Copy trading offers a hands-on approach by allowing traders to replicate expert strategies, providing accessibility for beginners and those lacking time for market analysis. Algorithmic trading utilizes pre-programmed algorithms to execute trades at high speed and precision, minimizing emotional bias and enabling sophisticated risk management. Choosing between copy trading and algorithmic trading depends on individual goals, technical expertise, and desired control over the trading process.

Connection

Copy trading and algorithmic trading are connected through their reliance on technology to automate investment decisions and execution. Copy trading allows investors to replicate the trades of experienced algorithmic trading systems, benefiting from pre-programmed strategies without needing in-depth market knowledge. Both methods enhance trading efficiency and enable access to sophisticated trading tactics driven by data analysis and real-time market signals.

Key Terms

Algorithmic Trading:

Algorithmic trading utilizes pre-programmed instructions and quantitative models to execute trades at optimal speeds and prices, minimizing human error and emotion-driven decisions. This method leverages real-time market data and complex algorithms to identify trading opportunities and perform high-frequency trades with precision. Explore further to understand how algorithmic trading can enhance your investment strategy.

Backtesting

Algorithmic trading relies heavily on backtesting to evaluate the performance of trading strategies against historical market data, ensuring robustness before live deployment. In contrast, copy trading deprioritizes backtesting as it involves mirroring the real-time trades of experienced investors, focusing on proven results over theoretical simulations. Explore in-depth comparisons of backtesting methodologies to understand how they impact risk management and strategy optimization in both trading approaches.

Execution Speed

Algorithmic trading utilizes advanced computer algorithms to execute orders at high speeds, often in milliseconds, enabling traders to capitalize on minute market inefficiencies faster than human traders. Copy trading relies on replicating the trades of experienced investors but generally lacks the ultra-fast order execution that algorithmic trading offers. Explore the key execution speed differences and their impact on trading strategies to make an informed decision.

Source and External Links

What is Algorithmic Trading and How Do You Get Started? - IG - Algorithmic trading uses computer codes and software to execute trades based on predefined rules like price movements, with common strategies including price action, technical analysis, and combinations of both, often deployed in high-frequency trading scenarios.

Algorithmic Trading - Definition, Example, Pros, Cons - Algorithmic trading executes trades automatically based on programmed rules such as moving averages, allowing traders to buy or sell securities when specific price conditions are met, helping to avoid market impact by breaking large orders into smaller pieces.

Algorithmic trading - Wikipedia - Modern algorithmic trading incorporates machine learning techniques like deep reinforcement learning and directional change algorithms, which adapt dynamically to market conditions and improve trade timing and profitability, especially in volatile markets.

dowidth.com

dowidth.com